Financial planner numbers back to where they were in 2015

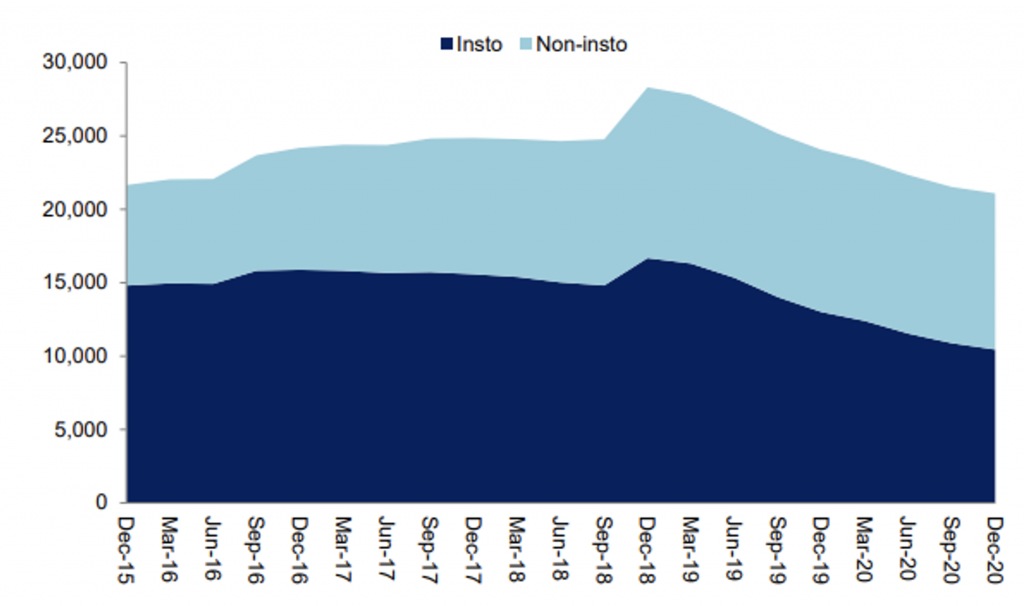

In what was an interesting year for all financial service participants, 2020 saw the number of financial planners in Australia decline, continuing the exodus of recent years. According to RainmakerLive’s latest research into the advice industry, the total number of planners fell by 12 per cent throughout the 2020 calendar year as captured in the chart below.

This brings the total number of financial planners in the industry back to 2015 levels. Those aligned to institutions or broader bank-backed licensees (such as AMP and IOOF) accounted for 85 per cent of this reduction. There are no surprises here as the education exodus continues whereby existing planners have until January 2026 to comply with new education requirements set out by the Financial Adviser Standards and Ethics Authority (FASEA). Additionally, the end of the calendar year also marked the end of trail commissions across legacy products.

Chart 1 – Total number of financial advisers, aligned and non-aligned

Source: RainmakerLive January 2021

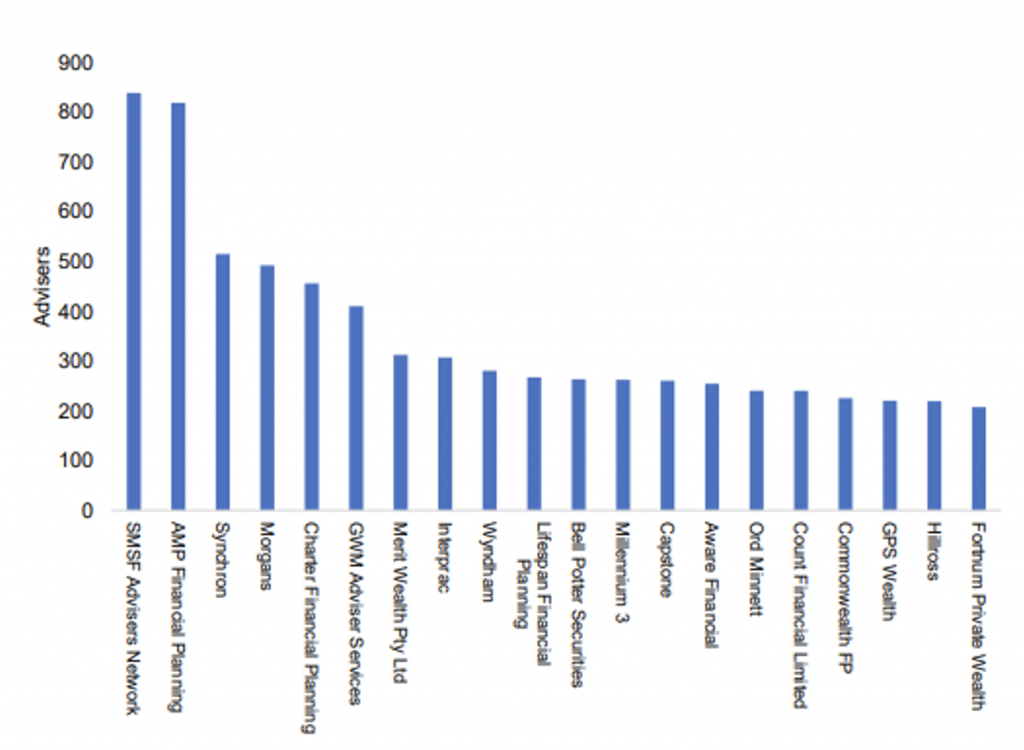

The changes within the make-up of the licenses also reveals an interesting dynamic at play. Firstly, as per chart 2 below, AMP is no longer the largest stand-alone licensee with the SMSF Advice Network taking the interim throne. Although headline grabbing, this isn’t entirely correct.

If you consider the sum of the parts, AMP would still be the largest dealer group in the land when accounting for the other licensees that also fall within the group, Charter Financial Planning and Hillross. The same can be said about IOOF, particularly following their recent acquisition of the MLC licensee. This is due to be finalised 30 June 2021 and will subsequently make IOOF the largest retail advice business by number of planners and Funds Under Administration (FUA). SMSF Advice Network, although having a large number of authorised advisers, won’t have the equivalent number of fully licensed planners, or planners that can provide holistic advice and not just on a limited basis, when compared to the larger incumbents.

Chart 2 – Largest groups by total number of financial advisers

Source: RainmakerLive January 2021

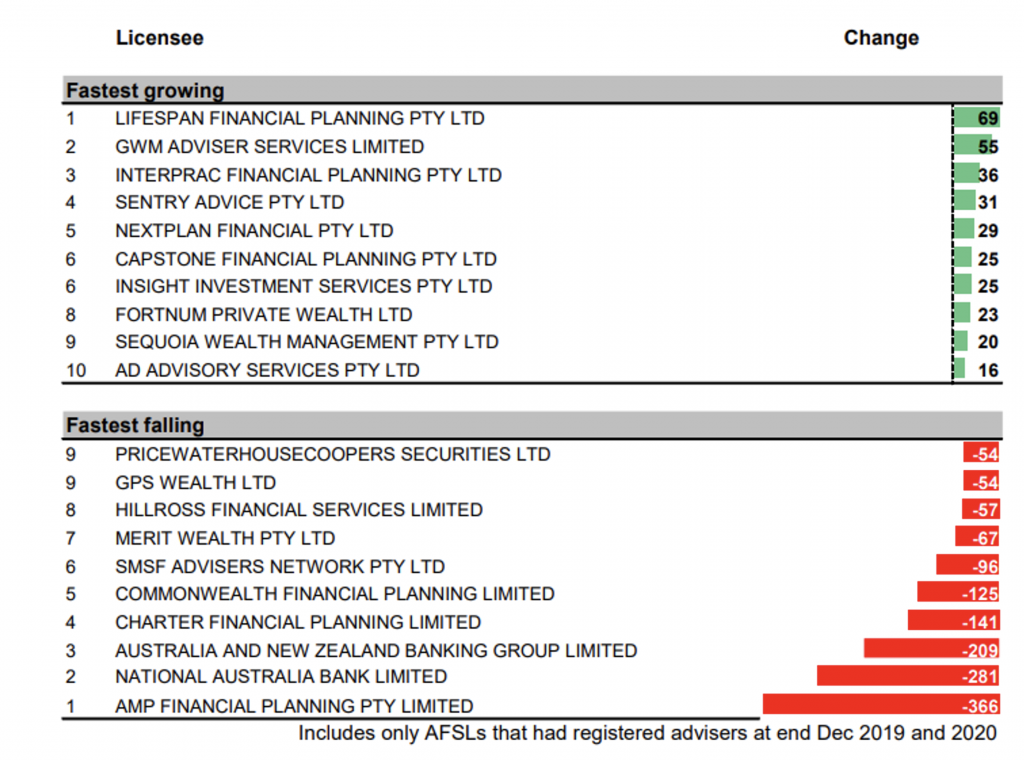

Last year also saw the continued fragmentation of the advice industry in Australia, with continued growth of non-aligned licenses. Last year, according to Rainmaker’s research, was the first time the total number of advisers attached to a non-aligned, or non-bank owned license, surpassed the number of aligned advisers. Of the top 10 fastest growing licenses over the calendar year, only one of them was aligned to a larger group (being GWM Adviser Services Limited) as per chart 3.

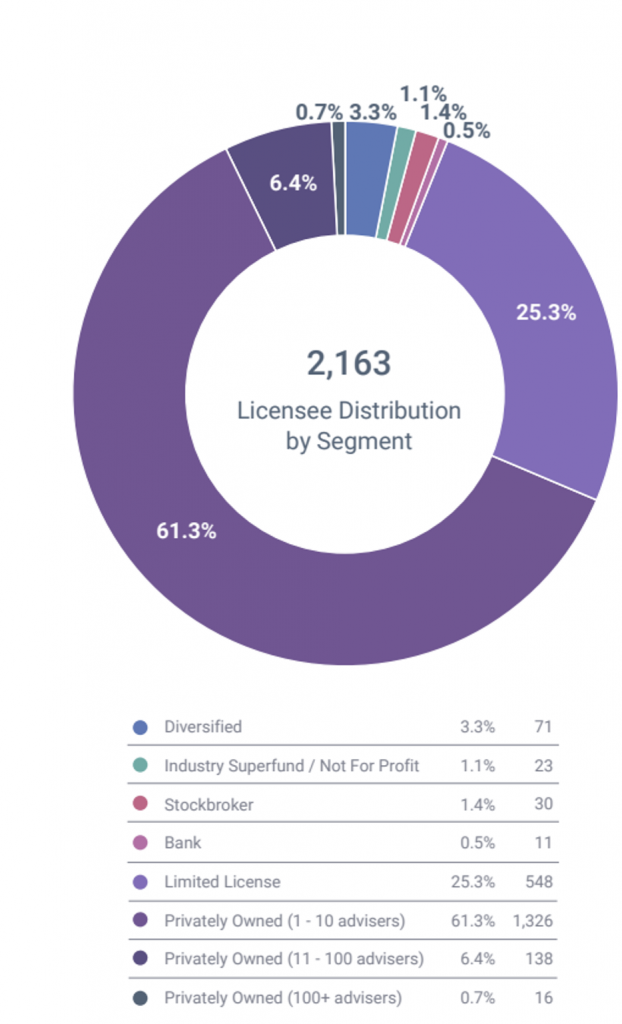

On the other end of the spectrum, the top 10 fastest falling licenses over 2020 were predominantly bank or institutionally aligned, with AMP Financial Planning Pty Limited experiencing the largest decline. Adviser Ratings recently provided a more detailed breakdown of the advice market in Australia by segment, and the largest license by category is privately owned or “self-licensed” with 1-10 representatives attached at 61.3 per cent of the market. Rainmaker now has the large aligned or institutional licenses accounting for just 20 per cent of the advice market, with this number expected to decline.

Chart 3 – Fastest changing licenses

Source: RainmakerLive January 2021

Chart 4 – Licenses by segment

Source: Adviser Ratings, Quarter 4 2020

What do we make of these changes?

A change in the guard in financial planners isn’t necessarily a bad thing for the industry. Adviser Ratings recently conducted a survey across the industry whereby 75 per cent had completed or were awaiting the FASEA test results with a deadline still a number of years off (January 2026). Furthermore, the growth of non-aligned licenses reflects a growing number of financial planners seeking a higher degree of independence, where the switching from aligned licenses will likely continue in the foreseeable future.