Here’s a story worth telling

There is a popular aphorism in investing circles that originally came from Winston Churchill; “never let a good crisis go to waste.” While the human and economic costs of the COVID-19 crisis remain current, Gary Rollo and Dominic Rose, the team behind the Montgomery Smaller Companies Fund have quietly taken advantage of the dislocation to establish the ground work for what might become an enviable track record.

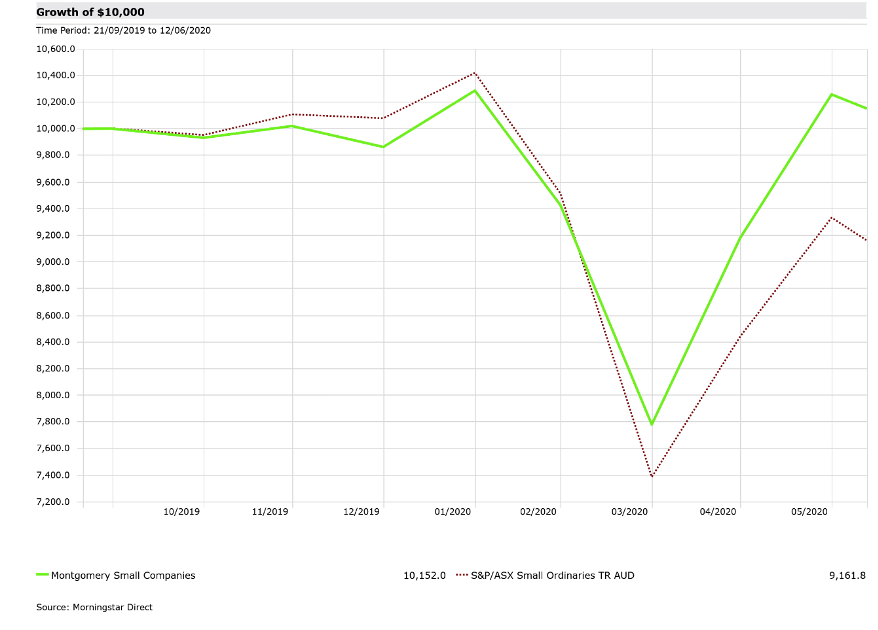

The Montgomery Small Companies Fund (The Fund) return since inception (21 September 2019 to 12 June 2020) shows only a relatively modest 1.52 per cent return, but as you can see in Figure 1., the total return after fees, has exceeded The Fund’s benchmark, the S&P/ASX Small Ordinaries Accumulation Index, by 9.9 per cent.

Importantly, Figure 1., shows The Fund out-performing during the market sell-off and also out-performing during the rally from the market’s lows on 23 March 2020. As an aside, the broader market, as measured by the S&P/ ASX 300 Accumulation index, has declined 11.1 per cent over the same period.

While the period is a relatively short one, it is important to note that a significant market sell off and rally, and therefore ‘market cycle’ has occurred. It is often the case that professional investors prefer to see how a manager performs ‘over the cycle’ before gaining confidence in a funds management team.

Figure 1. One Cycle: Montgomery Small Companies Fund (MSCF) vs benchmark, since inception

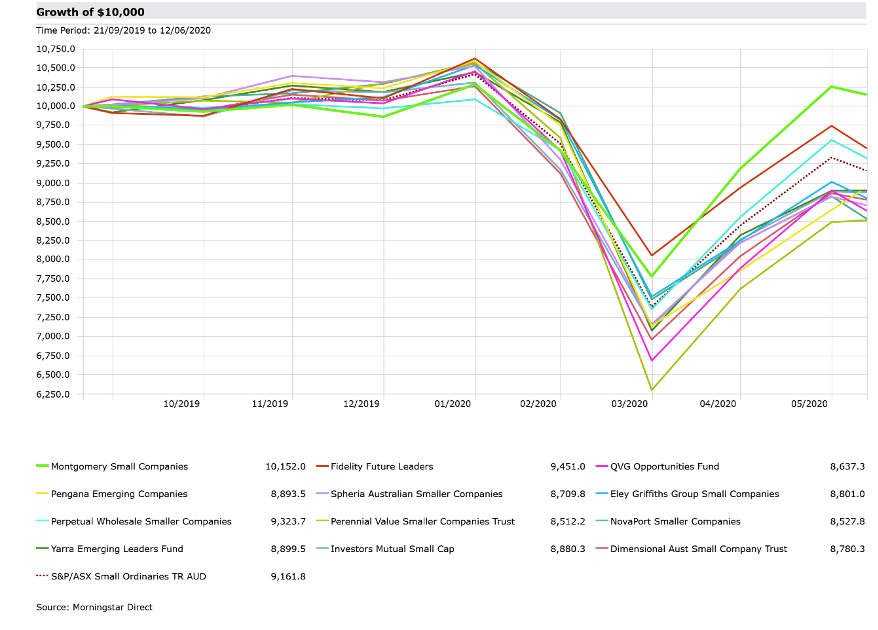

Comparing The Fund’s recent performance with other well-respected and highly-regarded, Australian small companies fund managers, we can see it, thus far, compares favourably.

Figure 2. Montgomery Small Companies Fund relative performance since inception

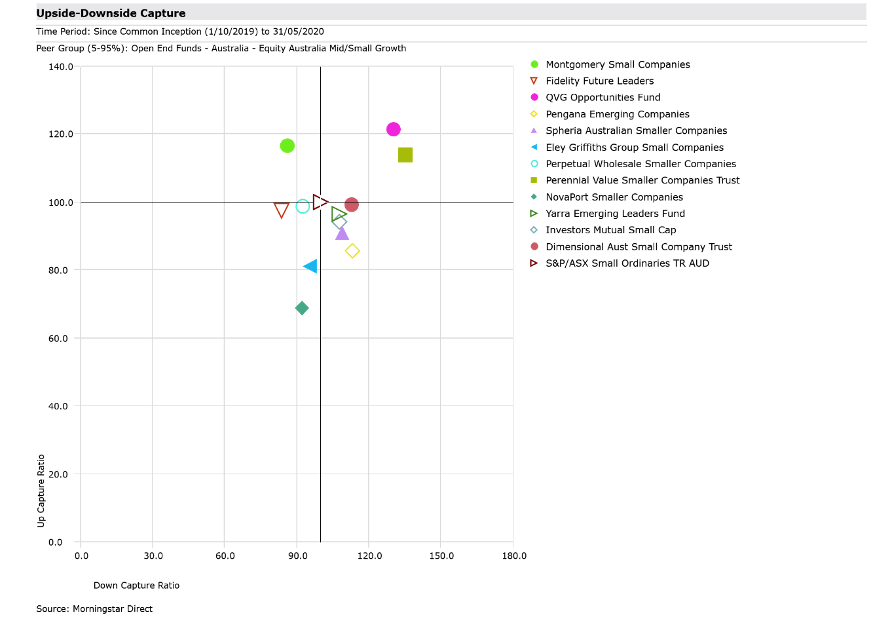

Importantly, this period of returns has also been delivered with very favourable characteristics that are illustrated in Figure 3. Since its inception, The Fund has captured, on average, 116 per cent of the upside in any month when the market generates a positive return, but captured only 86 per cent of the downside, on average, in any month when the market return has been negative. It goes without saying that if the Montgomery Small Companies Fund team can continue to deliver this type of return profile, or journey for investors, it would be an attractive outcome.

Figure 3. Montgomery Small Companies Fund Upside/Downside Capture

Finally, it is also worth mentioning that the companies held in the portfolio are on average growing their sales at twice the rate of the market but The Fund is only paying a 10-20 per cent premium to the market for this superior growth. We currently believe the growth that inheres in the portfolio is better quality and longer duration. This is partly due to the portfolio structure, which is overweight structural growth and underweight resources and cyclicals.

We’d be delighted to talk to you about an investment in the Montgomery Small Companies Fund. If you are considering an investment, it is accessible via a minimum investment of $25,000. Please click here for more information on The Fund.

Another way many investors have accessed various Montgomery Funds is via their Self-Managed Super Fund (SMSF). If you don’t have a SMSF but instead would like to have some personal input into your super investments, you might like to investigate a Personal Super Account, such as the Super Accelerator Plus product offered by Netwealth. Investments below $10,000 are permitted.

Netwealth’s Personal Super Account provides a huge selection of investment options including The Montgomery Fund, the Montgomery Global Fund and the Montgomery Small Companies Fund.

You will need to do your own due diligence to determine if Netwealth’s Personal Super Account is right for you, and you can talk to a Netwealth consultant. Please click here for more information on investing with your super.

Montgomery has no formal or monetary links with Netwealth outside of having our investment funds available on their menu.