Financial planning in a state of flux

It’s no secret that the financial planning industry in Australia has come under a great deal of scrutiny which peaked during the Royal Commission and its findings back in February this year. But what has been some of the real-world consequences of the Royal Commission and how are they impacting advisers?

Financial Adviser Standards and Ethics Authority (FASEA)

This body, formed in April 2017, is now the key standard authority on training and ethical standards of existing and new financial planners.

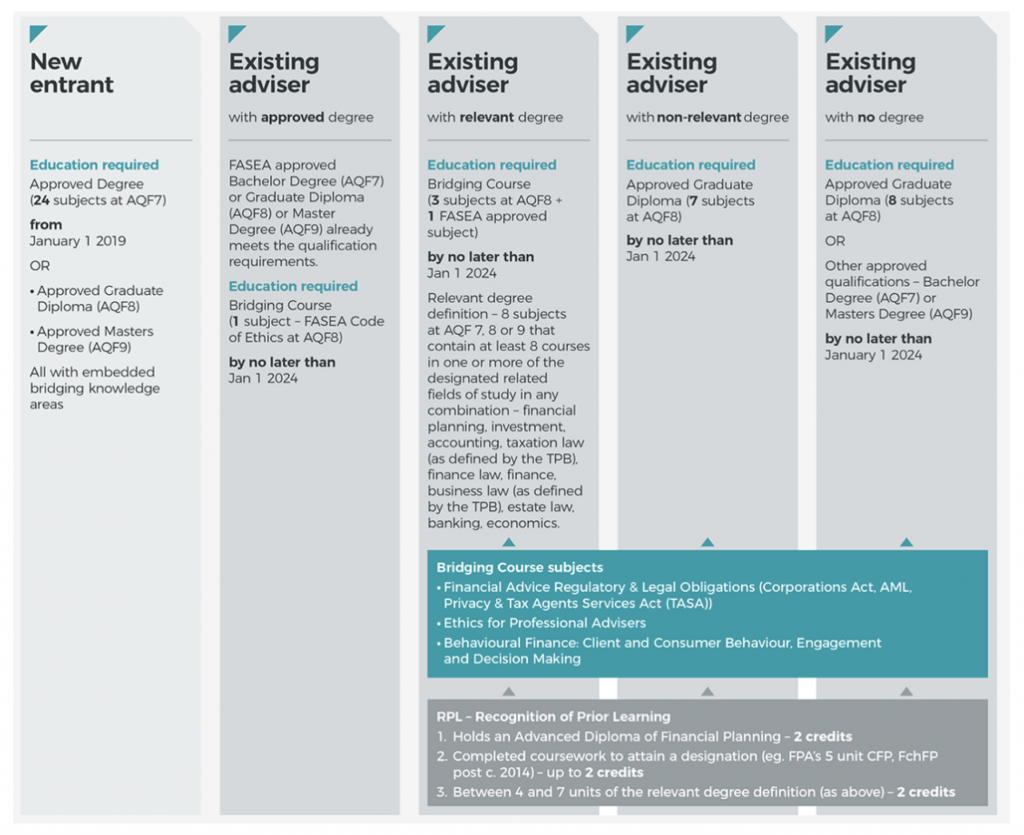

Under the new FASEA requirements, existing financial planners must make sure they meet the new standard of qualification by 2024, which could entail a minimum one subject (code of ethics and an exam) for those with an approved degree, or up to seven subjects for those with a non-relevant tertiary degree.

For those that have come out of University recently, this is the equivalent of almost a year’s full-time study (at four subjects a semester) or 18 months part-time (at two subjects a semester), noting most financial planners will still be working and held accountable to their clients over this period of time. For those interested you can read more about the new education standards on FASEA’s website here.

Source: FASEA

ASIC look back programme

Another direct outcome from the Royal Commission was the enhanced supervisory role of ASIC, which included the setting up of the Corporate Governance Taskforce whose role encompasses “targeted reviews of corporate governance practices in large listed entities. This will allow us to shine a light on ‘good’ and ‘bad’ practices observed across these entities.”

Such entities include the larger listed advisory firms and banks, such as AMP, IOOF, Centrepoint Alliance, as well as the aligned financial planner networks through the Commonwealth Bank of Australia, National Australia Bank and Westpac. For example, at AMP, this sees all financial planners having 45 files reviewed and if two files are deemed ‘non-compliant,’ then any file over the last 10 years can be reviewed as part of this programme. At the Commonwealth Bank of Australia aligned groups, this has seen advisers redo all their ongoing service fee agreements. The reality is compliance now more than ever will be a huge part of the advisers day-to-day, taking time away from servicing new and existing clients particularly for members in the large listed financial planning entities.

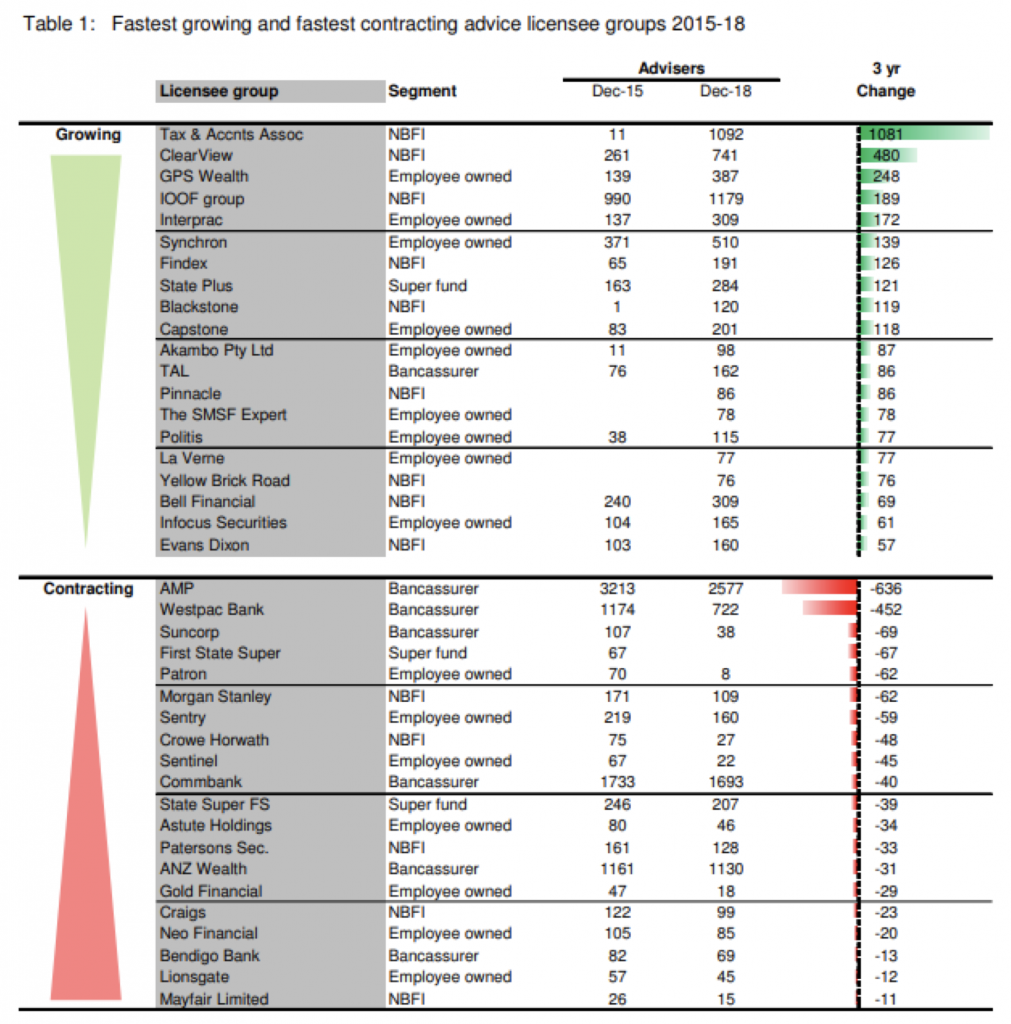

The great unwind of vertical integration

According to a recent report by Rainmaker, over the last three years “83 per cent of the 7,000-adviser increase was within non-institutionally owned licensees. That is, the number of non-insto aligned advisers grew almost 5-times faster than growth in those aligned to institutions.” As Table 1 shows below, in light of the changes in the industry a lot of advisers are leaving bank or institutional aligned licensees in favour of independent licenses, or those that are privately owned and not aligned to a bank or listed institution.

What this table doesn’t capture is the growing number of financial planners seeking their own license, which has grown 77 per cent over the same three-year period to December 2018. As a result of these two trends, bank or institutionally aligned licenses have dropped from two thirds of the market to just over half, with many aligned organisations walking away from some of financial planning organisations they have acquired such as Westpac which is in the process of winding up the Securitor and Magnitude licensee channels.

Source: Rainmaker

It is rumoured as a result of the changing landscape for financial planners, that over a third will exit the industry in the next three years[1]. As such, the change has only just begun which could mark a big shake up in the financial planning industry in the coming years.

[1]Source: The Sydney Morning Herald – A third of financial planers tipped to leave industry due to new laws

You’ve really just got to look at the size of the financial services industry as a percentage of the share market or gdp, totally insane, an industry that produces nothing, and just skims and scams the entire nation, a massive and out of control parasite, I mean check out the pure crazy shenanigans in the banking inquiry, and APRAs total about-turn in its rule changes, because the banks and their associated casinos, mainly the property casino are too big and powerful to fail and therefore be controlled by anyone, a totally ridiculous situation we have gotten ourselves into.

Basing your entire nation’s economy on a debt-fueled property ponzi scheme is really dumb, but heads won’t roll I guarantee you, the taxpayer and middle class will cop it again.

Things must change or we are finished.

We’re all finished in the end! You can quote that Andrew.

Financial Planning in the 21st century is like Medieval Medicine. It’s hit and miss, and as a result the chances of getting advice that leaves the client worse off is too high compared to proceeding as they were before the advice.

Hi Phil, thanks for your comment. In our view, quality advice is worth paying for. Regards, Dean.