FAREWELL FY16, HELLO FY17

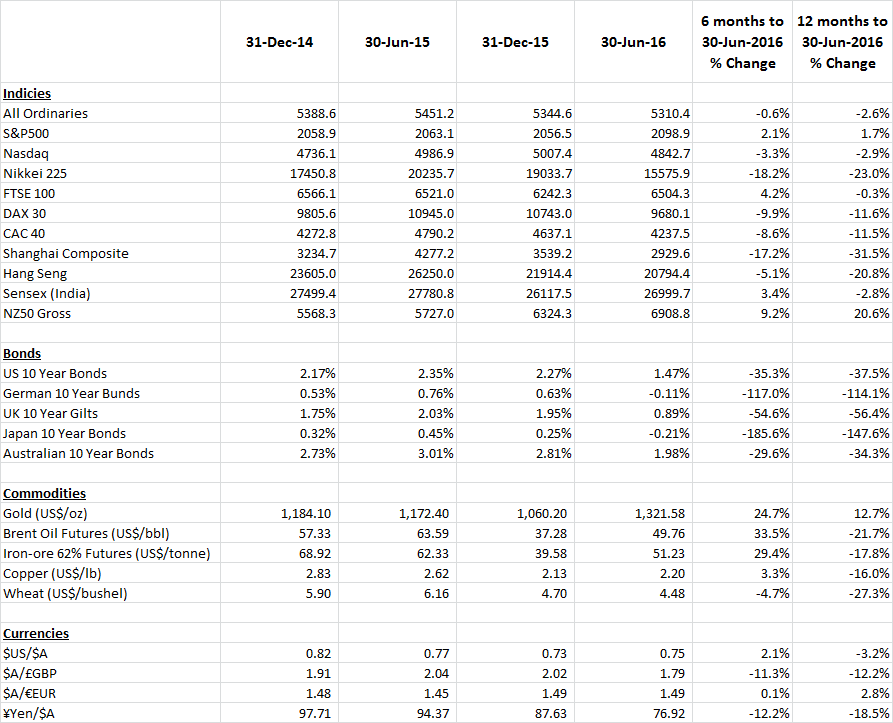

In the year to 30 June 2016 the Australian All Ordinaries Index declined by 2.6 per cent to 5,310.4 points. The current environment is somewhat challenging for investors.

After a strong rally into the December 2015 half-year, many share markets retreated over January and February of 2016. Hardest hit were the Nikkei 225 Index (down 18.2 per cent) and the Shanghai Composite Index (down 17.2 per cent). The New Zealand share market was an exception, delivering a positive 9.2 per cent return for the six months to June 2016.

Bond yields began more sustained dips into negative territory over the half. The German 10 year Bund yield declined from 0.63% to -0.11% as did the Japanese 10 year Bond from 0.25% to -0.21%.

The current environment is somewhat challenging for investors. High quality companies continue to trade at expensive valuations and whilst prices in some sectors have declined (for example resources), it’s difficult to find companies with both the bright prospects and attractive valuation we seek. Despite welcome rises in raw commodity prices (i.e. gold, oil and iron ore), our view largely remains unchanged.

The referendum in Britain with respect to leaving the European Union naturally generated excessive volatility in the markets and whilst opening up some opportunities in the financials sectors, largely left industrials in relatively expensive states. The terms on which Britain will leave the EU are currently uncertain (and won’t be agreed on until 2019) however we’d expect that businesses will adjust to whatever new paradigm emerges and those will durable competitive advantages will continue to prosper.

The Australian Dollar remained surprisingly steady, up from US$0.73 to US$0.75 over the 2016, which was a slight headwind for global share market returns for those Australian investors who have been un-hedged.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Hi Scott

I just crunched some numbers on the past 12 months performance of The Montgomery Fund. (TMF)

On the 1 July 2015 the Unit Mid Price was $1.3436 and at 30 June 2016 it was $1.4819 an increase of 13.83 cents . In percentage terms that’s a 10.3% increase and an outperformance of 12.9% against the All Ordinaries Index as according to your comments it declined by 2.6% over the last financial year.

The team at Montgomery need to be congratulated on achieving such an excellent result in difficult and volatile times – it shows that your investment strategy is working. Well done guys.

If it’s your view that “high quality companies continue to trade at expensive valuations” and because the price you pay determines your future returns and current valuations are high, then what future returns should investors in TMF expect in that challenging investment environment?

Hi Max,

We’ve been in this challenging environment for some time and as you can see, the fund has done quite well.

Whilst we can’t forecast returns. we’d expect perhaps better future returns if quality assets were priced more attractively however this is not the case.