For today’s investor, returns aren’t what they used to be

With rising stock prices and falling yields, long-term equity investors can expect a lower return today than in years gone by. How tough do they have it?

“House? You were lucky to have a HOUSE! We used to live in one room, all hundred and twenty-six of us, no furniture. Half the floor was missing; we were all huddled together in one corner for fear of FALLING!”

-Monty Python: The Four Yorkshiremen

Source: Factset, MIM analysis

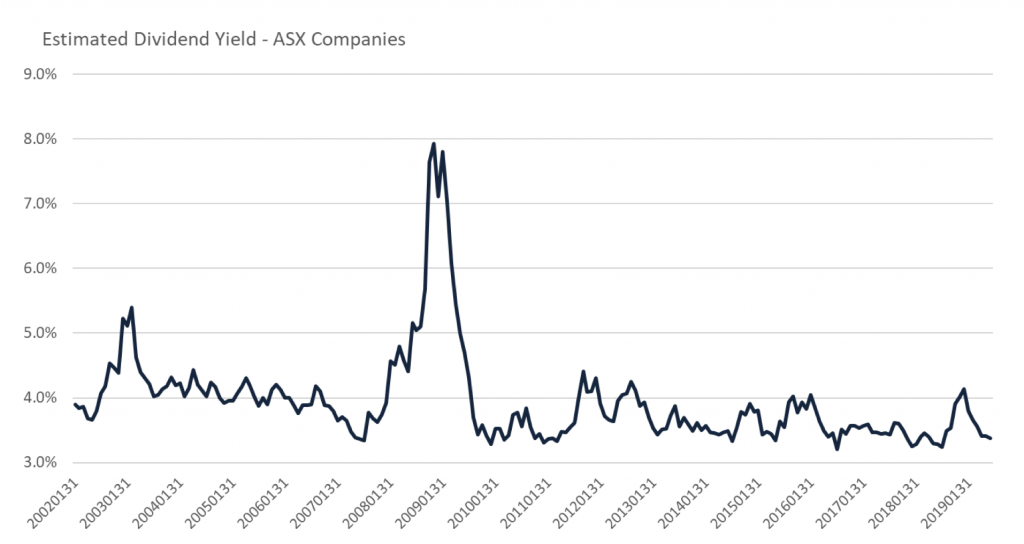

The chart above shows the forecast dividend yield on an equal-weighted portfolio of the largest 300 ASX listed stocks over the period since early 2002 – about as far back as the data for consensus dividend forecasts allows us to go.

You can see that there has been a gradual erosion of the yield over time, from a level consistently north of 4 per cent in the early part of the 2000s to somewhere in the mid-low 3 per cent range more recently – a development that may be uncomfortable for anyone reliant on dividend income to fund their lifestyle. We see a large spike in yields during the GFC, but that largely reflects consensus forecasts needing to be adjusted downward for the impacts of the GFC, and setting that aside, the chart shows a fairly consistent picture.

Current dividend yield of course is not the whole story when it comes to stock market investments. There is also scope for growth over time, and total return to investors can be thought of as the combination of the two. One way to estimate the rate of growth is by reference to the rate of growth in GDP, which sets a fence around the paddock that listed companies graze in. The chart below sets out the data, as provided by the RBA/ABS, for nominal GDP growth over the same timeframe.

Source: RBA

We can see that nominal GDP growth today is a little lower than it was at earlier in the period. While it has recovered from its lows, it now sits around 5.5 per cent p.a., but was closer to 8 per cent prior to the GFC. I doubt that many observers are anticipating a return to those levels any time soon.

Our equity investor then has been hit on both sides: dividend yield is lower than it was, and the rate at which we might expect dividends to grow is also lower. Total return may be as much as 3-4 per cent p.a. lower today than it has been.

One further thing we should take into account is inflation. Investors should be more concerned with real (after inflation) returns than nominal, as growth that keeps up with inflation does not translate into an improvement in purchasing power.

Happily(?), inflation today is a little lower than we have seen it previously. According the RBA/ABS, inflation is running at around 1.7 per cent p.a. currently, where it was around 3 per cent p.a. at the start of the period, so in rough terms, our investor has seen their real return decline from around 9 per cent p.a. (4 per cent div +8 per cent growth -3 per cent inflation) to something closer to 7 per cent p.a. (3.3 per cent + 5.5 per cent – 1.7 per cent).

There are a number of assumptions built into this, but in simple terms, long-term investors can expect a materially lower return on equities today than they might have expected in times gone by. So, how should they feel about that?

In absolute terms, the answer may seem straightforward: If investors can now earn less from their investments than they once could, that can only be an uncomfortable thing. However, the decline in equity returns is a flip side of growth in the value of those same equities. Yields are lower today largely because prices are higher, and investors who have held equities for some time have benefited from that rise in the value of equities. For this reason, equity investors today are probably not nearly as unhappy as the total return outlook might suggest.

But here’s where it gets tricky. That compensatory rise in prices is more in the nature of a one-off, whereas the reduction in future return is rather more sustainable. An investor who buys shares today with the intention of holding long term can expect to receive today’s reduced dividend yield and lower growth rate. It is possible that prices will continue to rise and provide our investor with a boost, but it is also possible prices will fall, compounding their pain. While today’s reduced dividend yield and tepid growth outlook is pretty much guaranteed, but there are no such guarantees in respect of further price appreciation.

One potential justification for this is low interest rates. If the return on low-risk investments like bonds has fallen, then it makes sense that the return on higher risk-investments should also fall, as the market finds an appropriate relativity between the two. Indeed, on the face of the numbers, finance theory might tell us that equity prices have further to rise (and returns further to fall) before the appropriate balance is found. If investors in ten-year Australian government bonds are willing to accept a negative real return to lend money to the Australian government (as they seem to be) then perhaps investors in equities should consider themselves lucky to still be in positive territory.

Or, as a Yorkshireman might put it: “Luxury!”

I’ll put a hypothetical out there, which sounds nonsensical at first, but don’t laugh – the insanity may just reach a point where you also get a negative, but “less negative” return on corporate bonds than you do on Government bonds, because the underlying asset of the former is riskier and since everyone piled into Government bonds because “they’re safer” to such an extent that the became even more negative thanks to the sheer weight of money.

Indeed, Chris. A touch of insanity could well be helpful in making sense of fixed income markets.

Feels like people are becoming resigned to lower for ever rates. I’m not sure what the trigger will be, but at some point the worm will turn and the vortex may be worse than the GFC. We had a sample Q4 2018.