Get Ready For Another Big Stick, Irrespective Of Which Party Wins

APRA released quarterly statistics for the private health insurance industry during the week. While the data showed rising gross margin trends for the insurers as a result of slowing hospital treatment volume growth, there were trends in the premium data that will be concerning for the Government.

Private health insurers are prevented from charging different premiums to consumers on the basis of their claims risk. This means that health insurance premiums are the same for consumers irrespective of their age, sex, and other risk factors such as smoking. Equally, insurers cannot deny insurance to consumers on the basis of these risk factors. This is essentially a social policy called Community Rating that is designed to make insurance more affordable for those that require it most.

The only exclusion from this is the loading paid by people that first take out health insurance after they turn 30 (2 per cent loading per year over 30) under the Life Time Health Cover reform introduced in 2000. However, the loading from the Life Time premium only makes up around 3 per cent of total health insurance premium revenue given that 86 per cent of people with health insurance pay no loading.

At the heart of this policy is a need for those that need private health insurance least to take out cover and effectively subsidise the higher claims costs of others.

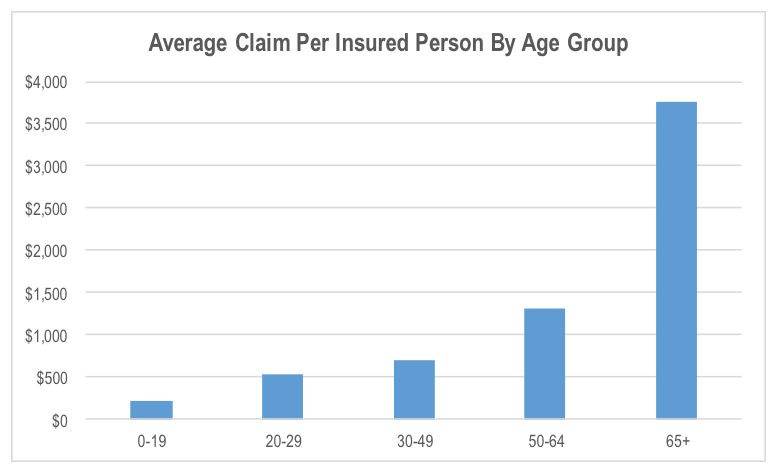

One of the biggest issues for this system is the ageing population base. Claims expenses for older policy holders are significantly higher than claims for younger people. The table below shows the average claims expense per person covered for each age group. This shows the degree of cross subsidisation in the Australian private health insurance system.

The chart above shows that an ageing population means that the average claims cost per insured person is likely to rise at a greater rate than the rate of growth in the cost of individual procedures. Because insurers can’t charge higher premiums as people get older, the high rate of claims cost inflation per insured period gets passed on to all policyholders equally. This will make health insurance less and less economically attractive to consumers over time, particularly younger consumers.

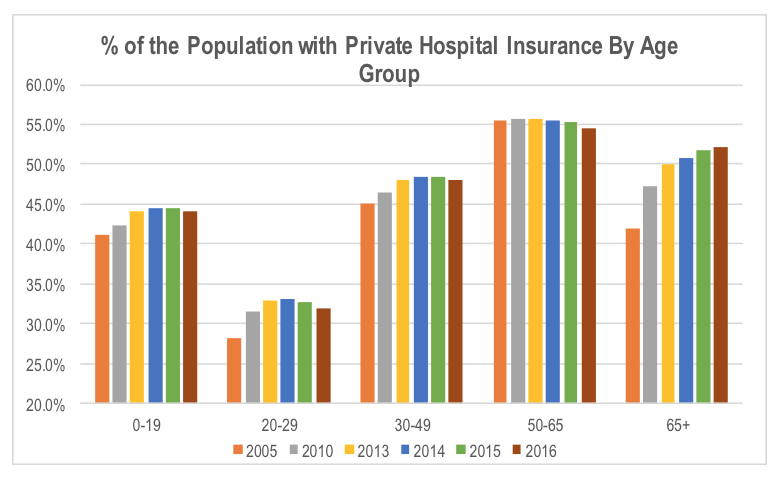

The last 2 quarterly releases from APRA show that after 10 years of gradual increases in the proportion of the population covered by hospital health insurance, this has now started to decline for the overall population.

This is the first problem for the Government given that lower penetration of private insurance coverage means more pressure on the public system.

The second issue is who is dropping out of the private system. The data suggests that while the percentage of people that are 65 years and older with private health insurance has continued to rise, the percentage of those with cover under 65 is declining. Of particular significance is the accelerating rate of decline in coverage rates for those aged between 20 and 29.

The Government will need to arrest the rate of decline in the proportion of people under 50 that have health insurance, given that they provide the economic subsidy for the older demographics, to ensure health insurance is affordable. If they continue to opt out of the system, it will exacerbate the outlook for claims cost, and in turn premium rate growth resulting from the ageing population.

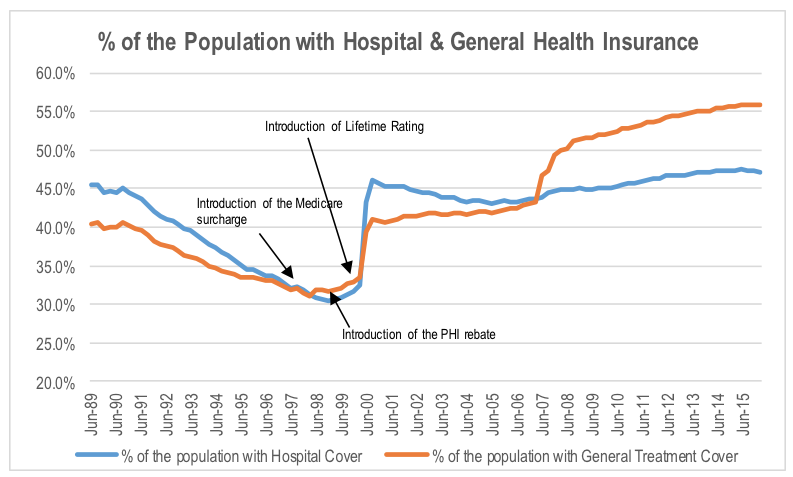

There are two ways the Government can arrest the decline in private health insurance coverage; it can use a carrot or a stick. The power of the health provider lobby groups means material reforms to reduce industry costs are unlikely, as demonstrated by the Government’s quiet shelving of prosthetics pricing reforms in recent months. So either the Government covers more of the cost to consumers (carrot), or it penalises those that opt out of the private system more severely (stick).

In the past, the Government has used both with the health insurance premium rebate (carrot) introduced in 1999, as well as the Medicare surcharge (introduced in 1997) and the Life Time Health Cover reform (introduced in 2000) which were sticks.

Given the budgetary constraints faced by the Federal Government, a stick seems far more likely that a carrot.

For the health insurance companies, the issue of elevated premium rises and the impact on affordability, consumer switching and downgrading are likely to be ongoing, albeit with a short respite resulting from the recent slowdown in the growth rate of hospital volumes per person.

Stuart Jackson is a Senior Analyst with Montgomery Investment Management. To invest with Montgomery domestically and globally, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Thanks Stuart. I think government will be slow to respond to this in the short-medium term but eventually will act to improve both affordability and sustainability. I don’t think I can adequately time an exit and re-entry so will stay put with the longer-term thesis unless the reported figures show a more imminent decline in profitability.

Great article Stuart,

I wanted to know what you mean by, “by the Government’s quiet shelving of prosthetics pricing reforms in recent months”.

I hadn’t seen any announcements on them ditching the review.

Cheers Jeff

Hi Jeff,

Feedback in the industry is that the Government is going cold on the reforms, having put them on the back-burner until after the election. The insurance industry was originally looking for Sussan Ley to push through reforms in the middle of this year. The suggestion is that the hospital and medical device lobby groups have been extremely active behind the scenes putting pressure on the upper end of the political spectrum, sapping the political will of the Government.

Hi Stuart, I thought MPL had more time to run, but the drop in 20-29 y/o people being insured is a concern. Time to sell? Do you still hold?

Hi Gav,

The trends by age demographic are concerning from a longer term perspective, but as discussed, the Government is incentivised to implement policies designed to reverse this trend. In the near term, there is likely to be upside risk to earnings expectations due to the persistently low rate of growth in procedure per covered person. MPL’s guidance for FY16 assumed that this growth rate would gradually return to more normal levels through the middle of this year. This is no real sign of this occurring at present. Having said this, most commentary in the market reflects the expectation of near term upside surprise in earnings.

Of course the resulting expansion in gross margins (for both MPL and the broader industry) will increase the pressure from the Government for a smaller premium rise in FY17. This means the elevated gross margins in FY16 are likely to be temporary.

While we like the longer term efficiency improvement story for MPL, we struggle with the valuation at current levels, and no longer hold the stock in the portfolio.