Farewell 2015, Hello 2016

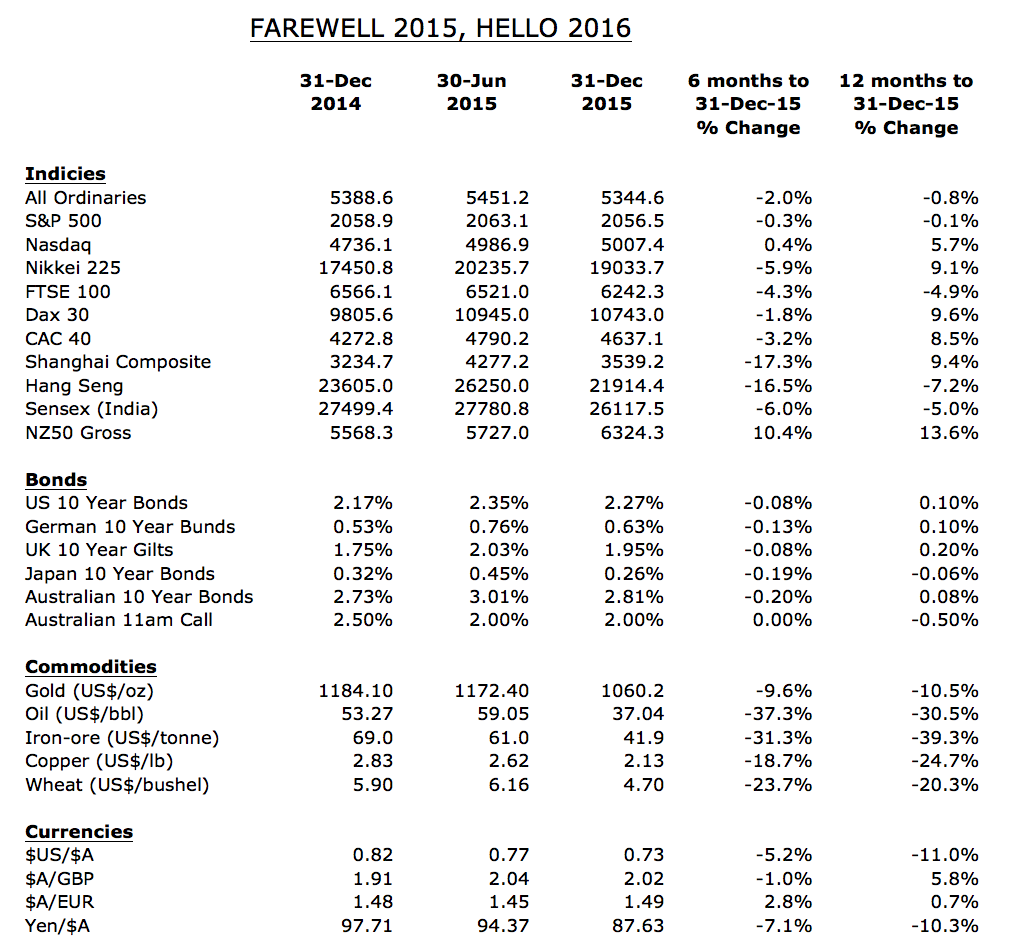

In the year to 31 December 2015 the Australian All Ordinaries Index declined by 0.8 per cent to 5,344.6 points. Excluding the reinvestment of dividends, the domestic market has made no progress since October 2013.

After mostly recording solid returns in the June 2015 half-year, many share markets retreated in the December 2015 half-year. Hardest hit were the Shanghai Composite Index (down 17.3 per cent) and the Hang Seng Index (down 16.5 per cent). The New Zealand share market was the exception, delivering a positive 10.4 per cent return for the six months to December 2015.

The more challenging environment was attributable to the surprise currency devaluation in China, sovereign defaults in Europe, the continuing severe bear market in commodity prices and the divergence in monetary policy with the US Federal Reserve tightening in mid-December 2015 after seven years of quantitative easing.

Over the past two years alone the price of oil has declined from above US$100/bbl to US$37/bbl, while the price of iron-ore has fallen from US$131/tonne to US$42/tonne. Copper at US$2.13/lb is challenging seven year lows; while in the past six months Wheat fell 24 per cent to US4.70/bushel.

The fall in the Australian Dollar, down from US$0.82 to US$0.73 over 2015, again assisted global share market returns for those Australian investors who have been un-hedged.

Conversely, a number of significant emerging markets appear increasingly vulnerable to a combination of increasing US Dollar indebtedness, weaker prices for their commodity related exports and record private sector debt to GDP ratios.

The blog is still in holiday mode currently, but you can expect to see us back and posting as usual from Monday 18 January.

To learn more about our funds, please click here, or contact me, David Buckland, on 02 8046 5000 or at dbuckland@montinvest.com.