Greased Lightning

The sudden fall in the oil price in the December 2014 half-year was unexpected by the market, but the speed of contraction in oil-related investment should come as no surprise. As the German economist Rudi Dornbusch observed, “In economics, things take longer to happen than you think they will and then happen faster than you thought they could”.

In the space of 6 months, the oil price has halved to under US$50 a barrel, largely as a result of the Organisation of Petroleum Exporting Countries (OPEC) announcing that it would not reduce production in response to a slowing China and a booming US shale oil market.

In our video insight on 16 December 2014, my colleague Andrew Macken postulated that new oil-related investment will all but grind to a halt. This has not taken long to eventuate.

On 21 January 2015, BHP Billiton (ASX: BHP) announced in its recent 2015 half-year review that it would reduce its operated rig count in response to the weaker oil prices:

“In petroleum, we have moved quickly in response to lower prices and will reduce the number of rigs we operate in our onshore US business by approximately 40 per cent by the end of this financial year (30/06/15). The revised drilling program will benefit from significant improvements in drilling and completions efficiency. Our ongoing shale investment program will remain focused on our liquids-rich Black Hawk acreage. However, we will keep this activity under review and make further changes if we believe deferring development will create more value than near-term production.”

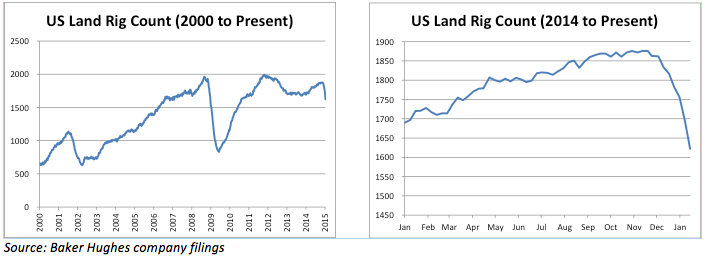

Baker Hughes, one of the world’s largest oilfield services companies, has been tracking the rig count in the US petroleum industry since 1944. In the past month, the US Land Rig count has fallen by over 10 per cent, and the major oil explorers are starting to lay-off staff en masse.

Investment in the sector should recover quickly when the oil price rebounds, but there seems to be no clear consensus as to when this may occur. BP is preparing for the possibility that prices will be depressed for the next three years. Its Chief Executive was quoted as saying:

“Companies like us, at BP, we’re going to need to rebase the company based on no guarantees at all that the price will come back up … We have go to plan on this [price] being down, and we don’t know exactly what level, but certainly a year, I think probably two and maybe three years.”

What we find even more interesting are recent comments from OPEC, with the Secretary General of OPEC recently affirming that the Group is very aware of its actions: “We know that there is over-supply in the market, that there is a lower demand—and we decided to keep production as it is … If OPEC was going to reduce supply, it had to be alongside production cuts by non-OPEC members, such as U.S. shale producers”.

While the Secretary General stated that it is not playing a game of chicken with its rivals, you get a sense that this group can continue to turn the screws for as long as the US shale oil sector is seen as a threat.

For the moment, it seems that there has been a reasonably orderly reaction to the sudden fall in the oil price, but we are acutely aware of the downside risks if the price settles below US$50 a barrel. Of particular concern is the high dependence of some emerging market economies and several US high-yield bond issuers to the oil price. Should the oil price remain depressed, the knock-on effects to pockets of the global economy could be swift and severe.

Ben MacNevin is an Analyst with Montgomery Investment Management. To invest with Montgomery, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY