Great result out of CSL, so is it now a buy?

We reviewed the FY17 result for CSL Limited (ASX: CSL). Below are our summarised notes which readers may find useful, including our view on CSL.

Main comments:

- Result itself wasn’t a huge surprise. 2H revenue was guided to be weaker than that of the 1H17 earlier this year since the company had sold its excess inventory in the 1H…and that’s what happened.

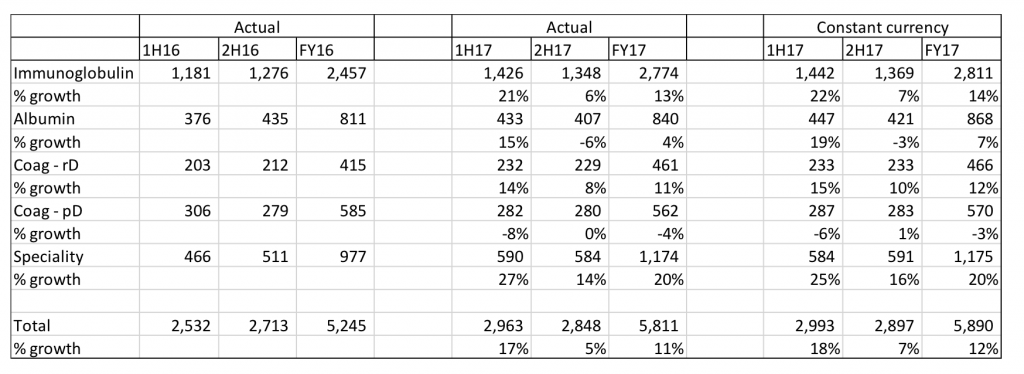

- Below we have segmented the results of the core business (CSL Behring) in order to see the underlying business trends.

- Underlying immunoglobulin growth was solid at 13 percent for the year.

- Albumin is notably trending down. There are two issues at play here, (i) mix shift from higher priced markets to lower priced and (ii) some temporary delays in shipping of product to China.

- Coagulants (recombinant) grew this year off of the back of Afstyla/Indelvion (products for the treatment of haemophilia). Take-up has been strong. Plasma derived coagulants still under pressure via the competitive industry.

- Speciality product’s exhibited strong growth off of Berinert/Kcentra (Berinert treats hereditary angioedema, Kcentra is an agent for warfarin reversal). CSL’s Haegarda (more info here) has notably been launched as of July 2017 and granted 7-year orphan exclusivity by the FDA. This is a positive although we’re concerned about the pending launch of a competing product – Shire’s Lanadelumab which recently met it’s P3 endpoints and if it gains FDA approval, will create issues for several of CSL products.

- Behring EBITDA rose from $1,960.9 million in FY16 to $2,182.5 million in FY17. EBITDA margins were down from 36.4 percent to 36.2 percent however if we strip out expenses from the Momenta deal and Ruide deal, circa 60 bp of margin expansion is apparent.

- R&D spend being lifted to 11/12 percent of revenue, up from 9 percent historically which would normally put downside pressure on margins, but this can be offset with strong margins from recombinant coagulation products.

- In addition, the run rate of capex will increase from circa $600 million$700 million historically to $900/$1 billion p.a. over the next 2/3 years. With this naturally will come a higher D&A charge. I’d say that ROIC’s could hold if speciality products continue to grow quickly.

- Seqirus revenue grew $652 million to $899.8 million. Given the firm now has both trivalent and quadrivalent vaccines, growth is easier to come by and future revenues should be less volatile. EBITDA losses reduced from -$303.3 million in FY16 to -$124.4m in FY17. Guidance for break even in FY18 was reaffirmed however management is not concerned if this guidance is missed just via timing (rational in our view).

Other notes:

- Three other things we liked from the result:

- Firm continues to invest in its moat and build more plasma collection centres – another 25/30 in FY18.

- CEO mentioned on the call that he’d rather invest/spend now and set the business up for FY25/FY30 rather than FY18-FY20 (I’m paraphrasing but the intent is clear).

- Buyback not foreshadowed in FY18. Firm’s using cash flow to control its debt ratio and up the capex run-rate.

Our view on CSL:

- CSL Limited is a high-quality manufacturer of pharmaceutical treatments derived from human blood plasma as well as influenza vaccines.

- Stock has rallied over the past 6 months, hitting an all-time high of $143 in June 2017 before falling back to circa $125 and slightly rising since then.

- In order to justify this price, the market seems to believe that

- Recent high growth in Immunoglobulin demand/other products will continue for 10-15 years.

- Competitors won’t be able to respond to meet the demand.

- We believe that CSL is a high-quality company but that on a normalised basis, its value is below the current share price.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

People who have sold this company in the past have all regretted it.

I will never sell CSL on valuation calculations alone, as this is arguably Australia’s greatest ever corporate success story, not just on financial grounds but also scientific and intellectual.

Hi Scott

Thanks for your article. TMF were a shareholder last year I believe. Curious to know as an investor in TMF if you exited last year or more recently?

Thanks

Sam