After a hefty price fall, is IPH now good value?

IPH Limited (IPH) listed at $2.00 in late 2014 and soared to over $9.00 just one year later. The market clearly liked the story. But for the past 12 months, the share price has steadily declined and IPH now trades around $5.00. After this sort of a fall, we had a good look at the business to see if IPH had become a bargain.

Source: Bloomberg

IPH earns money helping clients secure patents in Australia and Asia. Typically, its clients are large global corporates who have secured patent protection for their IP overseas, and want to extend that protection into other countries. IPH’s patent attorneys provide the local knowledge, contacts and experience to help them navigate that process.

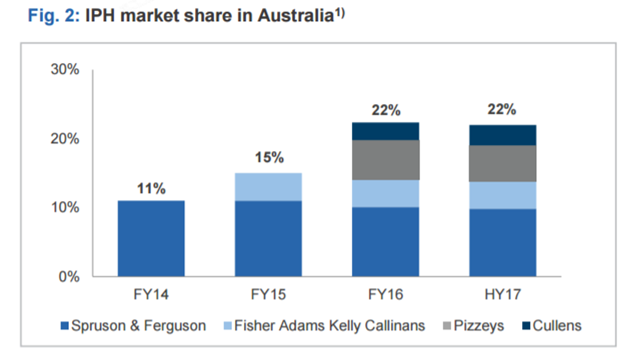

Since IPO, IPH has taken advantage of its listed currency to consolidate a strong position in the Australian market. As the chart below shows, IPH holds a market-leading 22% share, having acquired several large firms in FY15 and FY16.

Source: IPH

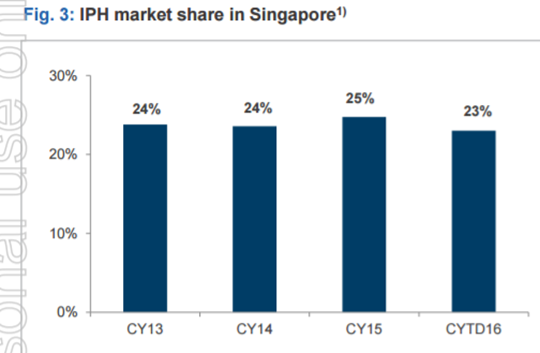

IPH also holds a leading position in the Singapore market, as shown below, and smaller market positions in a range of other Asian markets. However, Australia is a relatively large market and drives the bulk of IPH’s earnings.

Source: IPH

When we look at IPH’s growth over time we see two things: The most obvious is the acquisition strategy which taken IPH to its leading market position in Australia. However, while acquisitions have delivered growth, it is less clear that this strategy can deliver value. IPH pays “market” prices for the businesses it acquires, and the level of synergy it extracts appears modest at best. Accordingly, the economics of this growth are not overly compelling.

The other side to IPH’s growth is organic growth, due to a growing market, or gains in market share. As a service business, IPH requires very little by way of working or fixed capital, and so organic growth can be very profitable. Recognition of this may have helped drive the IPH share price to its 2015 highs.

However, the scale of the organic growth opportunity may be smaller than the market would like. The number of patents applied for in Australia by non-residents has been growing only slowly – averaging around 2% p.a. for the last ten years. The numbers are even lower in Singapore.

That leaves market share or price gains to do the heavy lifting in terms of organic growth, and the outlook is bright on neither front. Underlying market share for IPH appears to have been flat at best in recent years, and potentially declining. Also, EBITDA margins are already higher than those of most comparable companies, suggesting greater scope for decline than improvement.

Part of the problem may be that as a patent attorney grows in market share, it encounters conflict issues. Where IPH serves two clients who compete with one another, questions arise as to whether IPH can deliver the best possible outcome for both clients. The issue may be more perception than reality, but that’s still enough to constrain growth. Another issue is strong growth in the number of registered patent attorneys (potential competitors) in Australia in recent decades.

Having debated the issues around the table, the consensus view of the MIM team is that organic growth for IPH is likely to be very modest, and when we run that assessment through a valuation model, we come up short.

While IPH is certainly better value than it was, it still hasn’t reached a point that would tempt us on to the register.