How bad is Australia’s mortgage stress?

The level of household financial stress in Australia is a key issue. This is because a significant pull-back in the financial position of households would have flow-on effects across the economy. So, the recent data released by the nation’s largest lenders provides an important reading of future trends.

With the half yearly earnings reporting season upon us again, the market is provided with an update on household stress levels in the form of bank and insurer results. CBA and NAB have just released numbers, as has the largest mortgage insurer in Australia, Genworth.

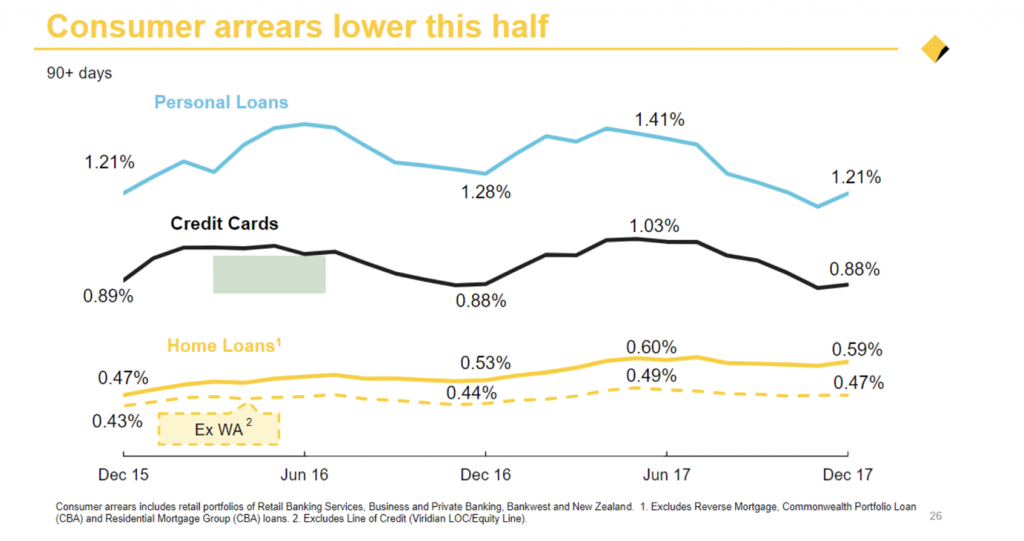

Interestingly, CBA reported declining levels of arrears in its personal and unsecured consumer loan book. In its mortgage book, arrears increased marginally, but only because of the ongoing deterioration in Western Australia.

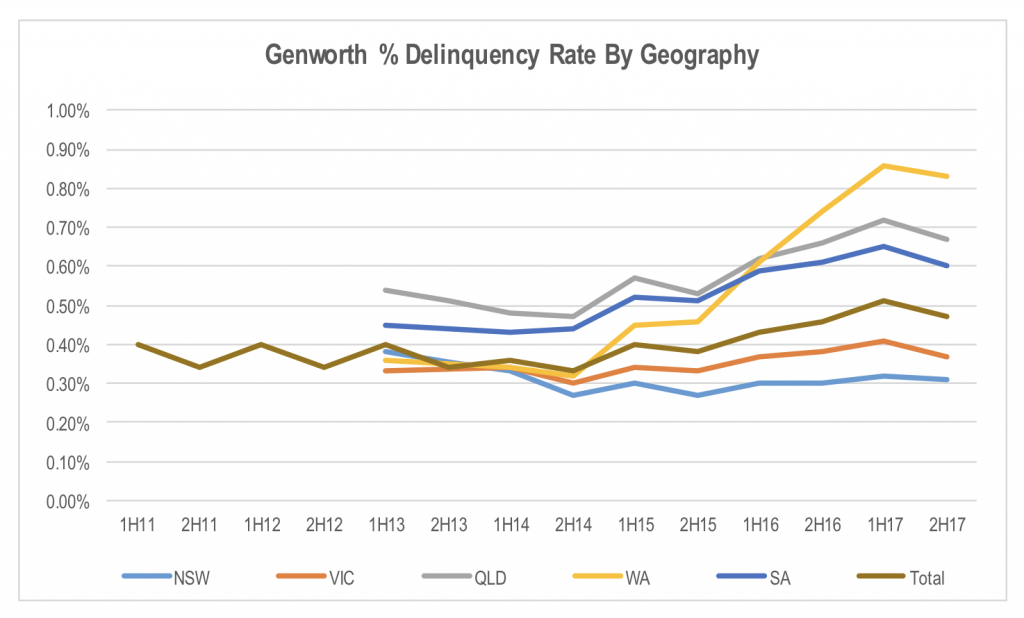

Genworth also reported a slight reduction in its mortgage delinquencies in the six months to December 2017.

This points to a slight improvement in household financial conditions, flying in the face of dire forecasts from a number of economists and strategists in financial markets. So why is this occurring?

One explanation is the strong employment data over the last six months. The increased number of people employed results in increased household income. While wage growth has remained weak, the volume effect of increased employment still provides a positive stimulus for household income.

The other factor is the availability of finance. Macro-prudential controls imposed on the banks has resulted in tighter lending policies being implemented by the majors. This is in the form of both higher interest rates being imposed in perceived problem areas of the market (investment property loans, interest only loans), as well as tightened serviceability and loan to value (LVR) hurdles in the approval process. This was the intended outcome of the policy restrictions. This should have increased household non-discretionary costs, increasing stress to some extent.

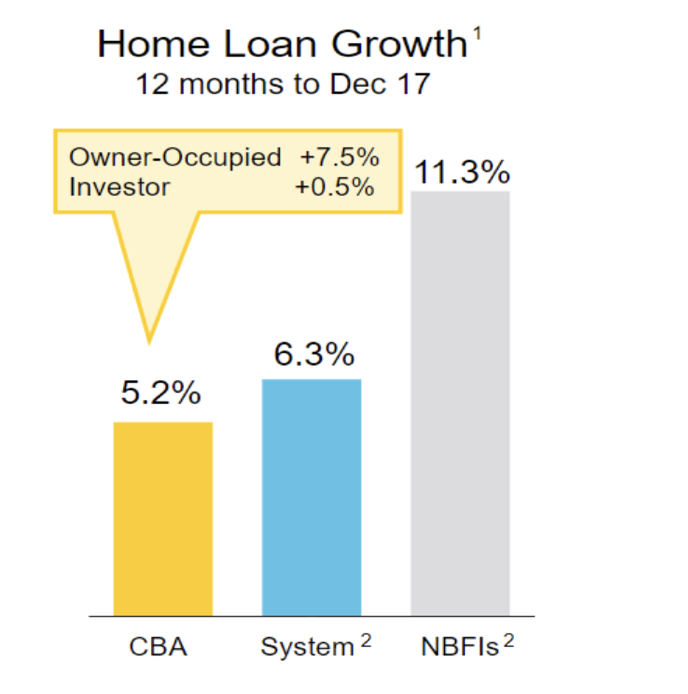

However, as CBA’s result presentation highlighted, while major bank consumer lending growth has slowed materially, non-bank financial institution (NBFI) lending appears to have taken up the slack. The NBFIs offer households a way to avoid the heightened stress that would come from the increase in costs flowing from the macro-prudential restrictions placed on bank interest only and investment property mortgages through refinancing.

Of course, this is not great news for the banks because either the macro-prudential restrictions put them at a competitive disadvantage to the NBFIs, resulting in ongoing reductions in market share, or the risks to the financial system that the macro-prudential regulations are intended to fix are not addressed due to the shift in lending demand to NBFIs.

Going forward, stalled or reversing residential property prices will make it more difficult for households to maintain their spending in the face of rising non-discretionary costs, as they will not be able to increase their debt levels on the back of revalued property asset holdings.

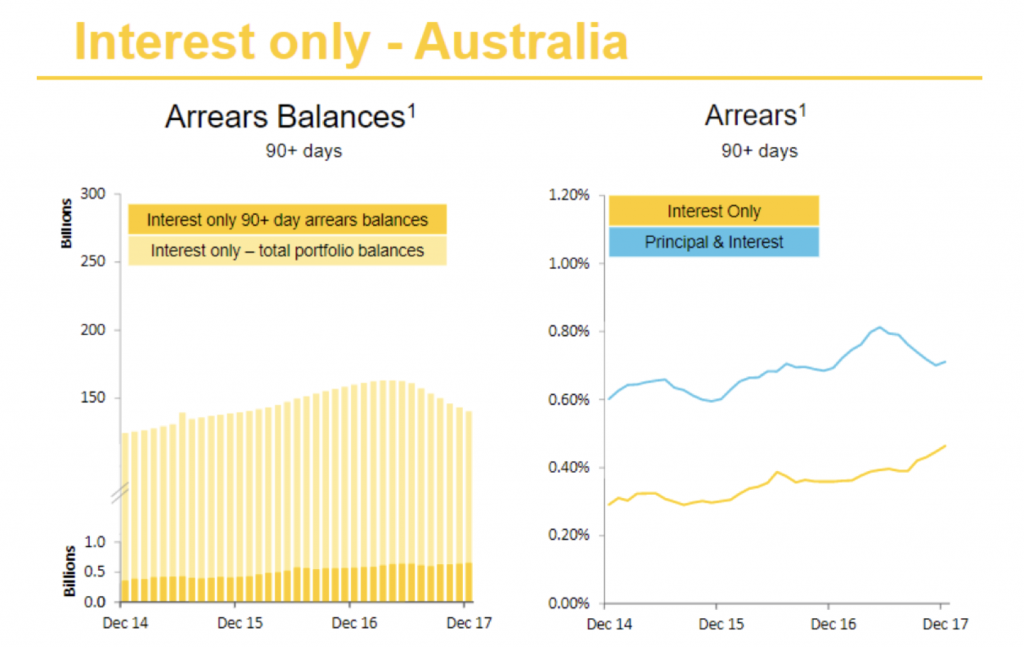

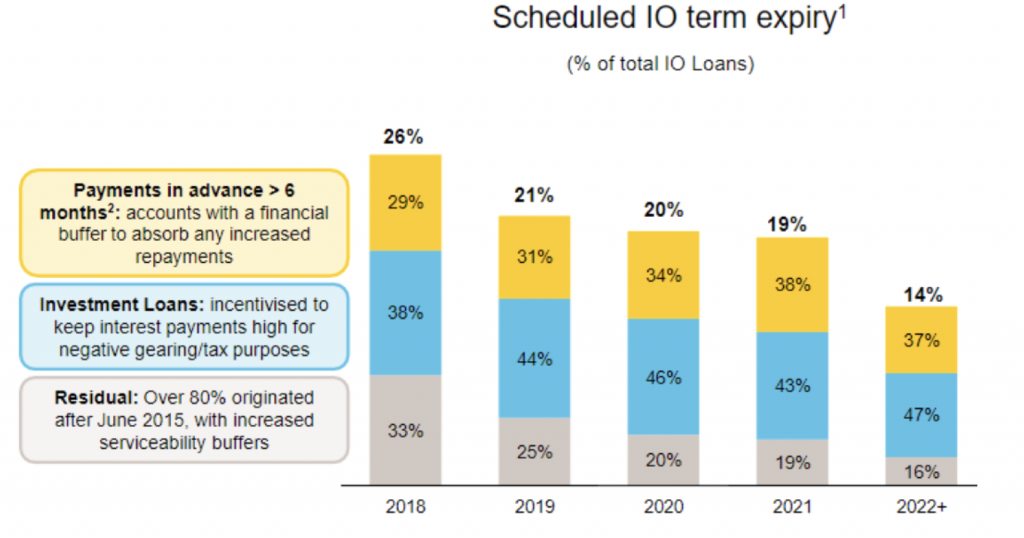

The other point of interest regarding household stress in the CBA result was the slides looking at the bank’s interest only mortgage portfolio. CBA noted that its arrears rate on the interest only book has been increasing steadily over the last three years. However, it commented that this is mainly due to a denominator effect with the size of the loan book having shrunk materially in the second half of the year. This is shown in the following charts.

While the reduction in the size of the overall interest only mortgage book mathematically drove the increase in arrears rate, the book has shrunk as a result of a combination of voluntary switching to principal and interest repayments by borrowers and existing loans rolling off the 5 years interest only period and converting automatically to principal and interest.

In the case of customers voluntarily switching to reduce the interest rate paid, these customers are unlikely at risk of becoming stressed by the increase in repayments (otherwise they wouldn’t switch). Those that reached the end of their interest only period would no longer be counted in the interest only arrears if the 30-40 per cent increase in monthly repayments when moving to principal and interest caused them to fall behind on their repayments. The stress caused by the increased repayments would count them as principal and interest arrears.

Despite this, the volume of interest only mortgages that are in arrears by more than 90 days has been steadily rising over the last 3 years.

The other point of note was the chart indicating that the rate at which the interest only period expires on the current interest only mortgage book. Using a 5 year lag on the APRA mortgage origination data suggests that the rate of conversion of interest only loans to principal and interest will continue to rise through to the second half of 2019. CBA’s data suggests its rate of conversion peaks this year.

This chart suggests that the peak of the pressure on this portion of CBA’s customer base is likely to occur over the next year or two. The problems for other lenders might take longer to play out, unless employment growth or an acceleration in wages growth comes to the rescue.

The level of household financial stress in Australia is a key issue. The recent data released by the nation’s largest lenders provides an important reading of future trends. Share on XThis post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

simon

:

we are looking at the wrong thing according to christpher joye-

The bottom line is that notwithstanding all the doves’ dreams of disinflation for decades, if you continuously pump demand ahead of finite supply for a sufficiently long time, you will get price pressures.

Back in 2015 they told me I was the only person in the world arguing the case that inflation-driven increases in interest rates would eventually decimate asset prices. While we’ve had a taste of this experience in February, the real valuation shock is probably only years away.

Andre L

:

As a mortgage broker, my view is the interference of APRA has just been a way of helping banks increase rates significantly on investors at a time where their profit growth had ceased. This significant increase in rates is the likely increase in IO delinquincies.

Even now they are using the new tighter lending policy and even use the royal commission as an excuse to stop most investors and even Owner Occupiers caught on their deceptive introductory / discount rate from having the option of getting market competetive rates.

When there is less lending growth they seem to be colluding to improve the margins from existing business and APRA is giving them the excuses.

E.g. recently a 68 year old client of mine with IO investments whose rates increased to 5.72% with Westpac and 5.11% with Macquarie tried to reduce to a more reasonable market rate. She was willing even to change to P&I as the payments would stay almost the same at the going market rate of 3.99%. Both lenders came back with offers at over 4.8% P&I and reduced her current loan term by over 10 years so in the end she would never be able to afford these new payments so was unable to improve her position. When I contacted NAB to refinance they would only offer the same short term P&I Loans and used the Banking Royal Commission as the excuse.

jimbo james

:

How times have changed. Twenty years ago at 50/60 you went conservative to preserve your asset base. Now we’ve got 68 year olds still speculating with interest only debt funding, presumably scratching their heads when the banks take the punchbowl off the table. There is very little scope to recover if it goes wrong and not a good example of risk management. We are far too de-sensitised to the risks after 26 years of economic growth (debt funded) and the house prices only appreciate dogma in this country.

Sam

:

Hi Stuart

Great analysis as always.

Do you think the majors will adjust their pricing/interest rates on IO loans down at some point (ie. reduce the gap between IO and P&I loans) due to materially undershooting the 30% interest only cap or will they just loosen other restrictions?

Thanks

Sam

Stuart Jackson

:

Thanks Sam. I suspect that the banks will become a little more flexible in assessing interest only mortgage applications before looking at reducing the spread between P&I and IO variable mortgage rates. They might also become more aggressive on new mortgage discounts in order to drive flow rather than cutting the margins on existing business. The gap between IO and P&I variable rates will also be affected by any changes in risk weight calculations implemented by APRA in the medium term as these changes impact the ROE generated on the products. This could see the gap shrink or expand depending on the final regulatory treatment.

Jake

:

Hi Stuart,

Just something to note which I have not seen taken into account in most of the public analysis of this issue: the cap on flows of /IO loans that APRA has imposed do not have a material impact on most existing loans bar over a very long time frame (10 years for most, not 5). A 5 year I/O term does automatically convert, however for investor loans this may be extended up to a total of 10 years without being captured in the flows cap. That means that unless the banks themselves refuse i.e. if they reassess the borrower or simply decline the request this is not a simple ‘5 years and switch’ matter for investor loans.

For OO loans it is more of an issue as maximum IO period including term extensions is 5 years. I note that intentionally or otherwise the banks have given themselves significant breathing room on this front due to the massive undershoot of the caps.

Most significantly on the ‘stress’ front, existing P&I borrowers can switch to I/O without being captured in the flows cap either – this might sound truly loopy but it does appear to be the case. You read correctly: the entire P& I book of the majors could technically switch over to I/O and not be captured by the existing flow caps (illustrative only to demonstrate just how soft the caps really are for the Big 4).

I believe that most of the analysis should be focusing on the serviceability assessment changes rather than the lending caps – from what I have been able to ascertain that is where the main driver of the slow down, and helps to explain the material undershoot of the flow caps by the majors.

You may well be across both issues. I don’t believe much of the press or even the analysts are across the first based on the work I have seen to date.

Apologies for the long comment, I know it’s not my blog!

Stuart Jackson

:

Thanks Jake, APRA made some changes to the way the cap works relative as you have stated. Serviceability hurdles have been increased by APRA over the last couple of years, and the major banks seem to be becoming a lot more aggressive in setting standard expense assumptions for borrowers, reducing their reliance on the figures provided by the borrower, and overriding them with higher assumptions in assessing servicability. This is one way the banks have managed down their investment property loan book and interest only lending, particularly within the mortgage broker channel. With all of the banks seeming to have materially undershot the 30% interest only cap in the last 6 months, it is likely that some of the restrictions being imposed will be relaxed, resulting in an increase in investment property and interest only lending.

John K

:

It is silly to expect delinquencies (especialy 90+ days) to go up in a rising housing market. When someone is facing prospects of not being able to pay mortgages for few months, in a rising market they simply sell and make profit.

Arrears and defaults on mortgages always happen later in the cycle, after house prices fall by 10% or more and selling to avoid default becomes harder. Just have a look into US data, delinquencies and foreclosures started rising a year after the peak price, when prices were already 10% down.

Stuart Jackson

:

Hi John, While that seems like a logical solution, particularly for investment property mortgages, people tend to be very reluctant to give up their owner occupied residence. The transaction costs, long settlement periods and illiquidity associated with the property market, along with the misguided belief that Australian property prices never fall, mean that those in financial difficulty would see selling as a last resort. With excess liquidity having been pumped into the financial system by the RBA, along with risk weights that have increasingly encouraged banks to lend against residential property, the default solution has been to refinance and raise even more debt against the unrealised increase in the notional ‘value’ of the property. One should always remember that the ‘price’ is no necessarily representative of the ‘value’ of an assets. The property markets is particularly prone to ignoring this fact. With capital requirements being tightened, and lending by the banks constrained in this area, this source of funds is becoming more difficult and expensive to obtain. Once property prices plateau (or perish the thought, decline), this source of support for those relying heavily on capital gains to offset property income deficits will stop. That’s when the music could stop and the market dynamics will become very interesting.

jimbo james

:

Spot on John. April 2006 on this chart says it all.

https://www.housingwire.com/ext/resources/images/editorial/BS_ticker/PDF/A-April-2016/mortgagerate.png

Paul

:

Great research Stuart, and value your opinion also.

Stuart Jackson

:

Thanks Paul.

Murray Wardle

:

Unfortunately the major, mid tier and regional banks are all deluded into thinking that 2018 will be the year of wage growth and all the problem ms with housing affordability, delinquency rates and real economic growth will suddenly be fixed.

Andre

:

Stuart,

Australia has a great track record of papering over the cracks and this time will be no different. My thoughts are we are on the cusp of another mining boom which is generated by the infrastructure spend from the USA. As the construction boom winds down, Blue collar workers will simply transfer from construction related jobs to jobs in the mining industry. Thermal and met coal will boast the east coast and iron ore will rebound in the west. These higher wages will be shared through the mining states creating a soft landing for the rest of the economy. Interest rates will remain low. Allowing wages to catch up to inflated assets prices. We have witnessed this cycle many times and this time is no different

Stuart Jackson

:

Hi Andre,

You might be right, but there is a sizable difference between mining and construction in their respective the labour intensity and contribution to Australian GDP. The increase in growth in mining would need to be multiples of the decline in construction for the net economic activity and employment impact to be neutral.