How Evergrande the parent hurt Evergrande New Energy

One thing that has recently caught my eye has been the unravelling of China Evergrande Group – a conglomerate with over 100,000 employees spanning primarily real estate development but also new energy, property services and health amongst other industries.

Keen market observers would be aware of the Chinese government’s recent crackdown on various industries. Most headlines have been focused around the tech giants and the for-profit education sector, but has also involved online gaming companies (gaming restrictions), the steel industry (push for decarbonisation) and most recently Macau casinos. It has also maintained its tightening bias toward the property sector, which has further dampened the prospects for rebar steel, and by extension iron ore.

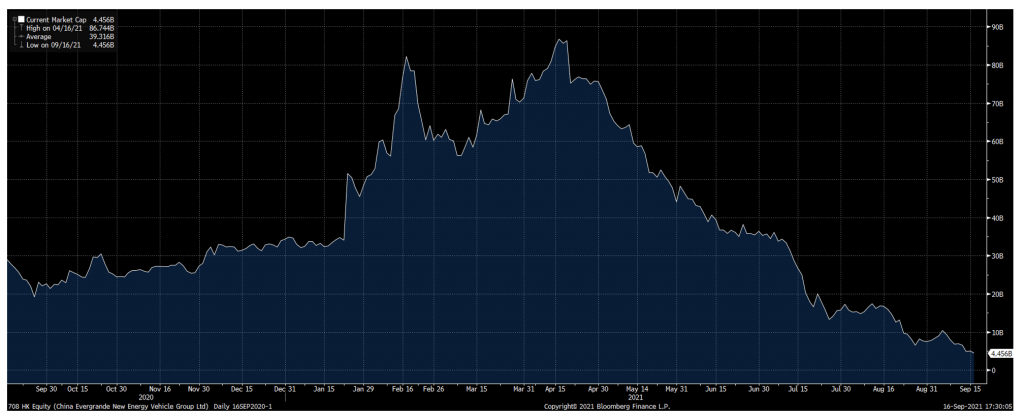

Property cycles are nothing new in China, with development and prices waxing and waning based on policy and availability of credit and partially responsible for cyclical price movements in iron ore. The most recent slowdown however seems to have hit the highly indebted Evergrande extremely hard, as unravelling confidence in its ability to repay its lenders (split between onshore and offshore) has sparked a sell-off in both its bonds (now trading at 30 cents on the dollar) while the company’s equity value, which peaked at a market capitalisation of over US$50 billionn and was as high as US$47 billion in June last year is now just US$4.4 billion.

One of the more interesting subplots has been the fate of its New Energy Vehicle group, a listed subsidiary in which the China Evergrande parent owns 65 per cent. Early in the Evergrande Saga, the Group proposed selling a stake in its new energy vehicles (NEV) subsidiary as one way to reduce its debt load. In January 2021, the group sold a ~11 per cent stake in the subsidiary to six investors, valuing the business at ~US$34 billion. Amazingly, this transaction – along with the hype surrounding the potential EV market in China and the company showcasing 6 new cars – triggered a furious rally which saw the share price rise 140 per cent in under 3 weeks, while its market cap peaked at US$85 billion despite not selling a single car (shades of Nikola in the US, albeit the NEV subsidiary also holds Evergrande’s legacy assets in the healthcare space and was formerly known as Evergrande Health Industry Group).

China Evergrande New Energy Market capitalisation

Source: Bloomberg

As concerns around its parent deepened, “investors” became concerned around the potential fate of its subsidiary with the Parent’s 6.35 billion NEV shares seen as a potential source of liquidity. This has seen a stunning collapse in Evergrande NEV’s market cap by ~US$80 billion since mid-April and has also caused liquidity issues in the NEV arm which just reported losses of more than US$742 million.

A good reminder to pay heed of any potential contagion and ripple effects, albeit most are hidden and only discovered after the fact (as well as the obvious lessons on the highs and lows of “investing” in pockets of extreme exuberance).

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY