GUEST POST: A PRIMER ON GOLD EQUITY INVESTING

By Praveen J on 9th January 2012 and updated Feb 20 2012

By Praveen J on 9th January 2012 and updated Feb 20 2012

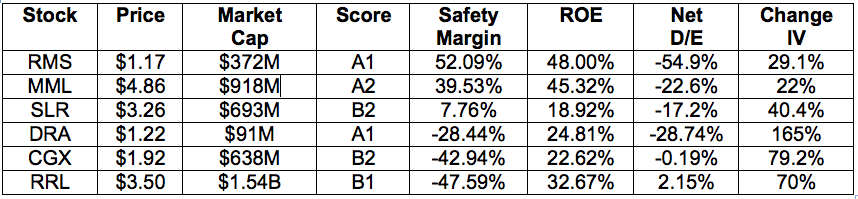

This year I have been given an opportunity to write about my experiences in applying what I have learnt as a Value.able graduate and Skaffold member. At the moment I am looking to invest in stocks with a market capitalisation under $2 billion (small to micro caps). Key MINIMUM criteria for me include: Return on Equity > 15%, Net Debt/Equity < 50%, and forecast change in Intrinsic Value > 5%. I will also be focussing on investment grade companies across ALL Industry Sectors/Groups that have Skaffold Quality Scores between A1 to A3, and B1 to B3. This will encompass my “investment universe” of stocks on the ASX. I will of course require a decent margin of safety, but I will be watching stocks that are trading close to their Intrinsic Value or at a small premium, in the event of a decline in price over the next 3 to 6 months. Initial screening using Skaffold reveals over 100 stocks, a more aggressive filter would reduce this number even further. Amongst the results are 10 stocks in the Basic Materials Sector and Gold & Silver Group, 6 of which are predominantly involved in gold exploration, development and production:

• Ramelius Resources (ASX:RMS)

• Medusa Mining Limited (ASX:MML)

• Silver Lake Resources (ASX:SLR)

• Dragon Mining (ASX:DRA)

• CGA Mining (ASX:CGX)

• Regis Resources Limited (ASX:RRL)

Table 1. Stocks listed by safety margin (highest to lowest, 9th January 2012) (Source: Skaffold):

Although Ramelius Resources (RMS) meets my initial screening criteria and is an A1 company, it has a NEGATIVE forecast EPS growth. So in this blog post I will be discussing and comparing Medusa Mining Limited (MML) and Silver Lake Resources (SLR). Here we have two companies that have commenced production of gold (they are making money), they are fundamentally healthy, they have good prospects for Intrinsic Value appreciation, AND are both trading at a discount to their Intrinsic Value. Being commodity businesses, the question I have to ask is whether either really have any competitive advantage. I will discuss this later.

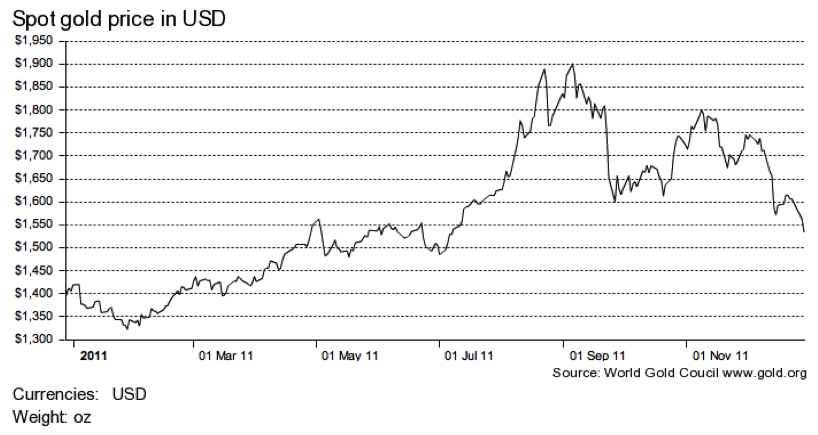

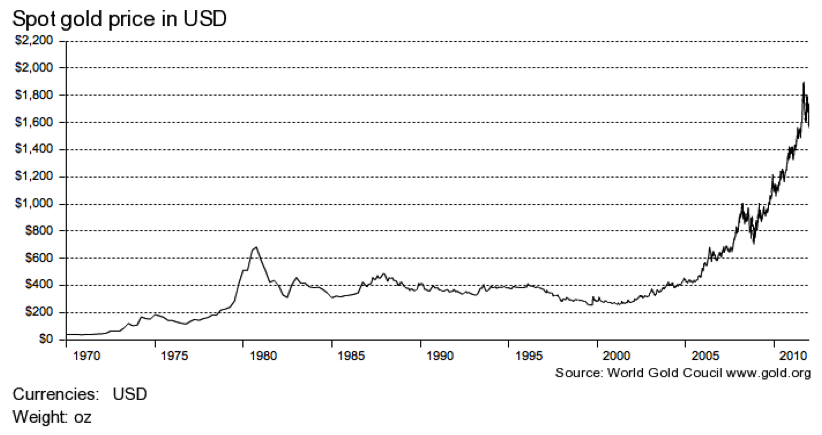

Now in the context of the European sovereign debt crisis, anaemic growth in the US, and concerns of a slowdown in the Chinese economy, I am wary about investing directly in a small cap Australian mining company. However, in this case we are dealing with a commodity that may benefit in this time of uncertainty, with gold long being regarded as a “safe-haven”. Having said that, the future price of gold is still a significant element of risk. At the time of writing the price had dropped down to around US$1600/ounce, after a peak of close to US$1900/ounce in September 2011. Below are some charts of historical gold prices, I’m not going to try and analyse them, but they may serve as a point of discussion. Certainly investing in gold equities requires a bullish stance on the future price of gold in the medium to long term.

Figure 1. Spot gold price chart last 1 year:

Figure 2. Spot gold price chart long-term:

GOLD PRIMER:

Annual reports and AGM presentations for gold and other mining companies assume a level of pre-existing knowledge. Without this, they really make no sense at all. So let me start with some bare basics before I discuss each stock in detail:

What is an Element? An element is a pure chemical substance. You may have heard of something called the periodic table (maybe in your high school science class), this is actually a list of all chemical elements. Examples of elements include carbon, oxygen, aluminum, iron, copper, lead, and of course gold.

What is a Mineral? A mineral is a naturally occurring solid chemical substance that is a combination of elements.

What is an Ore? An Ore is a type of rock that contains minerals. Most individual elements are found in the form of a mineral, though there are some elements that can be found in their elemental state, gold is one of them. Gold is also found in combination with silver and occasionally copper.

What is an Ore Deposit? This is an accumulation of Ore.

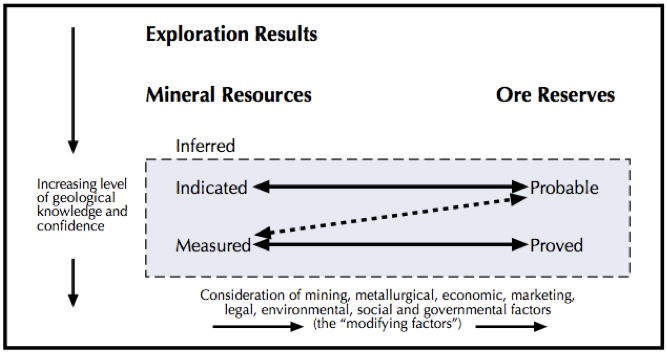

JORC? This is the Joint Ore Reserves Committee. The Code for Reporting of Mineral Resources and Ore Reserves (the JORC Code) is widely accepted as a standard for professional reporting purposes.

What is a Mineral “Resource” and what is an Ore “Reserve”? These terms are often incorrectly used interchangeably, the exact JORC definitions are below:

Figure 3. Resources versus Reserves (Source: JORC):

RESOURCE; “A CONCENTRATION OR OCCURRENCE OF MATERIAL OF INTRINSIC ECONOMIC INTEREST IN OR ON THE EARTH’S CRUST IN SUCH FORM, QUALITY AND QUANTITY THAT THERE ARE REASONABLE PROSPECTS FOR EVENTUAL ECONOMIC EXTRACTION. THE LOCATION, QUANTITY, GRADE, GEOLOGICAL CHARACTERISTICS AND CONTINUITY OF A MINERAL RESOURCE ARE KNOWN, ESTIMATED OR INTERPRETED FROM SPECIFIC GEOLOGICAL EVIDENCE AND KNOWLEDGE. MINERAL RESOURCES ARE SUB-DIVIDED, IN ORDER OF INCREASING GEOLOGICAL CONFIDENCE, INTO INFERRED, INDICATED AND MEASURED CATEGORIES.”

RESERVE; “THE ECONOMICALLY MINEABLE PART OF A MEASURED AND/OR INDICATED MINERAL RESOURCE. IT INCLUDES DILUTING MATERIALS AND ALLOWANCES FOR LOSSES, WHICH MAY OCCUR WHEN THE MATERIAL IS MINED. APPROPRIATE ASSESSMENTS AND STUDIES HAVE BEEN CARRIED OUT, AND INCLUDE CONSIDERATION OF AND MODIFICATION BY REALISTICALLY ASSUMED MINING, METALLURGICAL, ECONOMIC, MARKETING, LEGAL, ENVIRONMENTAL, SOCIAL AND GOVERNMENTAL FACTORS. THESE ASSESSMENTS DEMONSTRATE AT THE TIME OF REPORTING THAT EXTRACTION COULD REASONABLY BE JUSTIFIED. ORE RESERVES ARE SUB-DIVIDED IN ORDER OF INCREASING CONFIDENCE INTO PROBABLE ORE RESERVES AND PROVED ORE RESERVES.”

What is the difference between high and low-grade gold Resource? There aren’t any fixed definitions that I could find, but generally < 4.0 grams/tonne is low-grade, >8.0 grams/tonne is high-grade, and everything in between is about average. A large amount of low-grade gold could be just as profitable as having high-grade gold, as it could be cheaper and easier to mine the low-grade gold (for example low-grades in “open pit” or near surface mines, versus high-grades in “narrow vein” or deep underground mines).

Stages of mining: exploration, development, or production? Exploration involves primarily drilling activity in order to discover ore deposits and then define the Resource and Reserve levels, as well as feasibility studies, development involves primarily engineering / construction work, and production involves the mining, processing at the mill, and selling of the commodity.

Junior, mid-tier, or senior gold producers? Junior gold producers are generally considered as those producing under 200,000 ounces per annum of gold, seniors over 1,000,000 ounces, and the mid-tier producers in between.

What is a mining tenement? This is basically a license/permit granted by the Government to undertake exploration, development, and/or mining activities in a specific area.

What are royalties? Royalties are an expense that needs to be paid to the State Government in Australia for any minerals that are mined. In Western Australia for example, royalties are 2.5% of the value of gold produced.

What are cash costs? This is the operating cost required to produce one ounce of gold. Average worldwide cash costs are around US$620/ounce. Cash costs do not include capital expenditure. TOTAL cash costs include royalties.

What is hedging? Agreeing on the sale price of a certain volume of gold ahead of producing it, it is done to protect the company from the short-term volatility of the market gold price, but will reduce return when the price is rising.

Quick comparison of gold producing companies… First of all, make sure you compare similar companies, i.e. a junior producer with another junior producer, not a junior with a senior. Look at the total amount of resources they have, quoted in ounces, look at the cash costs, and look at how much ounces they have produced per year, and what level is expected in the future. Look for companies that are actively drilling to expand their resource base and find new ore deposits. A company may have one site producing gold, another being developed, and several others under exploration. This ensures that when Resources deplete at one site, there are other potential mines in the wings.

ANALYSIS: MEDUSA MINING LIMITED (ASX:MML)

MML is an un-hedged gold producer listed on the ASX and LSX and is currently operating in the Philippines.

Figure 4. MML’s Skaffold Line (Source: Skaffold 6th January 2012):

Looking at the figure above we can see that the share price has been on the climb since early 2009. The ACTUAL Intrinsic Value (which is based on analyst forecasts) has also followed suit since then, and has generally remained above market price. Market price reached a peak of $8.35 in September 2011 but has since been on a downward slope. More importantly though, the ACTUAL Intrinsic Value is expected to continue rising. In this instance however, the AVERAGE Intrinsic Value (a more conservative estimate), which is based on past performance with an emphasis on the last 3 years, is not expected to rise as strongly. As this value does not necessarily take into account all possible future events, what I need to find out is what future prospects the company has that could have contributed to the analyst’s forecasts. Another important thing to consider is why has the market price dropped almost 50% in just a few months? I’ll come back to this last point later…

Currently MML’s production is focussed on the Co-O mine in the Mindanoa Island area. A second potential gold production centre is under exploration at the Bananghilig deposit. MML currently have JORC code compliant mineral Resource of 21.3 million tonnes, at a grade of 9.6 grams/tonne (g/t) at Co-O and 1.3 g/t at Bananghilig, for a total of 2.6 million ounces (mOz). The company aims to keep Resource and Reserve levels at the Co-O mine stable year to year (by replacing whatever is used up each year), and in doing so avoid spending too much money on expanding this base to levels that will not get mined for several years. Exploration budget for 2012FY is US$27 million. Gold production for 2011FY was 101,474 ounces. Total cash costs for 2011FY were an extraordinarily low US$189/ounce (includes royalties). This could be due to the fact that mining is done predominantly via hand-held equipment, and labour costs are low. The site is also adjacent to a highway with close access to the port, and has grid power via hydropower.

Production for 2012FY was expected to be around 90,000 to 100,000 ounces. This will be ramped up to 200,000 ounces per annum by 2014FY after completion of the Co-O mine expansion. Exploration continues at Bananghilig, MML are targeting production of 200,000 per annum at this site by 2016FY. Near future expansion related capital expenditure will be funded from existing cash rather than through capital raisings and debt facilities, which is great and not surprising given their huge operating margins. Having said that, with regards to Bananghilig, no announcement has been made yet regarding whether feasibility studies are to take place, and whether this deposit will go into production phase at all. Further to this, based on current Reserves at Co-O, its mine life is only about 5 years. The risk here is if they are unable to continue replenishing the Resource and Reserve base over the coming years to extend the mine life further. However published analyst research reports are suggesting a possible mine life of over 25 years, indeed a similar mine south of Co-O (Diwalwal) has been mining for 20 years. There is also the risk of political/social instability in this country. MML is targeting 400,000 ounces per annum of production of gold by 2016FY.

Figure 5. Production timetable in ounces (Source: MML AGM Presentation November 2011):

ANALYSIS: SILVER LAKE RESOURCES (ASX:SLR)

SLR is also an un-hedged gold producer that currently operates in 2 key regions of Mount Monger and Murchison in Western Australia, approximately 50km south east of Kalgoorlie.

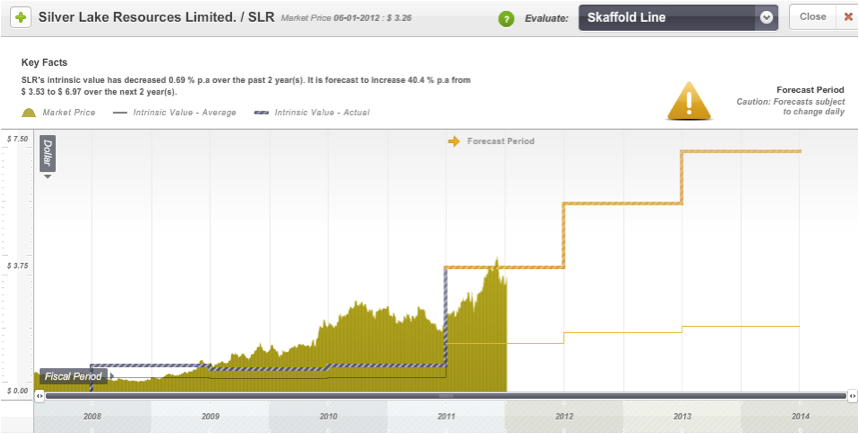

Figure 6. SLR’s Skaffold Line (Source: Skaffold 6th January 2012):

From the figure above what I can see is that the market price has generally been above the ACTUAL Intrinsic Value, although it appears that a great opportunity to buy would have been at the start of 2011. The ACTUAL Intrinsic Value has increased significantly since then, and looks like rising quite rapidly over the coming few years. Market price reached a peak of $3.87 in December 2011, and in fact SLR was one of the best performing stocks on the ASX for the year, significantly outperforming the S&P ASX 200 Index. However, the market price has since dipped down, and a buying opportunity has once again presented itself! The AVERAGE Intrinsic Value is also rising, but as with MML, the growth here is more conservative. Note that as these two lines become closer together, our confidence in the Intrinsic Value estimate is increased.

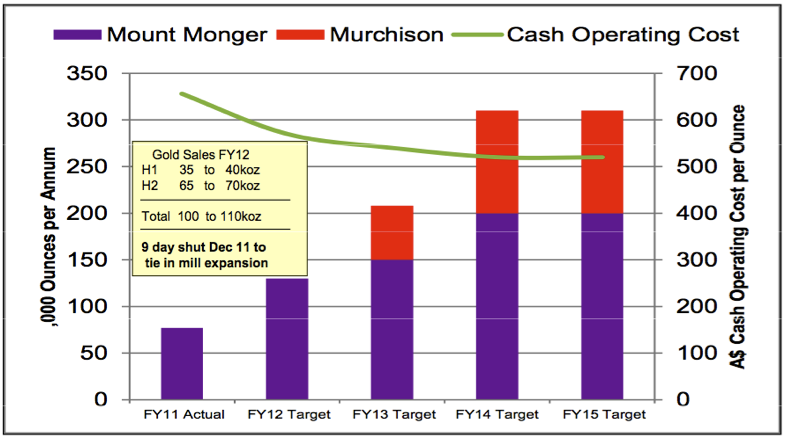

SLR currently has 24.1 million tonnes of JORC Resource at grades of 8.9 (g/t) at Mount Monger and 2.8 g/t at Murchison for a total of 3.3 mOz as at June 2011. The company is aiming to build the Resource base for 2012FY to 5 mOz. In the last 2 financial years, they have increased this Resource base by 1 mOz each year. This has been via an extensive drilling programme each year that is part of their long-term exploration budget ($18 million per annum). Total production of gold for 2011FY was 63,425 ounces. Total cash costs for 2011FY were US$674/ounce (includes royalties). The Mount Monger operations are targeting production of 100,000 to 110,000 ounces for 2012FY. The company expects to ramp up production here to 200,000 ounces per annum by 2014, with an expected mine life > 10 years. The Murchison operations will start production in Q3 2013FY, and is expected to produce 100,000 ounces per annum (from 2014FY) with an 8-10 year mine life. Mining at these locations is predominantly underground. Open pit productions have recently commenced at their Wombola Dam site. SLR has also recently reported high-grade copper discoveries at their Hollandaire site within the Eelya Complex that could provide added value. SLR is targeting 300,000 ounces per annum of production of gold by 2014FY.

Figure 7. Production timetable in ounces (Source: SLR AGM Presentation November 2011):

REVENUE, NET PROFIT, CASH FLOW, RETURN ON EQUITY:

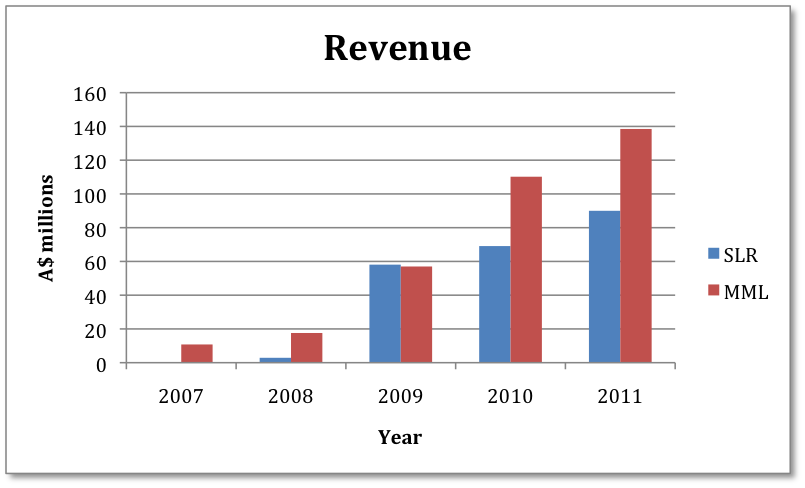

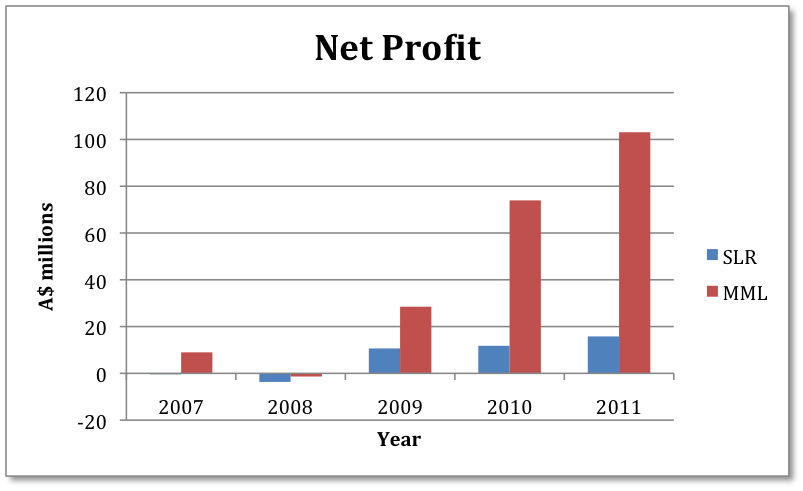

Figures 8 & 9. Comparison of Annual Revenue & Reported Net Profit:

Revenue levels for both companies look excellent, but we can clearly see that MML’s net profit figures are significantly larger than SLR’s, and is a reflection of their low operating costs. But as with any business, we need to delve deeper and look at their overall cash flow. With an impending “credit crunch” in 2012, and a degree of caution in the market with equity investing, a healthy cash flow could be essential in order for junior companies to be able to confidently fund their exploration and development activities.

Figure 10. MML Skaffold Cash Flow (Source: Skaffold 30th December 2011):

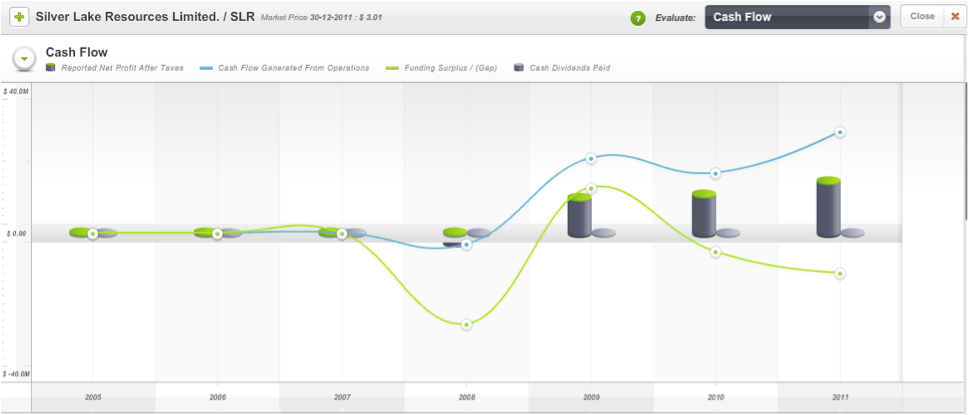

Figure 11. SLR Skaffold Cash Flow (Source: Skaffold 30th December 2011):

Both companies have rising levels of cash flow from operations (blue line). MML has an overall funding surplus (green line) that is increasing, and has also managed to pay dividends for 2011FY. Whilst at SLR the overall funding surplus is decreasing, to the point that there is now a funding GAP. This suggests that they have used up more cash in investments and financing than they have received directly from their operations. According to Skaffold, money to account for this spending has come from shareholder equity raisings and increased debt or a reduction in the cash at bank (if there is any). Looking at the Skaffold Data Table sheds more light on recent cash movements for each company…

MML generated a net cash flow of $90 million from its operating activities for 2011FY. However, it also spent a net cash flow of $49 million on investment activities, as well as $18 million for dividend payments (un-franked, low payout ratio). Investment activities were predominantly capital expenditure related to exploration, evaluation, and development activities. Despite the large amount of cash flow invested outside operating activities, after taking into account foreign exchange effects and equity capital movements (add ~ $5 million total), the company was able to increase it’s Bank Account balance by $28 million dollars. This left a 2011FY balance of $58 million (UP from $30 million 2010FY). SLR generated a net cash flow of $33 million from its operating activities for 2011FY. It also spent a net cash flow of $46 million on investment activities, clearly more than it’s operating cash flow. This is once again predominantly capital expenditure related to exploration, evaluation, and development activities. Consequently, despite a rise in revenue, net profit, and operating cash flow, the company actually had a net decrease in its Bank Account balance of $13 million, which left the 2011FY balance at $16million (DOWN from $29 million 2010FY).

MML’s last capital raising was in February 2009 for $20 million, about 3 years ago now. SLR’s last capital raising was as recently as November 2011 for $70 million, this was to help develop their Murchison project and accelerate copper exploration activities. Prior to this it had conducted capital raisings of $19 million during 2010FY and $30 million during 2008FY. Although neither company has significant debt, I think this reiterates that MML is in a better cash flow position at this stage. It appears that continued capital raisings have been required by SLR to help meet ongoing investment demands, unfortunately this could dilute shareholder ownership. Even if capital raisings were issued at a price above equity per share, I would prefer if they were able to fund their investments predominantly from existing cash flow.

A LITTLE ABOUT CAPITAL EXPENDITURE:

As I learnt with these examples, gold mining companies spend a great deal of their retained earnings and cash flow on exploring for gold and developing new mines. These expenses do not go immediately into the Income Statement, instead you will see the total expenditure in the Balance Sheet, as an Asset! These companies may have exploration happening at multiple different sites at any one time, if drilling results prove unsatisfactory, or mining is deemed not technically or financially feasible, part of these expenses will be written-down, and will affect future reported Net Profit. Similarly, cumulative exploration and development expenses will become incurred or amortised only once the mine goes into production. All this capital expenditure is not yet generating any profit, yet it adds to the equity. So unless the company is generating sufficiently higher profits each year from the mines that are in production (e.g. by producing more ounces of gold, at a higher average price, or doing it more efficiently), the Return on Equity will decline. From looking at the annual reports, I noted that MML had listed capital expenditure of US$116 million for 2011FY, and SLR A$76 million. Cleary these are highly capital-intensive businesses, though at the very least it gives their competition a high barrier to entry.

RETURN ON EQUITY:

Figure 12. MML Skaffold Capital History (Source: Skaffold 6th January 2012):

Figure 13. SLR Skaffold Capital History (Source: Skaffold 6th January 2012):

The Skaffold Capital History for MML tells me that although its Net Profits (green line) are forecast to rise over from the next few years, the shareholder equity is expected to rise even more, and thus Return on Equity (blue line) is forecast to decline from 45% 2011FY to 33% in 2014FY. Although a Return on Equity of 33% is still excellent. On the other hand, SLR’s Return on Equity is forecast to rise from 19% 2011FY, and remain stable at around 36% until 2014FY. I suspect that a stable Return on Equity is difficult to achieve in this industry given that there are often several projects on the go at different stages, some generating profits and others not, but at the very least the overall returns must always be high.

FINAL COMMENTS:

What attracts me to MML are its high margins and excellent cash flow that should insulate it against any significant changes in the gold price. A number of things may have contributed to the fall in market price, macroeconomic factors aside. Certainly the market price plunge happened not long after a mining fatality in October 2011. This, along with increased development to prepare the Co-O mine for higher production has resulted in lower production guidance for 2012FY. There was also some weather damage from a tropical storm to parts of their mill in December 2011, the scope of the effect on production will be available in the December 2011 Quarterly. Regardless, these are abnormal once-off events that should not impact on the long-term prospects of the company. For me the key is whether the Bananghalig deposit has a large enough Resource base, and whether it will be mined, as this will determine whether MML can grow from a junior to a mid-tier producer.

The advantage that SLR offers is that it already has a second mine that has progressed further in the development phase, and will commence production earlier. Though there are two things that concern me at this stage. The first being the relatively high operating costs that make SLR far more sensitive to gold price volatility. And the second is the company’s cash flow, and in particular its requirement for capital raisings to fund exploration and development activities. Having said that, forecast EPS Growth is 217%, and I expect that this should improve cash flow over the coming few years. Further to this, as with MML, the management team appears to have significant experience behind it, and in SLR’s case I noted that all the Directors hold significant shareholdings in the company, each owning over 4 million fully paid ordinary shares each.

But is either of these companies truly extraordinary? What does this mean? Well Chapter 5 in Value.able tells me that in an extraordinary business I must find the following factors; Bright long-term prospects, high Return on Equity driven by sustainable competitive advantage, solid cash flow, little or no debt, and first-class management. I think that MML comes closest to meeting all these factors, but others might disagree. The key factor for me is having a sustainable competitive advantage. In the Co-O mine they are sitting on a Resource that could last over 25 years, is extraordinarily low in operating cost, and could generate an enormous amount of cash that could easily fund future expansions, and perhaps even acquisitions. In a business that can be highly capital-intensive, the ability to fund exploration and development with cash flow rather than capital raisings and debt is a great advantage. The question mark of course is how sustainable this will be. And of course, I am no Geologist! What I do know is that this is a fundamentally healthy and profitable business, and despite this, the market is significantly undervaluing it. If I were to invest in this business, I would need to accept that there is level of risk involved, but by buying it at a significant margin of safety, and allocating such an investment in a reasonable manner within my portfolio, I think this risk could be significantly reduced.

POD’s (points of discussion):

1. Has gold’s bull run come to an end, or will it rise to new highs?

2. In your opinion, do MML or SLR have any sustainable competitive advantage?

3. What are the benefits/risks of mining in the Philippines versus Australia?

Since writing this post there have been a number of key announcements made by each company. Their share price’s and safety margins have also changed. Most notably, MML has now downgraded its 2012FY production guidance to 75,000 ounces, citing delays due to effects of tropical storms and torrential rain in December 2011 and January 2012. Also, SLR has announced a the acquisition of Phillips River Mining.

LINKS:

Skaffold

www.skaffold.com

World Gold Council

www.gold.org

JORC

www.jorc.org

DISCLOSURE:

I do not hold any shares in any of the companies mentioned in this blog post.

Can anyone help me with something: what does it mean on a mining company’s balance sheet when it says something like “exploration and evaluation expenditure”? Am I correct to think it means roughly that they’ve spent money looking for stuff in the ground and instead of calling it a cost they’ve called it an asset?

Thanks,

Marc

Spot on Marc. Capitalised expenditure. Telstra does it with software developments expenses too. Property developers used to do it as well and you have to look out for it. Its discussed in Value.able.

Benjamin Franklin: “Employ thy time well, if thou meanest to get leisure.”

Praveen, great post. I went through a similar process regrading Gold stocks when Skaffold was first released (with some excitment) and I settled on both SLR and IGR (Integra) – IGR are currently a B2, relatively low cost producer and recently added to the ASX200, as was SLR. Just curious as to why IGR was ruled out, for me it ticked the same boxes as SLR. Once again great post.

Thanks Mat R. IGR did not show up on my stock filter in early January, see the criteria i outlined in the first paragraph.

Thanks Praveen, I only mention it as was surprised at how closely our thinking was and how I came up with almost the identical companies, save for IGR. I just wanted to check if my Skaffolding skills were missing something, but perhaps it has just been a timing issue.

Thanks again for the great post

Good work Praveen,

It seems there there are quite a number of fellow bloggers out there who are interested in gold mining stocks. I would like to add the following points, if I may. My back ground is gold mining production (technical and operational) and design and construction of mineral processing plants currently. When you are looking at resource statements, look carefully on the gold mineral type as it has a significant effect on the cost of production. Free milling gold is easily recoverable with cyanidation at relatively high recoveries. Cyanide is the dominant chemical in the recovery of gold. If the ore is refractory then there could be problems with respect to processing costs, depending on how refractory the gold ore is. Refractory gold ores usually require more complex and therefore expensive technologies compared to free milling ores. Also refractory gold ores require finer grinding, which means much higher energy costs (to grind the ore). The biggest cost in gold processing is the cost of energy. Therefore if the deposit is in a country / location where cheap energy is available then there is natural advantage. If the deposit is too remote to connect to main grid lines, then diesel powered power plants may need to be built to ensure power supply. In terms of grade, I would be very happy with grades of between 4-8 g/t in Australia. These deposits are not plenty these days in Australia. Therefore free milling ores with grades higher than 3 g/t in Australia are extremely attractive propositions. Life of mine (LOM) is another important consideration, in the construction of gold plants. Having said that most small – medium gold plants, say up to 4-5 Mtpa capacity, may have been built with only several years of mine life (reserve category). Conversion of resources to reserves are continuing process. For example, one plant I worked and involved in the construction, was justified on a five year mine life. That was 8 years ago. The plant is still operating with another several years to go. I expect it to operate many more years. Another example is the biggest gold mine in Australia, which is super pit (may be the second right now). When I started working there 17 years ago it had 16 years mine life. I think it may have another 15 years life to go (reserves).

On the risk side, some jurisdictions banned the use of cyanide in the recovery of gold. Cyanide is the most effective and cheapest source of chemical for gold recovery.

Happy investing

Yavuz

Thanks Yavuz,

Your thoughts on RED 5 (ASX:RED)?

Hi Roger,

I have done some research on RED. There is not a lot of detailed information available in the web, maybe because it is a small cap gold miner or because it owns a relatively small and simple gold mine. RED have just commissioned a 1.0 Mtpa capacity gold plant. Currently they are achieving about 0.8 Mtpa processing low grade stockpiles (average gold grade 1.33 g/t). It is definitely a prudent strategy to use lower grade stockpiles during commissioning as potential gold losses to tailings will be minimal when problems can be expected during commissioning. RED experienced some materials handling problems during commissioning, due to wet and sticky ore. But they have resolved these issues quickly are or are in the process of resolving. The type of commissioning problems they reported are fairly common and can be resolved easily. The plant has a brand new semi autogenous grinding mill (SAG), which is good. This is an insurance policy against possibly frequent (and expensive) grinding mill shutdowns that they could experience if they had used an old / refurbished mill. Once the grinding mill is down in a gold plant all production stops. Gold plant operators / managers frequently quote to operating personnel how much money is lost for a minute or an hour of mill downtime. This helps everyone to focus on getting the mill back on line asap. Process flowsheet is a standard and simple one. Nothing complex about it. This is positive and local workforce should be able to operate this plant with ease (i.e. faster learning curve). RED is aiming to ramp up the production to full capacity once process commissioning is finalised (and any process warranties they and the EPCM contractor may have agreed are resolved). During commissioning they have achieved gold recoveries of about about 86%, which is low comparatively. But there is a reason for this. I noticed significant concentrations of silver in the ore. I also noticed elevated levels of copper in some drill core assays (this may be a common occurrence or not, I cannot comment further as what I saw from publicly available data may be restricted occurrence). Silver is recovered with gold, Copper may be detrimental to recoveries and costs. Low recoveries are probably because of the high silver content. This is also evident in high cyanide consumption levels they quoted (almost twice what I would expect to see in a good free milling orebody). Average grade for the open pit ore (OP) is about 3.42 g/t. They have about 3.1 Mt OP ore. They will then move to underground mining (UG). Average grade for the UG ore is about 5.82 g/t. Average silver grades for the OP and UG ores are 8.7 g/t and 9.1 g/t, respectively. These are all very good grades in my book. So in a way nice counteracting effect for the low recoveries. They also get significant silver production. RED quotes 10 year life of mine (LOM) and expect to keep converting resources to reserves, so expect a mine life of longer than 10 years. I noted very low cash costs about 450 $/oz. The reported processing costs are about 15 $/t, which seems to be very reasonable. Unit processing costs per tonne of ore processed are important, as even if there is gold in the mill feed these costs will be incurred. Therefore the higher the mill feed grade the higher the profitability will be. RED installed a gravity concentration circuit, which is positive. From the pictures on their web site they seem to have installed the gravity concentration circuit at the front end of the plant, which is again good. The gravity concentration circuit will recover all or some of the gravity recoverable gold (depending on the installed capacity), so this gold does not have to go through expensive cyanide leach section, which follows the gravity concentration section in the plant. Gravity gold takes about 2-3 days to convert to dore and sell at the mine gate. Whereas cyanide leached gold takes up to about 3-4 weeks. Therefore the higher the gravity recovered gold the quicker the cash flow. Technically this is a good mine with relatively long mine life and low cash costs, if they can maintain it (total costs are a different story, of course). The mine is in a wet region and this may impact on the operations from time to time. RED also installed a cyanide detoxification plant, which should keep cyanide levels at or below the levels required by the Philippines laws and International Cyanide Management Code (a code that most gold miners voluntarily signed on to be good corporate citizens).

I hope this information is useful. I only focussed in the technical part, as you have better access and analytical capability on the financials.

Yavuz

Good one Yavuz,

I like Red

It’s my nest idea in this space and has been for awhile,

But do your own research

Hi Ash – Thanks Yavuz – great to hear the RED 5 Siana Gold Project demystified so articulately. I note that Commercial Production was declared on April 16th (ASX announcement by RED on 20th April), with plant availability during that period running at 91.6% with downtime typically due to minor repairs to the MMD sizer. So it would seem they are still sorting out at last one bottleneck in the plant, but even that is causing them relatively little grief now.

The SP of RED suffered quite a lot with the cap raising coinciding with the (short-term) problems/downtime due to upgrades at Medusa’s nearby Co-O mine. Apparently the effects of the wet weather at Co-O (MML) focussed some investors minds on the fact that RED’s Siana Project is also in a similar wet area of the Philippines. I continue to hold the balance of my RED shares (having sold a quarter of them before the SP drop before the cap raising/share placement announcment), and I topped up my MML shares when they dropped below $5 in late March. I like both companies a lot. I also finally took the plunge yesterday Ash and purchased an initial position in SLR at $3.10 (8,000 shares). I’ve been waiting for an SP drop, and was hoping for closer to $3, but $3.10 will do. I’ve been wanting to have some Silver Lake in my portfolio but I didn’t want to pay $3.50+ back in March.

Also, have been topping up CCU at around $0.66, and have noted that mining has commenced at Wonawinta, with delivery of ORE to the ROM pad (2 April), and they’ve now drawn down the full $11M finance for the project from CBA, but still have an additional $5M available for working capital and cost overruns. Not long now… Have sold my BRG (Breville) and CDD (Cardno) shares in the past 3 days realising profits of 40% and 50% respectively.

No gold or silver stocks left that I want to buy. I’m turning my mind to some industrial, tech and retail stocks and looking for value and yield (with low to no debt, and high ROE & ROA). RCG, who own “The Athlete’s Foot” chain of stores plus other assets, are looking cheap, very close to their year-low price of $0.335. DTL (Data 3) is also getting close to my “BUY” zone. There are a few others I like, but their prices are heading the wrong way. Anything on your radar Ash, or anybody else, that you’d like to share?

Hi John,

I have had some good ones in the last 4 months (AGI EAX and JIN) but they are all at or near IV for 2012, so no joy anymore although I still hold EAX and JIN.

There is possibly a good takeover arb around if the price drops a bit but apart from that I am not coming up with any new ideas at the moment.

I would be careful with DTL, I love the business and have owned and sold before, but government cutbacks to get to the surplus may have an impact on them.

Cheers

we can concur with Ash’s comments. We’ll meet with the company before the FY results.

Wow, thanks very much Yavuz, you have provided some great insights!

It’s worth getting to know the locations of the mines well also… from wikipedia (I’m presuming the spelling is “Mindanao” http://en.wikipedia.org/wiki/Mindanao)

“… Mindanao has been the site of a separatist movement by the Moro Islamic Liberation Front (MILF), caused by religious differences and widespread poverty. Fighting between MILF and Philippine forces has displaced over 100,000 people. Mindanao also has a higher crime rate than the rest of the country.”

You can also drill down into the different sub-regions and find out more, wikipedia is a breathtaking piece of the internet.

Praveen

With apologies for being repetitive (as I am sure that all readers want to post a thank you) but this is a brilliant post – well thought out and explained. Thanks for sharing it with us.

Thanks for all the comments! Hope to write more later in the year, but maybe covering some different sectors.

Praveen, I very well constructed and informative post. Being a holder of both stocks I thank you for your excellent analysis, which gels with my own far less comprehensive analysis. I suspect the lower consensus forecast is based on lower gold prices into the future which wil impact EPS rather more than the more optimistic Skaffold EPS based on past performance? I wonder if some of the regional actions in Indonesia regarding foreign ownership may also be spilling over into potential political risk factors weighing on the MML price. Once Swan recognises his MRRT wont extract the required pound of flesh from the iron ore industry one wonders whether he will target gold producers next (or probably banks because we all enjoy a bit of bank bashing).

Thanks Martyn. The consensus analyst forecasts are the more optimistic ones. The conservative forecasts are the ones that are based on past performances in these examples. Although in some instances the consensus analyst forecasts may be worse than what is expected from past performances. Obviously analyst forecasts are based on a lot of assumptions, i presume the value of the gold price could be one such assumption.

Outstanding A1 post Praveen J, very educational and informative for newbies to gold equity investing… props!

And what a great blog this is too, thanks Roger.

Thanks Gav.

A fascinating article! I have in the past owned SLR and seriously thought about MML. Instead, by accident I stumbled upon a small gold miner, Cougar Metals (CGM). Now some of these very small players (M.Cap 38Mil) are more risky, especially for a value investor, so I wasn’t that keen at first, but a quick look over their figures are quite impressive.

They have no debt, they are producing gold from their trial mining in Brazil in increasing quantities with investments in infrastructure to make the cost of production quite low.

Their exploration of their Ze Vermelho area has been growing and thus far the few extra bits of drilling they have done in recent months looks extremely promising.

On top of all that they have a drilling business that has been making a profit for the last few years.

To cut a long story short, I went from extremely skeptical to very surprised. I’d love to hear anyone’s thoughts on this company. I don’t have a large position (yet), but it is definitely a company worth looking at, as the potential to me seems huge!

Thanks Phil, I will check this one out. Hasn’t been on my radar. What’s the cash flow situation, are they making any profit? What’s their Resource base, production timetable, cash costs…

Cougar made a profit of around $6mil last year, and gold production has risen due to better infrastructure. I don’t think they have a JORC yet, but they’re working on it and should get something on it very soon… They have struck bonanza grades several times and all seems very exciting for a small venture. The directors own approx half the company so they have put their money where their mouth is.

Seems worth a look!

from smart person.

“FORT KNOX

According to the United States Mint, which is officially in charge of the nation’s gold, here are the facts.

Amount of present gold holdings: 147.3 million ounces.

The only gold removed has been very small quantities used to test the purity of gold during regularly scheduled audits. Except for these samples, no gold has been transferred to or from the Depository for many years.

The gold is held as an asset of the United States at book value of $42.22 per ounce.

The Depository opened in 1937; the first gold was moved to the depository in January that year.

This ends the entry: “The Depository is a classified facility. No visitors are permitted, and no exceptions are made.”

We are assured that there are “regularly scheduled audits.” By whom? Reported where?

WHY NOT SELL IT?

CENTRAL BANKERS still hold gold, despite the fact that it pays no rate of interest – rather like U.S. Treasury bills today.

WHY?

In every textbook used in colleges, whether Keynesian, monetarist, or public choice, we are given reasons why gold is not necessary or advisable as a monetary metal. The Party Line of the economics departments of all stripes is this: (1) central banking is not really a cartel, even though it looks like one; (2) every economy needs a central bank to protect the people from politicians, who would inflate; (3) gold is a liability as a monetary metal because it keeps central banks from inflating.

The textbook Party Line is simple to summarize: “Central banking is reliable; politicians and the general public are not.”

Then why hold gold at all? Why not sell it and buy Treasury bills or bonds? Why not buy the bonds of lots of other nations? The bonds pay interest.

Could it be because the economic return on these bonds is risky? Could it be that central bankers never did trust PIIGS debt. Could it be that they regard the long-term value of gold as more stable than the long-term value of other currencies?

This would indicate that the experts in charge of monetary policy have adopted ideas not discussed in textbooks.

1. Gold is more reliable than fiat money.

2. Gold functions as money for central banks.

3. Gold is not a barbarous relic.

4. Central banks with gold reserves are trusted.

5. Gold is a symbol of central bank reliability.

Any of these answers would apply just as well to a commercial bank. They would apply to private citizens.

The textbooks ridicule such a suggestion. But the textbooks also avoid asking this question: “If gold is just another commodity, then why do central banks hold it as a legal reserve?” There is no gold redeemability. No central banks pay gold on demand to anyone, including other central banks. They did prior to August 1, 1914 (the start of World War I), but not today.

What is it about central bankers? Have they lost their ability to think through the principles of economics that they were taught in America’s best universities? Have they not adopted the logic of economics?

It is clear that they have not bought into the textbook Party Line. Neither should anyone else.”

Your blog is awesome Roger and skaffold is even better thx.

I want to brag a little , i bought gold in 2004 when i came to Australia and some gold shares , i still have my gold and silver position ,but sold most of my gold shares , some i still wish i had of kept , but im glad i sold the others .

i have made enough profit to buy another house on my gold holding if i want ! .

when i bought in 2004 there was not that much hype on tv reg

gold , and my full service broker, was not bullish at all on the yellow metal i have even seen Roger talking about gold on tv and he did not seem very bullish ,

I never bought the gold with the view of tripling my money, i just wanted some insurance , and i have always seen gold as money not a commodity , my father lost allot of money on gold in the 1980s after the peak, he bought and it kept falling, so i am careful not to get carried away . I do think gold could might be in a bubble or might become one..

but it depends when you bought ,if gold falls to

800 it will be a bubble for the people who bought at 1900 .

when i look at gold as a commodity it looks very expensive ,if i look at gold as money it looks very undervalued .

i do think holding 10-20% is ok but going all in is like playing russian roulette with more than one bullet in the chamber .

Outstanding analysis, well done.

Nice article,

MML is my favourite stock at current prices with all the uncertainty in the world.

A great post. Thank you. I bought MML at $5.5 in 2010 on the basis of being a low cost producer, that they could fund expansion out of operations, they didn’t have too many shares on issue compared to most mining companies, grade was OK, and they were about to pay their first maiden dividend. I then sold at around $7.00 because they rose so quickly ( and then went above $8)!

My question would be how do you apply intrinsic value re mining companies where currency movements, time to get a project to market and ‘unknowns’ like new government regulations, EPA studies, cost blow outs for ‘most’ projects, infrastructure needs, and, commodity prices are key drivers and can change quickly? Both BHP and RIO – the blue chips of the companies – are cases in point re project cost blow outs.

Most money in the context of mining companies (I am not referring to the service providers) is to be made on key announcements of non- producing companies; like JORC compliant resource, PFS, DFS.

To answer your questions: 1.) I don’t know what gold will do. If I was confident it will rise I may buy MML again below $6.00 but it would be a trade rather than a long term hold. 2) MML’s competitive advantage is very low cost of production compared to other gold producers. The ‘weather’ in the Philippines is a risk to meeting production targets.3) Not without sovereign risk but the company obviously has good knowledge re local conditions and culture, and, cost of doing business including labour would be lower in the Philippines.

Two general comments:

1) Commodities are sold in USD so currency is a very big factor. If our AUD went back to .80cents, (unlikely any time soon) it would give our local producers a huge boost. If our AUD stays where it is many of our explorers not yet producing may face grim times as costs increase, government regulation including tax and EPA studies increases costs, and, raising capital becomes more difficult.

2) Many projects in Australia require massive infrastructure including roads and ports. South Australia, for example, still doesn’t have a port from emerging producers; an ongoing issue for a decade!

Thanks Liz, good points. I guess the ‘unknowns’ to a large extent are what make investment a bit of an art, and not just science. I think that although Skaffold gives us a great starting point for finding undervalued and fundamentally healthy businesses, there is so much more that cannot really be quantified in terms of a rating or dollar value for a business. I think that we have to make a lot of decisions on the best available information we have and accept certain ‘unkowns’ as a risk, and if there are too many ‘unknowns’, and the investment is above your risk threshold, then reconsider the investment. Certainly the more research you do, the greater you truly understand the business you are investing in, it’s competitors, and it’s industry, the more confidence you will have in the investment. At the end of the day, despite all this, there will always be a chance of unforeseen events. But if you made your decision with the best available information, from your own research, then you should have no regrets. I guess we have to be comfortable in what is ‘unknown’ and be comfortable with the fact that we are not always going to get it right! Also, i agree that there is greater potential in terms of capital growth from explorers, but to me that is a game of speculation.

Praveen, There was an article in “Resource Investor” last week talking about the price of gold increases in the last 5 years v cost and how this corrlates with margins (or not).

great article ,the hardest part of investing is figuring out how a company will do in the future. this article really helps me with my calculation of what margin of safety i will be happy with for this industry.

thanks Greg

Thanks for sharing Praveen!

I look at Figure 2 showing the gold price and wonder why any value investor would buy gold or gold stocks. A little late to be joining the party? If you think the economic uncertainty will support the gold price, when is this all priced in?

Hi Michael,

I valued Simon Black’s thoughts on the subject too:

In Warren Buffett’s latest round of gold-bashing last weekend, he described all the gold in the world as a useless cube that would fit snugly within a baseball infield.If you owned such a cube, you would only be able to ‘fondle’ it… but generate no investment return. The same ‘value’, meanwhile, would allow the owner to purchase all the productive farmland in the United States plus 16 Exxon Mobils, in total yielding over $800 billion annually.Granted, Buffett’s views on gold are perhaps stymied by his poor experience investing in silver some 15-years ago. But still, he fails to see some obvious fallacies in his logic.

Most assets left unmanaged will fail to produce an investment return. The virtuous farmland that Buffett extols in his hypothetical example does not magically spawn corn, nurture it, harvest it, sell it, and deposit the proceeds into its owners’ pockets. Our farmland here in Chile certainly does not.

No, it takes a lot of work, a lot of experienced people, a lot of know-how, and a little bit of luck. All of this has to be managed.

Even the baseball field that Buffett references (when trying to give his investors an idea of the scale of all the gold in the world) is an asset. Simply left sitting there, a baseball field will soon be overtaken by erosion, weeds, and the dilapidation that comes with neglect.

Maintained and well-managed, however, a savvy owner of a baseball field can lease it out to the local little league. Or pull a Kevin Costner and turn it into a tourist attraction. None of this happens without appropriately managing the asset.

Even Exxon Mobil, with all of its royalties and intellectual property, requires tens of thousands of employees to manage the company’s assets, collect the profits, and ensure shareholders get paid.

Likewise, a huge cube of gold left alone in a baseball infield will fail to produce any investment return. When managed, however, gold is like any other asset– it can be leased, traded, loaned out, used as collateral, etc.

More importantly, though, the reason that many gold investors purchase the metal to begin with is because physical gold carries no counterparty risk.

Unlike paper currencies which are issued at will by corrupt central banks, or even Exxon Mobil, whose success depends heavily on the management team’s goodwill and diligence, a one ounce gold coin in your pocket will still be a one ounce gold coin tomorrow. This is the entire premise behind money as a store of value.

As my friend Tim Price told me over drinks in London several months ago, fiat currency is simply an abstraction of the concept of money; paper money conjured out of thin air cannot be real money, it’s merely an idea based on confidence and collusion.

Curiously, only a tiny percentage of worldwide money supply is actually physical paper– most ‘money’ is in digital form, simply entries in a computer… a few bits of code which constitute your net worth. In this way, our currency is actually an abstraction of an abstraction of the concept of money.

To this I would add that the entire financial system is underpinned by a complex network of hypothecated debt and derivative instruments whose notional total exceeds (by many multiples) the entirety of world GDP. In this manner, we are talking about abstractions of abstractions of abstractions.

Gold is real. It exists. And it scarcity dictates that it is a reasonable store of value, particularly in a world of abstract money.

There’s a lot of talk right now, for example, about rising oil prices which have created uncomfortably high gasoline prices. In gold terms, however, gasoline prices are in a deflationary spiral.

Priced in grams of gold, gasoline is near an all-time low. [In fact, there’s a great site run by my friend Charles V. that shows this trend with a variety of commodities and retail goods.] Buffett (and others) argue strongly that investors should be in stocks… that a company like Coca Cola or productive farmland is a better long-term investment than a useless hunk of metal.He’s probably right. Except that the useless hunk of metal isn’t really an investment. It’s an anti-currency… appropriate for those who want to sit out of the market and be in cash without having to be in cash.

An excellent post Praveen, well done and thank you. You have raised the bar at this excellent blog.

I think you may have missed the point of Warren’s latest spiel Roger, when you say

“Most assets left unmanaged will fail to produce an investment return.” And go on to list farmland and baseball fields as examples which would become useless if unattended.

It’s not that gold will not produce an investment return, if left unattended in a field, it’s that gold will not produce anything of any utility to society, and by that I don’t mean extra profit to the speculator, I mean a valuable and useful service or product. As a businessman who takes seriously his ‘inner scorecard’ I can imagine this being of some importance to the Great Man.

As Warren says, ‘What the wise man does in the beginning, the fool does in the end.”

Which if believed by the majority here (I don’t know?) should be of concern when considered next to Figure 2.

Hey Nick,

I was quoting Simon Black.

Hahahaha, then I think Simon missed the point and also that I need to read more carefully.

Keep up the good work Roger.

Thanks Nick

Physical gold may have an element of scarcity, but what if you factor in gold futures, wouldn’t they effectively make the supply of gold unlimited? Maybe gold can be ‘printed’ after all. I’m not sure of the answer to this, but it is a question that runs through my mind. Im sure alot of the speculation in gold is by way of futures, rather than people buying and selling gold bars to put in the store room.

Certainly gold has had a great run, but that is not always the case with gold stocks – for various reasons, poor drilling results, low production numbers etc…MML as an example had quite a steep fall in share price in the latter part of 2011, but earnings and cash flows had been quite robust, IMHO making it undervalued at the time. Even if there were to be a correction or fall in the gold price, the businesses with significantly high margins should continue to be profitable so long as they are digging up larger volumes of gold.

Excellent article! Thank you SO MUCH Praveen! Excuse the pun but this is GOLD!

I have been reading ASX statements and reports from mining companies and trying to decipher them and your post is just a brilliant HOW TO invest in gold companies 101 with Skaffold.

It is not only excellent and insightful to detail your thought process to us but also the explanations along the way and real life examples with SLR and MML are just brilliant.

I wish they were more article like this for other sectors (construction services (GCS, NFK, SWL), telcos, etc.)!

After reading this I now feel like going back to Skaffold and applying this method for the other gold stocks or mining stocks!

Thanks a lot

Praveen, thanks for a great example. This is exactly how I should use Skaffold correctly & meaningfully and that I would not blame Roger (or or you) on my very own decisions as I must do my very own analyses. Printed out for references.

Thanks Roger for maintaining the quality of the Value.able blog.

Very informative. May I venture off point for a moment and just ask anyone else whether they consider JBH oversold. If people do not, is it because they subscribe to the death-of-bricks-and-mortar-retail thesis? Personally, I have real problems with this thesis but I’d be interested in hearing any convincing views on it as I would be in hearing views to the contrary.

Great post Praveen, it was very informative. Can’t add much to gold but thought i would help Justin out with my thoughts.

I am still a fan of JBH, however not as much as i was. I am not a believer in the death of bricks and mortar but i do feel that they will need to revamp their stores a little. For example, what to do about all that retail floor space taken up by CD’s and DVD’s when i do not think there is a market for them physically in the medium to long term.

I do believe that all retail companies that would be significantly affected by online retail will need to offer the customer something that online stores can’t and overcome the lower costs that these online businesses can operate under. I also think that they will need to intergrate online stores themselves somehow (oroton has done a good job, JBH is getting better and online sales are definitley increasing)

I think JBH are doing a good job in a tough space at the moment. No doubt it is still the leader and they appear to be still living up to their message. They will nto be immune from new competition online. They had a high net debt last FY which i think put some people off them, however their interest cover was sound. Going by the HY report i think they have paid a fair whack of this off.

They still meet my investment philopsphy. They still have good competitive advantages, strong brand and strong financials. The management seem to be aware of the issues they face and are trying to set up strategies and offerings to match them. They are in a good competitive position and i would expect that when sentiment gets a bit more positive and people start buying more than they will come out of it with an increased market share against their bricks and mortar equivalents.

Some negatives, they don’t have long to go in their store roll out and each store they do roll out now will likely be less profitable. Also, what i said about online, it is a threat to them and although i expect them to be able to match it, i cannot at this moment know just how hard this might hit them.

Also, could be a negative, positive or non issue depending on your philosophy, they are no longer in the growth phase and are now in my opinion mature. This would mean that dividends would likely be increasing and as per the value.able formula, a company that is earning a high ROE is worth more when able to retain their earnings and compound at that high ROE than what it is if it pays it out as dividends. However, my opinion is that they would be hard pressed to retain and compound at a high enough ROE so they are doing the right thing anyway by paying it out. However, if the price gets quite low, i would prefer they cancel dividends and buy back stock.

Does the Intrinsic Value formula work for gold companies or does it require modification? Cheers.

William.

You have to understand that the formula is based on equity and the profitability of that equity. It can be applied across all businesses. Different industries may accept different ‘conventional’ methods for valuing themselves but more often than not they are simply earnings multiples or net asset valuations (which in turn are based on recently transacted prices). If you know what the gold price is going to do (assuming the company doesn’t hedge its production) as well as how much gold the company has and how much it costs to extract and when that gold will be extracted, you can work out ROE and then value the business. Predicting the gold price is the hardest part.

Thanks Roger for the reply :)

I think gold is going up up and away

Praveen J, congrats on a very thorough and well thought out post.

Unlike industrial stocks, evaluating and comparing resource companies requires a deeper skill set which you have covered so well. Looking forward to a future post or two .Well done!