Furniture turning down? Ask Nick Scali

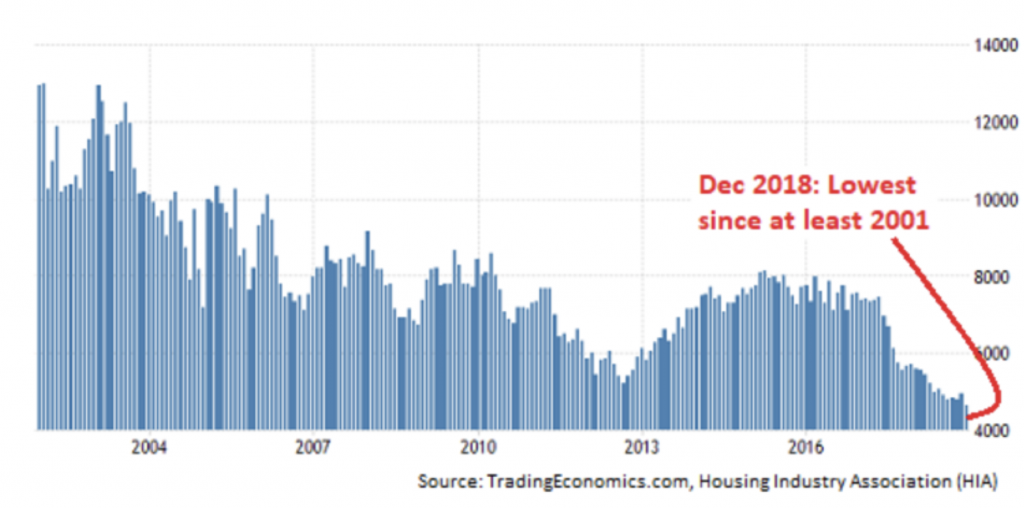

With new house sales in December slumping to the lowest levels in almost two decades, retail sales of household goods declining 2.8 per cent in the December quarter, and December foot traffic down eight per cent year on year, the outlook for furniture retailers doesn’t look promising.

Figure 1. shows a material decline in the sale of new houses suggesting a slump in furniture and appliance sales is on the way.

Figure 1. Monthly sales New Houses Australia

Nick Scali (ASX:NCK) however delivered a first half result that on first inspection appears to suggest the company is bucking the trend.

Nick Scali’s first half 2019 profit after tax was reported up eight per cent to $25.1 million on revenue that was 10 per cent higher. Like-for-like sales revenue was unchanged and very strong cash conversion of circa 80 per cent means there’s plenty to hand out as dividends. But digging a little deeper we find the speed of growth is slowing, which suggests Nick Scali won’t be able to escape the gravitational forces of ‘consumer deleveraging’.

Customer deposits provides a useful insight into future sales and while the $20 million reported is up 1.4 per cent on the previous corresponding period, the company has expanded the number of stores it operates. On same store basis the customer deposits have fallen by about 15 per cent.

Importantly, while the like-for-like sales number was flat for the first six months of the financial year, that number was said to be up two per cent in the first quarter, which means the second quarter saw like-for-like sales decline by about the same amount or a little more.

The company’s numbers have also benefited from a one-fifth reduction in lead times – an improvement quantum that may be difficult to repeat.

The company has said at its briefings that it will maintain prices, rather than volumes, as the market cools, to ensure its brand is protected “out the other side”, implying the company is expecting to enter a rougher patch. Back in 2005 and 2008 the company reported like-for-like sales declines of as much as seven or eight per cent and the share price fell almost 40 per cent in 2005 and 83 per cent in 2008 (GFC influenced).

Nick Scali’s share price peaked in April 2017 at $7.48 and has since declined 25 per cent to around $5.59, putting it on a PE of between 10 and 11 times forward earnings and about five times equity per share. This seems slightly expensive given the downside risk, given the sustainable ROE is probably somewhere south of 40 per cent and given other retailers who are further into their cyclical downturn are trading on PEs of less than ten times.

Assuming a sustainable ROE of 40 per cent (which of course may be optimistic) and a payout ratio of 80 per cent, Nick Scali shares estimated intrinsic value may sit between $5 and $6. A big discount to intrinsic value – a safety margin, however is warranted given the deteriorating outlook, the depths of which is impossible to estimate.

We’ll be watching this sector closely because a couch requires at least two people to move it, making the logistics side for online competitors difficult and thus perhaps protecting Nick Scali from the ecommerce threat.