Fear takes flight

SARS, bird flu and swine flu had a material impact on global financial markets, yet the long-term impact on economies and businesses was relatively minor. Even though there is a precedent of pandemics passing relatively quickly (this is not to downplay the value of lives that were lost), it is unsurprising to see the volatile response of financial markets to the Ebola outbreak.

After all, fear is a difficult thing for human beings to shake, particularly when a sensationalist media conveys that civilians are in mortal peril.

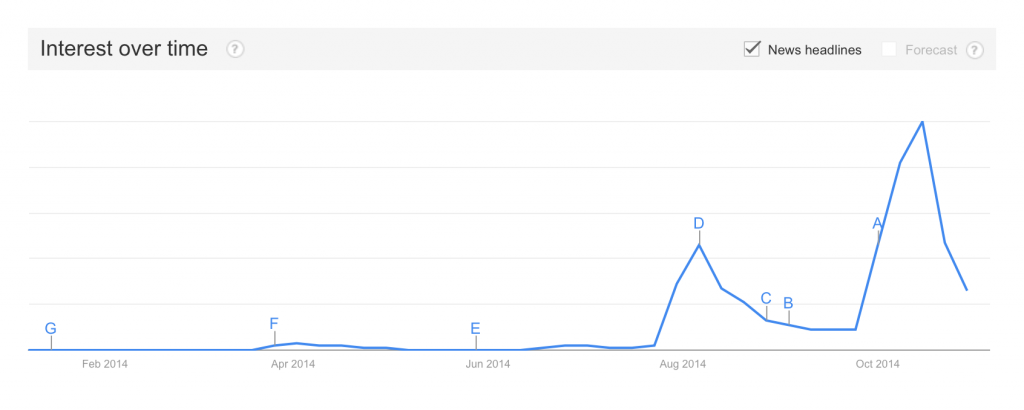

The above chart tracks Google Search interest for Ebola in 2014. The World Health Organisation declared the Ebola outbreak as an international public health emergency on 8 August 2014. In the early parts of the emergency, the reaction in the market was relatively benign. But it was not until the virus reached America in early October that fear in the market really took hold.

The above chart tracks Google Search interest for Ebola in 2014. The World Health Organisation declared the Ebola outbreak as an international public health emergency on 8 August 2014. In the early parts of the emergency, the reaction in the market was relatively benign. But it was not until the virus reached America in early October that fear in the market really took hold.

The chart above depicts the Dow Jones U.S. Airlines Total Stock Market Index for 2014. On 3 October 2014, the index closed at 191.47. Over the next 6 trading days it declined to 159.94, or 16.5 per cent. Yet it only took another 6 trading days for the index to recover from this fall, and it has since continued to appreciate to the highest level of 2014.

This blog post does not advise to buy airline stocks whenever a pandemic hits (you should know how the team at Montgomery feels about the attractiveness of airlines as an investment). The take away message is that the market can be highly affected by the hysteria of its participants, who are more likely to react to short-term events than rationally consider the long-term implications.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY