Farewell fiscal 2014, hello fiscal 2015

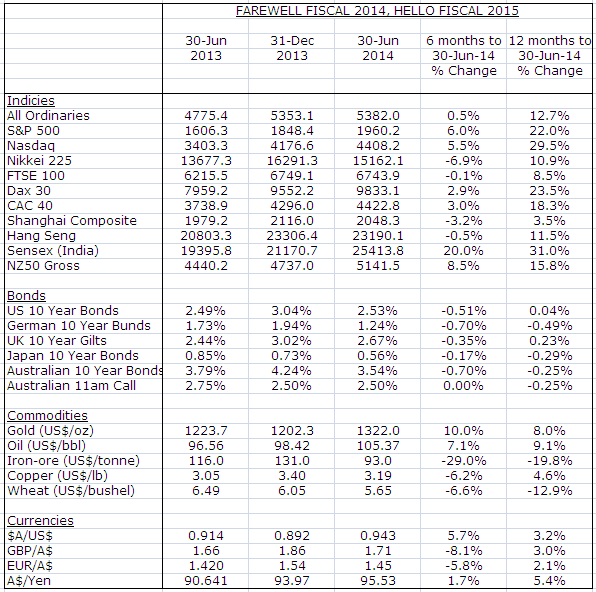

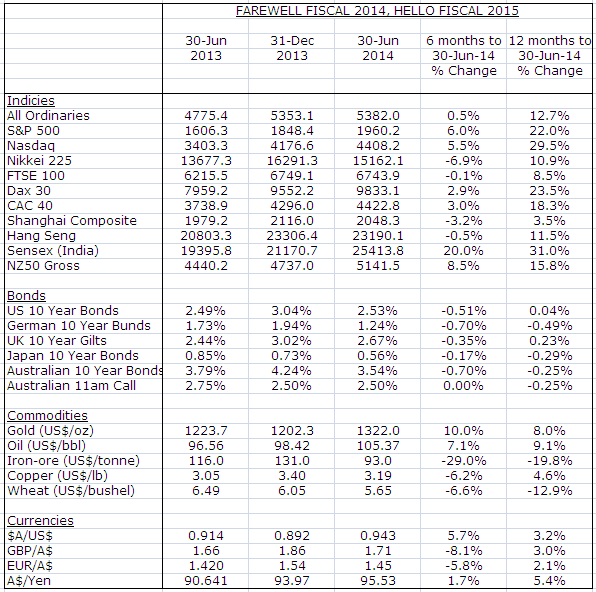

Excluding dividends, the best performing markets over the year to 30 June 2014 were the Sensex (up 31.0 per cent), the Nasdaq (up 29.5 per cent) and the S&P 500 (up 22.0 per cent).

The Australian All Ordinaries Index put in a respectable 12.7 per cent while the Shanghai Composite Index continued to struggle with a 3.5 per cent return.

Much of this gain took place in the December 2013 half-year while the June 2014 half-year, with the exception of the Indian market (up 20.0 per cent), was fairly quiet.

I wonder if this was related to a slowdown in global growth – and this was reflected in the bond market – with the US ten year bond yield declining by 0.51 per cent to 2.53 per cent, the German ten year bunds down by 0.7 per cent to 1.24 per cent and the Australian ten year bonds also down by 0.7 per cent to 3.54 per cent.

Commodities were reasonably quiet – although the iron-ore price fell by 29 per cent in the June 2014 half-year from US$131/tonne to US$93/tonne.

The Australian Dollar rallied by 5.7 per cent against the US dollar to US$0.943 in the June 2014 half-year.

MORE BY DavidINVEST WITH MONTGOMERY

Chief Executive Officer of Montgomery Investment Management, David Buckland has over 30 years of industry experience.

David is a deeply knowledgeable and highly experienced financial services executive. Prior to joining Montgomery in 2012, David was CEO and Executive Director of Hunter Hall for 11 years, as well as a Director at JP Morgan in Sydney and London for eight years.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

Patrick Poke

:

Wow, who would’ve picked gold as one of the top performers of the 2nd half of the year? Glad I had some exposure to gold mining, unfortunately I also had some exposure to iron ore, which more than offset said gains. This has reminded me why I’ve been reducing my exposure to commodities and increasing my exposure to industrials.