How and when to buy real estate

Will Rogers infamously suggested real estate was the best investment in the world because no more was being made. He obviously wasn’t considering how many apartments could be constructed on a postage stamp of land nor do I expect he had Singapore in mind; In the two photos following you can see that Raffles Hotel on Beach Road in Singapore is one block back from the beach. Between it and the coast sits the Britannia Club building. In the second image Raffles is partly obscured by the roof of a high rise building in the foreground but the Britannia Club now has a green painted roof in the section of land marked for sale.

What is particularly intriguing being that the beach, which should be in the upper right hand corner of the photograph is gone and replaced by high rise buildings and a lower rise shopping mall.

Photo 1 Raffles Hotel and Singapore coast line 1969

Photo 1 Raffles Hotel and no coast more recently

Photo 1 Raffles Hotel and no coast more recently The reason for the Singapore history and civil engineering references is that they speak to the supply of real estate. Apartment supply is something we will come back to shortly.

The reason for the Singapore history and civil engineering references is that they speak to the supply of real estate. Apartment supply is something we will come back to shortly.

Back in early 2012, Gloom and Doom author Harry S. Dent predicted another worldwide economic downturn – for that year to be precise, and that it would cause Australian real estate values to fall back to where they were 10 years prior.

“People in places like Sydney or Tokyo or Miami say, ‘Hey, real estate can never go down here, we’re a great place, everyone wants to move here, there’s not much land for development’, and what I say is that is exactly the kind of place that bubbles.” “Outside Hong Kong and Shanghai, Australia is the most expensive real estate market in the world compared to income.”

On 60 minutes at the weekend, another individual, Jonathan Tepper, joined the conga-line of overseas experts who arrive on our shores and marvel at the extent of our housing bubble, and made yet another prediction of impending doom.

It is easy to dismiss these calls and many, including a buyers advocate I chatted with at a recent function at the Art Gallery of NSW, say that house prices can’t fall. This is plain silly and ignores the facts.

Property prices have fallen in Australia and one only needs to cast their mind back to the GFC to find suburbs where individual houses traded for 30 or 40 per cent less than their previous traded price.

Even today, mining towns have experienced 70-80 per cent declines in house prices and some rural communities 50 per cent declines. We note that Tepper report dated February 22, 2016 predicts 80 per cent falls for mining town real estate despite the fact this has already occurred.

The point being that house prices can and do decline.

And it’s also wrong to claim, as AMP’s economist Shane Oliver did in Domain here that “unless we have a very severe recession or interest rates go sky high causing people to default, it’s not going to happen” and “I’ve seen all these claims before and there is an underlying resilience in the Australian housing market that sees it hold up”.

Price declines for any asset aren’t restricted to requiring pressure on vendors. A mere absence of buyers, or a decline in their number – for example if they are spread over a greater supply of property – can causes prices to decline. Bids merely have to be lowered and the true price is less than that at which even unforced vendors are willing to sell.

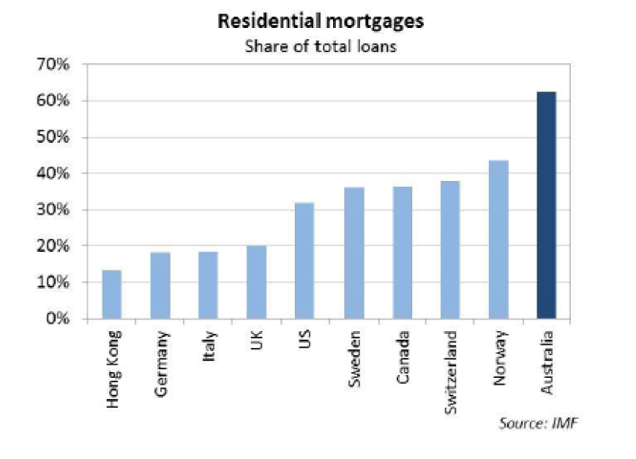

Jonathan Tepper’s report, which is the topic of the 60 minutes piece, provides a litany of charts and graphs that purport to prove Australia is in a bubble. Residential mortgages as a share of total loans is higher for Australian banks than anywhere in the world according to the IMF, household debt as a percentage of income and the house price to income ratio are at levels never seen before, as are interest-only loans, and while median Sydney incomes have risen just 17% in eight years (the period prior to the GFC) house prices have doubled. In Sydney and Melbourne median house prices are 10 times gross household income. They peaked at eight times in Ireland before their collapse and five times in the US at the peak of their bubble. As you know we have some sympathy for the view that cheap financing has fuelled absurd prices, and that lending practices investigated by ASIC have shown poor lending practices have been promulgated. All the signs of a property price peak are in place and we have warned, informed and watched house prices for investors many times in the past few years including here, here and here.

As you know we have some sympathy for the view that cheap financing has fuelled absurd prices, and that lending practices investigated by ASIC have shown poor lending practices have been promulgated. All the signs of a property price peak are in place and we have warned, informed and watched house prices for investors many times in the past few years including here, here and here.

But just because a mortgage is interest only, it doesn’t mean the risk of default is greater. As Stuart Jackson here at Montgomery notes “Interest only mortgages are quite often used by borrowers as a means of have more flexible principle repayments (eg for investment properties with more seasonal incomes)” and “All of the banks have been noting a significant increase in the number of mortgages that are being repaid ahead of schedule.”

When looking at Australia’s ‘highest debt-to-income’ ratio the amount needs to be adjusted for funds held in offset accounts and our banks have noted the growth in these account balances. So, while mortgage debt is growing faster than nominal GDP in aggregate, not all of the improved affordability resulting from lower interest rates is being reinvested in increased debt.

As an aside we thought it curious that Tepper, upon witnessing a house auction first hand, and implying a lauding of property, would marvel that “yes, they auction middle class property in Australia as if they were selling Picassos”. Clearly he hasn’t been to a cattle, sheep or wool auction.

Nevertheless, only two things matters when it comes to property prices and that is 1) supply, and 2) demand.

Back in the 2009 letter to Berkshire Hathaway shareholders Warren Buffett explained the metrics to watch at the depths of the global financial crisis;

“The industry is in shambles for two reasons, the first of which must be lived with if the U.S. economy is to recover. This reason concerns U.S. housing starts (including apartment units). In 2009, starts were 554,000, by far the lowest number in the 50 years for which we have data. Paradoxically, this is good news.

“People thought it was good news a few years back when housing starts – the supply side of the picture – were running about two million annually. But household formations – the demand side – only amounted to about 1.2 million. After a few years of such imbalances, the country unsurprisingly ended up with far too many houses.

“There were three ways to cure this overhang: (1) blow up a lot of houses, a tactic similar to the destruction of autos that occurred with the “cash-for-clunkers” program; (2) speed up household formations by, say, encouraging teenagers to cohabitate, a program not likely to suffer from a lack of volunteers or; (3) reduce new housing starts to a number far below the rate of household formations.

“Our country has wisely selected the third option, which means that within a year or so residential housing problems should largely be behind us, the exceptions being only high-value houses and those in certain localities where overbuilding was particularly egregious. Prices will remain far below “bubble” levels, of course, but for every seller (or lender) hurt by this there will be a buyer who benefits. Indeed, many families that couldn’t afford to buy an appropriate home a few years ago now find it well within their means because the bubble burst.”

Buffett may have been just a little early with his prediction, but looking back the focus on these two factors was instructive and prescient.

The time to buy property is when housing starts, including apartments, have collapsed and the oversupply is being soaked up by new household formation.

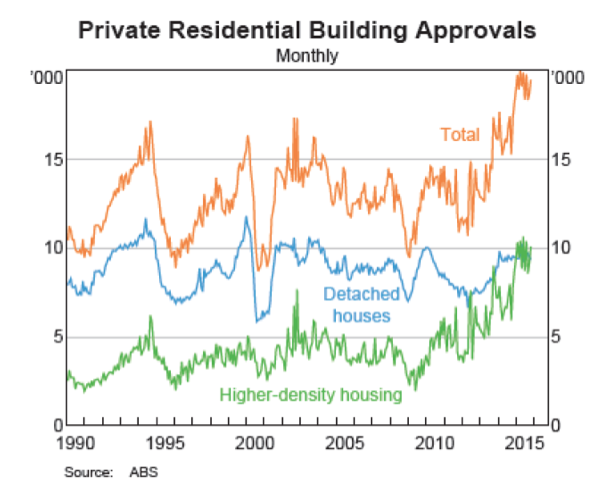

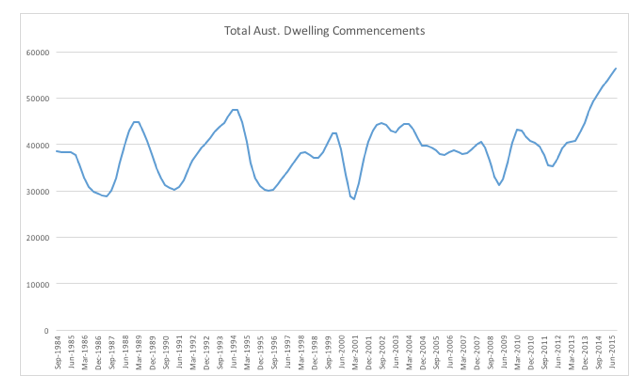

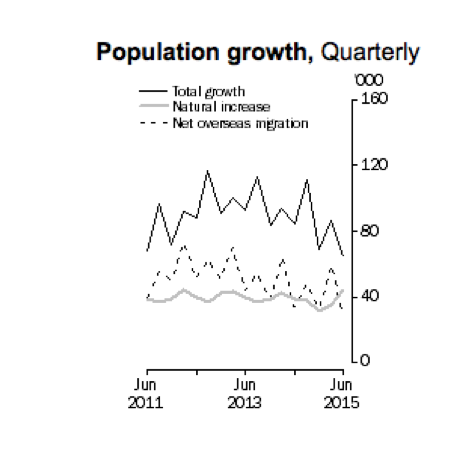

That is not the case today, indeed the opposite is occurring in Australia, and as the following charts reveal, we have record approvals, commencements and completions at the same time that population growth is slowing. Oversupply seems inevitable.

Figure 1. Record Approvals Figure 2. Record Commencements

Figure 2. Record Commencements Figure 3. Declining rates of population growth

Figure 3. Declining rates of population growth It seems inevitable that in Australia an oversupply of apartments will exist in the near future. This should lead to lower prices as unsold units are liquidated by their developers or their lenders at prices buyers are willing to pay.

It seems inevitable that in Australia an oversupply of apartments will exist in the near future. This should lead to lower prices as unsold units are liquidated by their developers or their lenders at prices buyers are willing to pay.

Somewhat predictably agents and media commentators will initially reassure investors that the problem will be confined to apartments. But real estate transacts on a ‘relative’ basis (valuations for example, are simply an examination of recently sold similar properties), and fewer buyers will turn up to the auction of a full-priced, three bedroom house, if a three bedroom apartment is available at a discount. And so after unit prices decline, houses will too.

For those of you who have made it this far – you are clearly interested – the following excerpt from Berkshire’s 2014 Letter offers two examples of successful real estate investing made by Buffett and the lessons extend to successful investing more broadly. In both cases, it appears he adhered to the adage to be greedy when others are fearful and fearful when others are greedy, and as is essential; keeping an eye on the economics – the return that could be made from owning the asset, rather than the prospect of a higher price being achieved on a future sale.

From Berkshire’s Letter to Shareholders:

“This tale begins in Nebraska. From 1973 to 1981, the Midwest experienced an explosion in farm prices, caused by a widespread belief that runaway inflation was coming and fuelled by the lending policies of small rural banks. Then the bubble burst, bringing price declines of 50% or more that devastated both leveraged farmers and their lenders. Five times as many Iowa and Nebraska banks failed in that bubble’s aftermath as in our recent Great Recession.

“In 1986, I purchased a 400-acre farm, located 50 miles north of Omaha, from the FDIC. It cost me $280,000, considerably less than what a failed bank had lent against the farm a few years earlier. I knew nothing about operating a farm. But I have a son who loves farming, and I learned from him both how many bushels of corn and soybeans the farm would produce and what the operating expenses would be. From these estimates, I calculated the normalized return from the farm to then be about 10%. I also thought it was likely that productivity would improve over time and that crop prices would move higher as well. Both expectations proved out.

“I needed no unusual knowledge or intelligence to conclude that the investment had no downside and potentially had substantial upside. There would, of course, be the occasional bad crop, and prices would sometimes disappoint. But so what? There would be some unusually good years as well, and I would never be under any pressure to sell the property. Now, 28 years later, the farm has tripled its earnings and is worth five times or more what I paid. I still know nothing about farming and recently made just my second visit to the farm.

“In 1993, I made another small investment. Larry Silverstein, Salomon’s landlord when I was the company’s CEO, told me about a New York retail property adjacent to New York University that the Resolution Trust Corp. was selling. Again, a bubble had popped — this one involving commercial real estate — and the RTC had been created to dispose of the assets of failed savings institutions whose optimistic lending practices had fuelled the folly.

“Here, too, the analysis was simple. As had been the case with the farm, the unleveraged current yield from the property was about 10%. But the property had been undermanaged by the RTC, and its income would increase when several vacant stores were leased. Even more important, the largest tenant — who occupied around 20% of the project’s space — was paying rent of about $5 per foot, whereas other tenants averaged $70. The expiration of this bargain lease in nine years was certain to provide a major boost to earnings. The property’s location was also superb: NYU wasn’t going anywhere.

“I joined a small group — including Larry and my friend Fred Rose — in purchasing the building. Fred was an experienced, high-grade real estate investor who, with his family, would manage the property. And manage it they did. As old leases expired, earnings tripled. Annual distributions now exceed 35% of our initial equity investment. Moreover, our original mortgage was refinanced in 1996 and again in 1999, moves that allowed several special distributions totalling more than 150% of what we had invested. I’ve yet to view the property.

“Income from both the farm and the NYU real estate will probably increase in decades to come. Though the gains won’t be dramatic, the two investments will be solid and satisfactory holdings for my lifetime and, subsequently, for my children and grandchildren.

“I tell these tales to illustrate certain fundamentals of investing:

“You don’t need to be an expert in order to achieve satisfactory investment returns. But if you aren’t, you must recognize your limitations and follow a course certain to work reasonably well. Keep things simple and don’t swing for the fences. When promised quick profits, respond with a quick “no.”

“Focus on the future productivity of the asset you are considering. If you don’t feel comfortable making a rough estimate of the asset’s future earnings, just forget it and move on. No one has the ability to evaluate every investment possibility. But omniscience isn’t necessary; you only need to understand the actions you undertake.

“If you instead focus on the prospective price change of a contemplated purchase, you are speculating. There is nothing improper about that. I know, however, that I am unable to speculate successfully, and I am sceptical of those who claim sustained success at doing so.

“Half of all coin-flippers will win their first toss; none of those winners has an expectation of profit if he continues to play the game. And the fact that a given asset has appreciated in the recent past is never a reason to buy it.

“With my two small investments, I thought only of what the properties would produce and cared not at all about their daily valuations. Games are won by players who focus on the playing field — not by those whose eyes are glued to the scoreboard. If you can enjoy Saturdays and Sundays without looking at stock prices, give it a try on weekdays.

“Forming macro opinions or listening to the macro or market predictions of others is a waste of time. Indeed, it is dangerous because it may blur your vision of the facts that are truly important. (When I hear TV commentators glibly opine on what the market will do next, I am reminded of Mickey Mantle’s scathing comment: “You don’t know how easy this game is until you get into that broadcasting booth.”)

“My two purchases were made in 1986 and 1993. What the economy, interest rates, or the stock market might do in the years immediately following — 1987 and 1994 — was of no importance to me in determining the success of those investments. I can’t remember what the headlines or pundits were saying at the time. Whatever the chatter, corn would keep growing in Nebraska and students would flock to NYU.

“There is one major difference between my two small investments and an investment in stocks. Stocks provide you minute-to-minute valuations for your holdings, whereas I have yet to see a quotation for either my farm or the New York real estate.

“It should be an enormous advantage for investors in stocks to have those wildly fluctuating valuations placed on their holdings — and for some investors, it is. After all, if a moody fellow with a farm bordering my property yelled out a price every day to me at which he would either buy my farm or sell me his — and those prices varied widely over short periods of time depending on his mental state — how in the world could I be other than benefited by his erratic behavior? If his daily shout-out was ridiculously low, and I had some spare cash, I would buy his farm. If the number he yelled was absurdly high, I could either sell to him or just go on farming.

“Owners of stocks, however, too often let the capricious and irrational behavior of their fellow owners cause them to behave irrationally as well. Because there is so much chatter about markets, the economy, interest rates, price behavior of stocks, etc., some investors believe it is important to listen to pundits — and, worse yet, important to consider acting upon their comments.

“Those people who can sit quietly for decades when they own a farm or apartment house too often become frenetic when they are exposed to a stream of stock quotations and accompanying commentators delivering an implied message of “Don’t just sit there — do something.” For these investors, liquidity is transformed from the unqualified benefit it should be to a curse.

“A “flash crash” or some other extreme market fluctuation can’t hurt an investor any more than an erratic and mouthy neighbour can hurt my farm investment. Indeed, tumbling markets can be helpful to the true investor if he has cash available when prices get far out of line with values. A climate of fear is your friend when investing; a euphoric world is your enemy.

“During the extraordinary financial panic that occurred late in 2008, I never gave a thought to selling my farm or New York real estate, even though a severe recession was clearly brewing. And if I had owned 100% of a solid business with good long-term prospects, it would have been foolish for me to even consider dumping it. So why would I have sold my stocks that were small participations in wonderful businesses? True, any one of them might eventually disappoint, but as a group they were certain to do well. Could anyone really believe the earth was going to swallow up the incredible productive assets and unlimited human ingenuity existing in America?”

Roger Montgomery is the founder and Chief Investment Officer of Montgomery Investment Management. To invest with Montgomery domestically and globally, find out more.

Thanks Roger for the insight. I agree the real estate market is booming and many buyers are looking for a new home I do understand that we need to consider things before investing in real estate.

Terrific article Roger. Thanks for the thorough review, educating us and spreading wise investment words from people like Warren Buffet.

Thank you for passing on this sage advice. We need more level headed discussions of property (and shares) such as this rather than attention-grabbing headlines which are created solely for the purpose of creating publicity for the commentator. The chart showing the number of property developments commencing is certainly interesting and something to note.

Hi Roger,

great post and so informative. I don’t always comment but I’m always interested in what you have to say.

I do agree with your opinion on real estate but I’m not sure when or if there will be some sort of correction (or maybe many years of zero growth until wages and inflation catch up).

I did note recently McGrath Real Estate (MEA) in it’s HY 16 announcement did comment on a “slow down in Chinese buyer activity”. This will dampen some of the support that real estate has been receiving. Interestingly this also suggests a slow down in China that you have spoken about too.

Hi Roger,

As you know, long time reader etc.

I agree with your central thesis, that prices do not always go up, and yes, credit is an issue in the economy.

My household has been formed for approx. 6 years now, and we are moving into a greenfields estate on the fringes of a major city. Initially we looked at suburbs that were a lot further in. The rationale was that we were going to try and have a place where the mortgage although large, is not going to crack $500k. We are way off from that *on the downside* thankfully.

When we looked around at what our coin was going to get us, in the eastern suburbs of the city I live in, it was clear that we were going to be severely disappointed in what we would be getting, with insufficient space for what we want, and insufficient bathrooms for what will in a few years be a tween. Just a little more space…

Anyway, I thought about what kind of work I would like to be doing, eventually, and it wouldn’t be something that I have to sit on a train for, for 1 hr each way each day, taking 10 hours a week out of my life. Which is although good time to read, time that I could spend doing sport or with the family. 21 days a year I spend sitting on a train reading, commuting into the city.

Then I think about technology, the future of work and what type of life I want to live and I figured that eventually being a bit further out wont matter. I don’t need to be in the city unless I want to. Which BTW, I love…

Now these arguments weren’t arguments to support my case as to why I would buy a greenfields block on the fringe. It was basically a function of what I believed I could actually afford to repay, or what my wife and I could afford to repay if we were both on the adult minimum wage working full time.

That sounds rational right? Now to the Buffett argument. Buffett has a 3 br starter home in Nebraska, if I recall correctly, which he has lived in since he bought it. He hasn’t sold. He’s accumulated all this money in his business and lives off $100k from Berkshire.

Whats wrong with just staking out your space, what you think you’d be happy with, finding a way to live work and raise a family.

I think the core issue with Aussies is that they haven’t figured out that at some point you just need to say enough. There’s a certain threshold of comfort, there’s a certain level of happiness that you can get, and there’s a dollar per year in income figure that is strongly correlated with that.

Unfortunately, by not accepting “enough” and wanting more, people just think – oh let’s go get 42 investment properties. That’s a distortion in the system. That’s like going to the gym and doing arms every day and ignoring the legs. And people do it.

I think that while property is overpriced, it’s the Salim Mehajers and the Real Estate agents with their underquoting and their slick leased lux euro cars that typify exactly what is wrong with our society. It reflects a status anxiety that a lot of people have, because they feel insecure about their jobs, their relationships etc.

Why do the executives who just hop off a flight immediately turn on their phones to check their email? Because they’re worried they’ve been sacked while disconnected from the world.

“Wealth is not an absolute. It is relative to desire. Every time we yearn for something we cannot afford, we grow poorer, whatever our resources. And every time we feel satisfied with what we have, we can be counted as rich, however little we may actually possess.”

That’s the fundamental issue with Australia and its property bubble. We just desire too much, we forget how much of a wealthy nation we are, how good we have it. People want holiday homes, they want caravans, they want overseas holidays, they want the bigger car.

They want all this stuff because it lets them feel comfortable about where they sit in the hierarchy. What it also says is that people want “fairness” but it’s really only because of credit growth and the scales being tipped in their favour that they can afford it. They want fairness until fairness is imposed upon them.

But just sitting in the park looking over Sydney harbour, or on Birrarung Marr looking over Melbourne, it shows you just how advanced and fortunate we are here, and that’s free.

So I mean, I’ve staked out my space. Sure it’s a bit far out, yeah it’s not perfect. But by doing this I’m at least employing people to do work. Sure, I’m making some landowner wealthy, sure it’s not going to be the luxury house in Hawthorn, or Moss Vale or whatever.

But it’s enough for me. And if there were more like me, and less people trying to buy the next big thing, then I think we’d be a lot better off.

Thanks for your insights and I hope that what we see is a gradual decline in the prices and not a cliff dive…

An excellent piece Roger.

As a 24 year old who is renting it’s extremely difficult to justify paying current prices. It’s also difficult to attain the deposit required as the savings interest rate is so low and the house price is increasing so much. Please note I’m referring to the outskirts of Melbourne metro, not Toorak prices.

The ‘first home buyer’ type of house is also a prime target for an investor, as they can justify paying a higher price with negative gearing (whether negative gearing is useful is a different question entirely..). Then it perpetuates the situation because the can’t-afford-a-house renter is paying rent to the investor, so they can then buy another..

So when is the appropriate time for me to buy? Wait until there’s a property crash? Looking back at your other RogerMontgomery articles, we could say in 2012 property prices were expensive, 3 years ago and we’re still waiting and saying the same thing.

Perhaps there will be a price reduction in 1-3 years, at that point you’d imagine the share market would drop as well. As an investor who knows the power of investing at good value prices coupled with the power of compounding, that would be the best time to invest in shares..it would be hard to pick.

That’s assuming the property market does drop substantially. If other first home buyers + property investors see a 10%-25% drop (which would still be a fairly expensive real-estate market right?) then they would buy at that point, keeping the prices supported at a not-much-lower level.

Yet I can’t just sit on the sidelines forever expecting it to drop 50%+, that might never happen.

As for the Warren Buffett part of your article, very interesting and I love his techniques. I wonder if he’d be able to become as rich starting in today’s market and what path he’d choose?

Tristan

There are a number of unique factors that keep Australia’s real estate prices up. These factors are the reason property prices have not experienced corrections of the same magnitude as that in US and certain European countries.

First factor is negative gearing. When negative gearing was abolished in US in late 1980s, a great transfer of wealth took place. High earning middle class liquidated investment properties because they could no longer use property related tax deductions. This caused huge price declines, and those with cash at the ready picked up the bargains. Interestingly, there is a serious debate going on about abolishing negative gearing in Australia. Indeed if that was to happen, property prices could collapse almost overnight.

Second factor is Australia’s relatively small population in relation to the sheer number of foreign investors. Thus, it takes only a small percentage of Chinese, Hong Kong, European or US investors to overwhelm the supply of properties available in Australia. Indeed, if prices were to show signs of collapsing, the government could relatively quickly open the foreign investment tap to bring them back up.

Brilliant article Roger. As a first home buyer, this article was definitely worth reading. Thank you for all your great insights.

Fantastic piece Roger. Buffett is just amazing.

Does our banking sector already have a severe property downturn priced in? Given the banks have been more restrictive on investment loans of late and a vast majority of their loan books are ahead of prepayments, the banks should be able to withstand a property downturn that isn’t too severe. Wondering your thoughts on this.

Thanks for all you do to educate people.

Very interesting Roger, but what about Chinese buyers?

I can well understand them risking Aus property, instead of the chinese stock market or financial system…..

Great article Roger.