US Healthcare Spending

The US Congressional Budget Office (CBO) provides analysis on economic and budgetary decisions, and it’s just materially revised downward its growth projections for US federal healthcare spending.

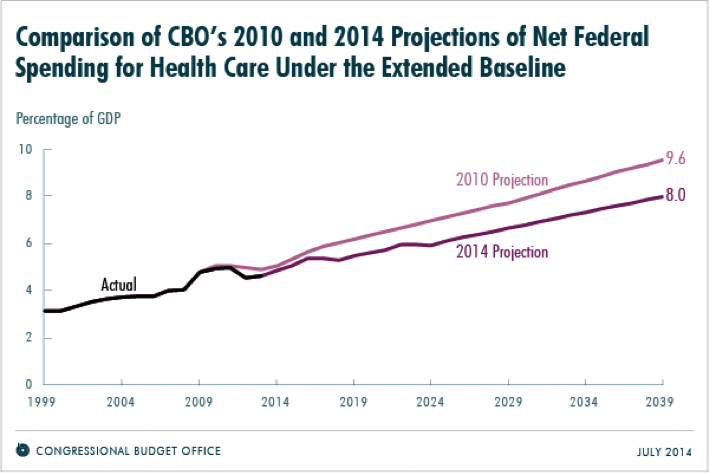

In this announcement on 15 July 2014, the CBO noted that actual federal healthcare spending in recent years had been lower than anticipated. Furthermore, it expects that growth will also be slower than previous projections.

In 2010, the CBO projected that net federal spending for healthcare programs in 2039 would grow to 9.6 per cent of US Gross Domestic Product (GDP). The agency now projects that healthcare spending will instead account for 8.0 per cent of GDP. The effect of this change is a $1.1 trillion reduction to spending for Medicare and Medicaid collectively over the fiscal years 2011-2020.

Historically, the US Government has provided reimbursement rates at a considerable premium to private insurers. In recent years, it has endeavoured to curtail this excess spending with a number of programs, such as market-based bidding, and it seems that these efforts are having the desired effect.

It’s interesting to note the drivers behind the CBO’s growth projections. In September 2013, the committee attributed only 35 per cent of the growth in funding to the ageing population, while excess cost growth explained 40 per cent of the increase, and the remaining 25 per cent was attributed to the expansion of insurance coverage under the Affordable Care Act.

We wonder how willing the US Government will be to direct 8 per cent of GDP to spending on healthcare, and on the surface it seems likely there will be plenty of fat to trim.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Hi Kelvin,

The US accounts for around 40 per cent of CSL’s revenues, of which Government Departments would comprise a meaningful share.

Ben

Hi Ben, what effect does this have on CSL?

Thanks.

Kelvin