Health Insurance – Will the market get nervous sitting in the waiting room?

The Federal Government is currently conducting a number of reviews into the healthcare industry. These include the Reform of the Federation White Paper, the Private Health Insurance Review, the Primary Health Care Advisory Group, and the Medicare Benefits Schedule Review. You might have seen recent media stories about an online government survey that the public can take to provide feedback on a range of issues and options for private health insurance reform.

The various reviews are likely to throw up a number of potential industry issues that will scare the market from time to time. The main one that will cause concern for the market is the potential removal of the government rebate from ancillary or extras cover.

Extras or ancillary cover is essentially a prepayment of future healthcare costs for consumers. This is a very different consumer proposition than hospital cover, which is a more traditional consumer proposition of protection against a very expensive adverse event. The value of the consumer proposition is partially funded by the government rebate for all demographics other than high income earners with the government effectively subsidising the cost of these procedures. The other part of the value of the policy is the ability of the insurer to use its bulk purchasing power to reduce the price of services for the consumer.

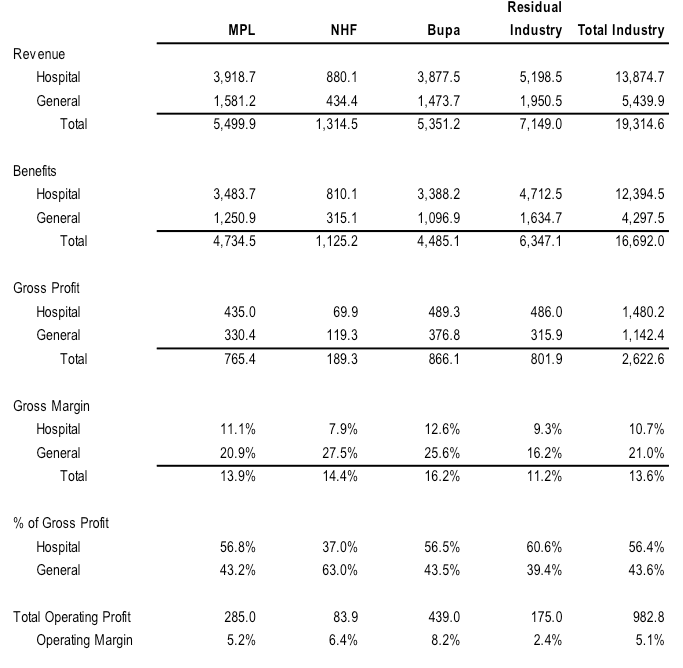

The industry generates almost double the gross margin on ancillary benefits policies compared to hospital policies. The table below shows APRA data on the gross profit split for MPL, NHF, Bupa and the overall industry in the 2014 financial year between Hospital and Ancillary premiums. At present, the rebate ranges from zero per cent to 27.8 per cent of the policy value for those under 65, depending on the insured person’s income level (the rebate goes as high as 37.1 per cent for those over 70).

At present, the rebate ranges from zero per cent to 27.8 per cent of the policy value for those under 65, depending on the insured person’s income level (the rebate goes as high as 37.1 per cent for those over 70).

In the 2014 financial year (FY14), the total cost of the private health insurance rebate was A$5.53 billion or 28.6 per cent of total premiums. This will have fallen to 26.5 per cent in the 2016 financial year due to CPI indexation, and will be lower again in the 2017 financial year.

Removing the rebate on ancillary cover would result in premium increases of between zero per cent and 36 per cent on the portion of the premium relating to ancillary cover. This averages around 25 per cent of a total hospital and ancillary policy premium, implying an increase of between zero per cent and 9 per cent on an average hospital and ancillary cover insurance premium (in addition to the usual annual increase on 1 April).

Given total industry profitability of under A$1.0 billion, if the overall cost of health insurance to the consumer did not increase (ie the PHI providers absorbed the ~A$1.56 billion reduction in the aggregate rebate paid by the Federal Government), it would result in the private health insurance industry becoming loss making in aggregate.

The degree to which the reduction in the aggregate rebate paid by the Government is passed onto the consumer through higher net premiums would be determined by the least profitable private health insurance (PHI) providers. Excluding MPL, Bupa and NHF, the weighted average operating margin of the rest of the industry was just 2.4 per cent in FY14.

Given the reduction in rebates would represent around 7.5 per cent of overall revenue (ie A$1.55 billion or industry premium revenue totalling A$19.3 billion), the industry ex MPL, Bupa and NHF would need to pass through at least two thirds of the reduction in rebates to consumers as higher net premiums to maintain operating margins above breakeven.

Increasing the net cost to consumers relative to the benefits paid would reduce the value proposition of ancillary cover as a means of pre paying and saving money on anticipated treatments. As such the policy would be likely to see some members opt to drop out of ancillary cover.

However, the personal tax implications for those earnings more than A$90,000 a year (A$180,000 for families) of dropping hospital cover through the Medicare levy surcharge means that people are unlikely to cancel the total policy. It would probably result in an increased proportion of those earnings less than the MLS income threshold falling back on the public system and dropping private health insurance cover.

Hence, if the rebate on ancillary/extras insurance policies is eliminated by the Federal Government following the various reviews of the healthcare industry are completed, one of two things are likely to occur:

- PHI companies could rebalance the gross profit generation and margins between hospital and ancillary policies by taking prices up on hospital and down on ancillary. This would improve the value of ancillary products as a separate product to consumers, as well as allowing the tail of the PHI industry to remain viable.

- The tail of the industry would significantly rationalise, forcing consumers to switch to more profitable PHI providers that can absorb more of the margin impact of the reduction in ancillary policy profitability. The increase in policy numbers would improve the scale of the larger PHI providers, providing some fixed cost leverage, increased negotiating power with healthcare providers, as well as significant revenue growth. While overall average margins might be lower, aggregate profits for each PHI provider could easily increase due to increased market share.

A combination of the two outcomes would be likely if the government removed the rebate on ancillary benefit policies. While the market would be likely to view such an announcement from the government as being a negative, the medium to longer term impact on MPL could actually be a longer term positive if it acts as a catalyst to rationalise the industry. The strong will get stronger and the weak will disappear.

Considerations for the Government would include the implications for dental and optical care in the population, the net impact on the budget of any increase in people dropping out and relying on the public system, the implications for PHI competition of a rationalisation of less profitable insurance providers.

However, speculation regarding potential outcomes is likely to cause uncertainty for revenue, margins and earnings in the near term for the PHI stocks. With a significantly higher proportion of its gross profit generated from ancillary cover policies, NHF is arguably more vulnerable to any change than MPL.

This is only one of many potential adjustments to the current system, a number of which would be positive for the insurers.

Stuart Jackson is a Senior Analyst with Montgomery Investment Management. To invest with Montgomery domestically and globally, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

$0 Premium Health Insurance is available. Search google.

That’s true, if you’re willing to potentially wait for years for anything classified as elective. Additionally, if everyone chooses the free option then the system will collapse, unless you’re willing to pay substantially higher taxes.

Hi Stuart, I think any changes they make will ultimately be to make the industry more affordable for patients and sustainable for the industry. They won’t want the changes to act as a strong incentive for people to fall back to relying on the public health system. Dropping the ancillary benefits rebate for things like dental, optical and physio would be pretty bad for these particular business, especially dental I would think. In practice most healthy younger adults with hospital and extras cover would only utilise their private health insurance for their regular dental check ups and for getting some new contact lenses or spectacles. I think this group would be much less likely to take up private health insurance in this case, and from what I’ve read the industry is actually keen to encourage more younger members to subsidise older members. I wonder whether they will just make some exclusions on what can be included in ancillary cover such as homeopathy and naturopathy? Or reduce the ancillary rebate applicable to these policies? No point in the government subsidising things which have questionable benefit and with limited evidence. Or things that a prone to abuse eg. massage therapy.

Hi Gav, any changes to the rebate on ancillary premiums are likely to be offset by other more positive reforms stemming from the reviews such as potential lifetime discounts for those under 30, the ability for insurers to enter the primary care market, increase data sharing, cuts to prosthesis purchase prices etc. Any changes to the rebates are more likely to focus on benefits that are considered non-essential as you point out. There will be greater public and industry resistance to the removal of the rebate from dental and optical. These two areas contributed 69% of MPL’s ancillary claims expenses in FY15 (physio and chiro contributed another 13%). So alternative therapies only contribute a very small proportion of the benefits paid out (around 6% of all ancillary claims in FY15 according to MPL).

In terms of the risk of younger people lapsing as a result of affordability issues, given the Government is undertaking this review to ensure the sustainability of the system, it will be very focused on ensuring the changes do not provide an incentive for consumers to revert back to the public system (as you note). So if the affordability of insurance is negatively impacted by the changes, you can probably expect additional penalties to be imposed on those that are seen to be able to afford private health insurance but choose not to take it out.

My other point is that in looking at the impact on MPL or NHF of any changes in regulations, you need to consider the impact on the broader health insurance market. Invariably, costs that are imposed on all players tend to get passed through to consumers. It will be interesting to see what the Government does to ensure the consumer is willing to pay the higher cost resulting from those changes.

Thanks Stuart. Yes encouraging younger members through lifetime discounts and also those that can afford to but choose not to have private cover would be good. I agree overall it will be good for MPL in the medium term and particularly so over the smaller insurers, given their scale advantage. Let’s see how this plays out.

Brilliant perspicacious post!

This blog is certainly becoming Australia’s premier investment blog! Keep up the good work guys!

Thanks Tom

Great piece, extremely insightful!

Thanks Muhammed