How Far Can The Big Four Banks Go?

Strong investor support for stocks with high dividend yields has been one of the defining features of the Australian share market over the last year or two. The big four banks have been particular beneficiaries of this, and with a healthy first half result reported this week by ANZ, the theme has additional momentum.

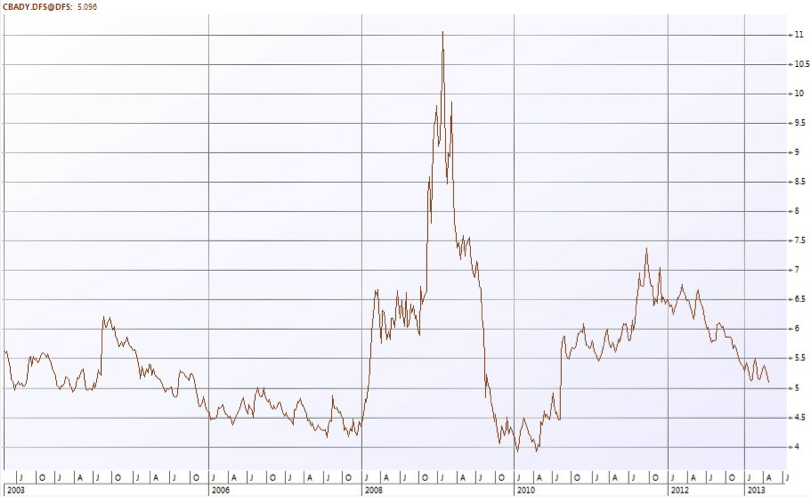

The chart below shows the yield on CBA shares over the past 10 years, and provides some illustration and context for the recent dynamic. Notice the steady decline in CBA’s yield since 2011 – investor support for CBA has meant that the yield has compressed, as the share price has risen faster than the dividend.

Ultimately, of course, this dynamic is self-limiting. If the share price rises faster than the dividend, then the yield eventually reaches a level that is no longer attractive. Growing dividends helps keep the process going for longer, but the CBA share price has risen significantly faster than dividends can be expected to grow.

A good question for investors is how far this dynamic might go before it runs out of steam, and the chart provides some context. In 2007, CBA’s dividend yield got as low as 4.2%, and it seems reasonable to think it could do so again – although it should be noted that this would imply a very positive outlook for credit growth.

With a franked dividend yield of 5.1% today, interest rates at very low levels, and the first sign of improving profit numbers, the analysis suggests that there is scope for CBA shares to rally for some time yet.

The problem with this analysis is that it doesn’t consider value. As value investors, we remain committed to this concept, even when dividend yields are all the rage with other investors.

For us, the big four banks look expensive. Just as they did in 2006 and 2007.

I hold approx 10% of banks in my portfolio for yield , I agree they are not cheap, but CBA the best bank cannot be valued more than twice as much its nearest rival…..CBA Profit $7b SP approx $70, WBC Profit approx 3.2H say 6.4B Full year…..SP today under $29…

In my opinion CBA is a bubble and the next 3 although not cheap, hold for yield…

I believe on current valuations WBC is my pick, but would only accumulate around $24 to $26……..People suggest NAB is the cheapest, but I dont see that! it has a better yield to intice investors, but has more risks…..after EX could pull back considerably to mid 20’s……

ANZ today announced buy back, I get nervous when they do buy backs when market is toppy…..why not return to shareholder…..So my prefered bank is WBC on current SP, followed by ANZ, distand NAB and CBA just too expensive……I am of the opinion no recession and if we have a housing revival WBC is in a good position……I hold the 3 banks excluding CBA……only my opinion ….

Cheers!

How to explain why Bank of America makes $4.2 billion net income from $2.2 trillion in assets and CBA makes $7.1 billion net income from $718 billion in assets (Westpac makes $7 billion from $670 billion in assets) and keep breaking records year after year. In asset terms, CBA and Westpac are one third the size of BoA and makes nearly twice BoA’s profit… Just pity poor Australian consumers who are being screwed, except Aussies live in an Island (Bubble). Everyone travels to Bali so we don’t know how banking is done in US, Europe and the rest of the developed world.

Just how profitable can 4 banks get? All they need to do is do EVEN LESS lending to small business and farmers or stop pretending to be the “Engine rooms” of the economy. BTW Rabobank (the Dutch) lends to farmers!!!

Banks may look expensive but there are no competitors on the horizon and the Federal Treasurer is reduced to “begging” banks to pass on interest rates in full but they just give him 2 fingers and talks about cost of funds blah blah (complete BS as money has never been cheaper especially) for AAA institutions with Government backing. In order to reduce pressure on the Australian Dollar RBA will continue reducing interest rates. Of course this will just make dividends from 4 Banks EVEN MORE attractive.

Good points.

The price collapsed in July 2007 under the GFC. Would CBA’s price have continued on it’s rise and maintained a yield of around 4.5% had it not been for the GFC?

Hi Ben,

Sorry for my ignorance but can you explain “although it should be noted that this would imply a very positive outlook for credit growth.”

Thanks.