Farewell Fiscal 2012/2013, Hello Fiscal 2013/2014

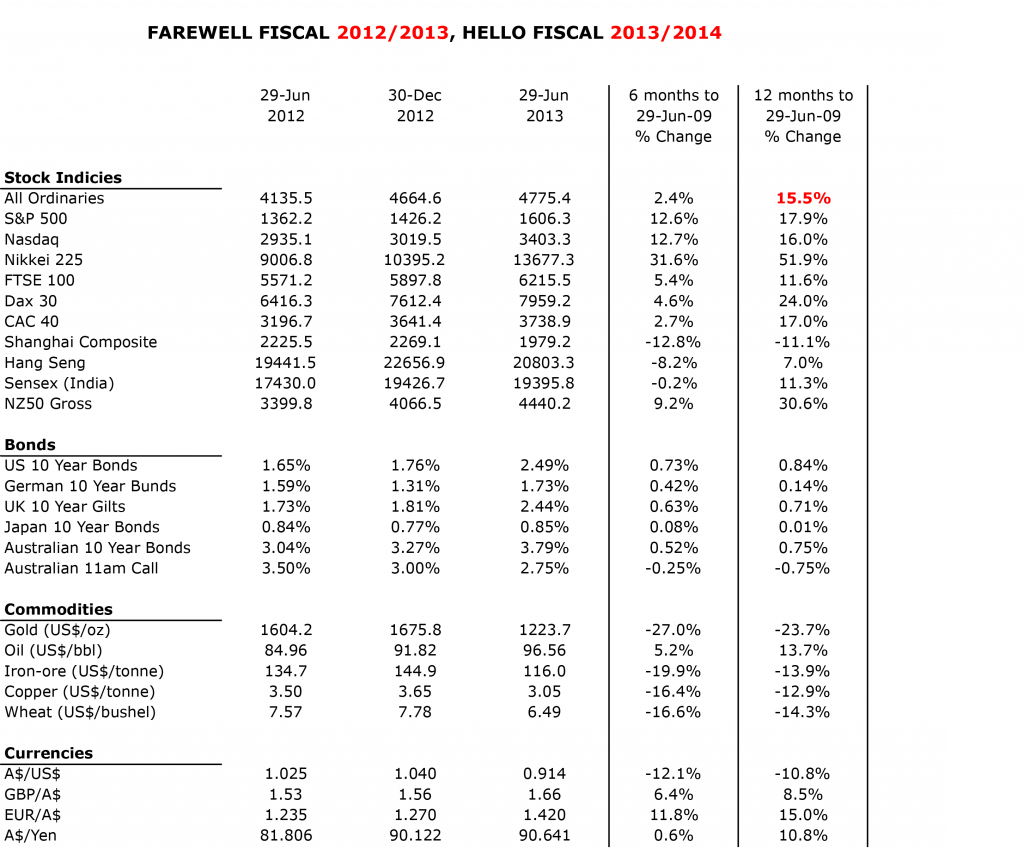

The Australian market, excluding reinvestment of dividends, rose 15.5 per cent in the year to 30 June 2013, from 4,135.5 to 4,775.4. The vast bulk of this gain came in the December 2012 half-year.

The June 2013 half-year rose only 2.4 per cent and was characterised by rising bond yields, weak commodity prices and earnings downgrades. Gold fell by 27 per cent to US1,223.70.oz, iron-ore declined 20 per cent to US$116/tonne, while Copper was down 16 per cent to US$3.05/lb.

While the Japanese Nikkei 225 rose 32 per cent to 13,677, the Shanghai Composite Index continued its poor performance, down 13 per cent to 1,979. China’s shadow banking system, for which there is no asset quality information, received a lot of negative attention during the period.

Fitch Rating’s Charlene Chu cut China’s long-term local currency debt rating to AA-, saying “the credit-driven growth model is clearly falling apart”.

Chu calculated China’s total credit at 198 per cent of GDP in 2012, when adding back off-balance sheet assets, up from 125 per cent in 2008.

This 73 per cent increase in four years, or double the annual rate of GDP growth, “is usually one of the most reliable predictors for a financial crisis”.

While it is early days, we were pleased with the performance of The Montgomery [Private] Fund and The Montgomery Fund over Fiscal 2012/2013. In the year to 30 June 2013, The Montgomery [Private] Fund out-performed its benchmark, the S&P/ ASX 200 Industrials Accumulation Index, by 12.97 percent, after expenses.

In the period between its inception, 17 August 2012, and 30 June 2013, The Montgomery Fund out-performed its benchmark, the S&P/ ASX 300 Accumulation Index, by 12.23 percent, after expenses.