How competing firms can prosper by solving the Prisoner’s Dilemma

The Prisoner’s Dilemma provides a framework for understanding how to strike a balance between competition and cooperation. It’s possible for rival firms in a competitive market to solve the Prisoner’s Dilemma, without collusion, and for their mutual benefit. Let’s look at how it can be done.

We recently discussed applying the Prisoner’s Dilemma model to McMillan Shakespeare (ASX:MMS) and Smartgroup (ASX:SIQ), which compete in the salary packaging space.

We noted that given the alternatives for each company and via the levelling of the competitive landscape it appears likely that each firm will compete more aggressively with each other than had historically been the case.

This coupled with industry incumbents and individuals all flagging more aggressive competition in the future makes for a rather convincing case.

Competition is (for lack of a better word) the inverse to high returns on capital. As competition in an industry increases, returns usually decrease and vice versa. Hence if the analysis of a firm’s prospects flags higher levels of competition, it’s a no brainer that we must examine what returns on capital are implied via the firm’s current stock price. If the implied returns appear too high, then downside risk becomes apparent.

There are, however, characteristics in some industries which can throw a spanner into the workings of this mechanism, even when all incumbent firms possess no competitive advantage over one another (i.e. all incumbent firms competing on a level playing field). The tool for analysing these characteristics is the Prisoner’s Dilemma model. So let’s start by reviewing the previous article.

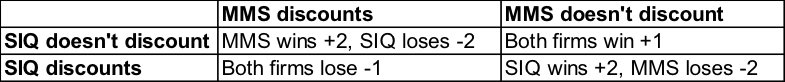

Recall that we were analysing the potential outcomes from MMS & SIQ competing for customers seeking novated leases on cars. Each participant doesn’t wish to discount its fees if it can help it but if it does so with no response from the competition then it will take a large slice of market share and be much better off. If it doesn’t discount however and the competition does so it will lose a large slice of market share. If all participants discount on fees, they will all lose revenue from the discount but none will lose market share.

Finally, if no participant discounts, each benefits from organic market growth on full fees. We also imposed the condition that the competitors cannot collude, i.e. each participant cannot discuss its intentions with the other. This breaks down the usefulness of the model but (more importantly) is an illegal act with severe penalties in the real world.

We noted that each competitor would be likely to discount its fees since, by doing so, each firm’s worst case outcome would be -1 but the best would be +2. If a competitor didn’t discount, it’s best outcome would be +1 yet it’s worst would be -2.

So given the imposed conditions, how can this dilemma be solved in a way that doesn’t involve collusion but allows the incumbent firms to operate without fear of its competitors discounting in a bid to steal market share? There are actually several well-known ways, but first we wish to generalise the solution.

In short, to solve the Prisoner’s Dilemma model is to change the overall outcomes via the removal of the upper left and lower right parts of the table.

Now we can see that any discounting activity won’t benefit the originator via market share (in fact, the firm gains no market share and is hurt by its own discount) and that by each participant using a ‘no discounting’ strategy means that all win.

In some retail markets, this is achieved by the largest incumbent firms offering a ‘lowest price guarantee’. Take Bunnings for example, which is part of the Wesfarmers Limited group of companies (ASX: WES). Any competitor which attempts to discount knows that Bunnings will match its price and knock a further 10% off. The competitor is thus not incentivised to discount against Bunnings in a bid for market share (since it won’t gain any) but it will incur a penalty via its own discount.

Other industries divide the market into segments and each incumbent firm then specialises in providing the optimal level of service/value within each segment. Notably, each firm then has little incentive to move into another firm’s segment since its offer is not designed for that segment and will incur aggressive competition on another’s turf.

It’s critical to note that none of these practices are anti-competitive nor collusive (and hence comply with our ‘no collusion’ condition). They are well-known characteristics of some industries that result in alternative outcomes when examined under the Prisoner’s Dilemma model.

The latter characteristic (market segmentation) would’ve seemed like the optimal solution for the novated leasing industry (although from what we’ve seen so far, we’d say it’d be difficult to achieve at this point). The industry could have been divided into industry segments (e.g. via operations such as healthcare, certain types of charities etc) with each incumbent specialising its offering to the specific needs/wants of each group.

If this characteristic were present, then it’s fair to say that the prospects for each firm’s prosperity would be much brighter in the future. Without it, however, we cannot see any material impediments to competition eroding returns over time. Exactly when this occurs, however, is another question.

With that – next stock!

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY