Gaining from the declining AUD

The declining Australian dollar is often seen as a negative event, raising the cost of imports and overseas holidays. Over 2013, the Australian dollar fell by 14 per cent against the US dollar (US$1.04 to US$0.89), 16 percent against Sterling (GBP0.64 to GBP0.54) and unbelievably 18 per cent against the Euro (EUR0.79 to EUR0.65).

The fall, however ,benefits exporters, those that have invested in offshore assets (unhedged equity funds), and Australian domiciled businesses with a large component of international earnings and assets.

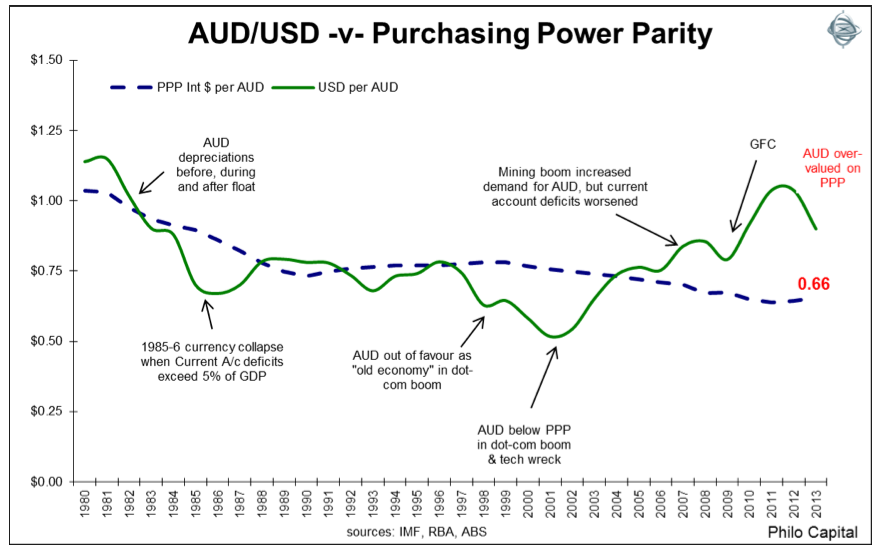

Our friend Hugh Dive at Philo Capital Advisers has produced the following graph, detailing the AUD/USD exchange rate against an assessment of fair value, based on purchasing power parity (PPP).

Purchasing power parity looks at what it would cost Australians to purchase a similar basket of goods and services in different countries, verses the cost of purchasing those goods and services in Australia. This is a similar concept to The Economist‘s “McDonald’s Big Mac Index”.

The Australian dollar appeared very cheap, on a relative basis around the 2000-2001 tech wreck, and very expensive, on a relative basis in 2011-2012.

Given the Australian dollar still remains well above its purchasing price parity, we are pleased the Montgomery Funds have a number of high quality industrial companies, which have a large component of their revenue or assets offshore. Examples include CSL (CSL), Seek (SEK), Sirtex Medical (SRX), ResMed (RMD) and QBE Insurance Group (QBE).

Conversely, we are aware companies like JB Hi-Fi will see the cost of those Samsung televisions eventually jump with the rising Korean Won!

Hi Roger,

The declining AUD is a major theme for me right now. Which of the current crop of overvalued companies with overseas income, do you think is least overvalued? Tom

Very interesting stuff David. Is there any evidence that currencies tend towards their ‘PPP’, either causal or statistically?

On the topic, and not that I wouldn’t believe Graham and Buffett, what hard evidence shows share prices actually do tend towards intrinsic value?

There is some published research on this. We have also done work with University of Sydney to examine its efficacy and have been extremely pleased with the outcomes.

HI Dave,

My two cents on your second question. Hard evidence will be hard to come by as there is no “one” intrinsic value for prices to trend towards but i believe there may be some posts in the archives here of screenshots of Skaffold charts for companies that tend to show that. I think one post had Ben grahams name in the title but was posted a while ago.

Not sure if you are a skaffold member but if you are then i think most share price vs intrinsic value share price charts would show a relationship over long term time frames.

An article i wrote a while ago and posted here saw Roger add a chart for Webjet which shows a reasonable correlation as well. http://rogermontgomery.com/guest-post-thoughts-on-fast-maturity/

I think if you were to find a reasonable proxy for intrinsic value and overlay on a chart of a companies share price performance you will see a reasonable correlation. not exactly 100% correlation but high as long as you are looking over the long term (multiple years) as sometimes it can take a while (ABC Learning is possibly an example of this for some people).

Whilst not neccesarily proven, i think it is a reasonably acceptable view.

Very interesting stuff David. Is there any evidence that currencies tend towards their ‘PPP’, either causal or statistically?