Farewell 2012, Hello 2013

Despite the global economic slowdown, 2012 was a good year for investors in the major share markets.

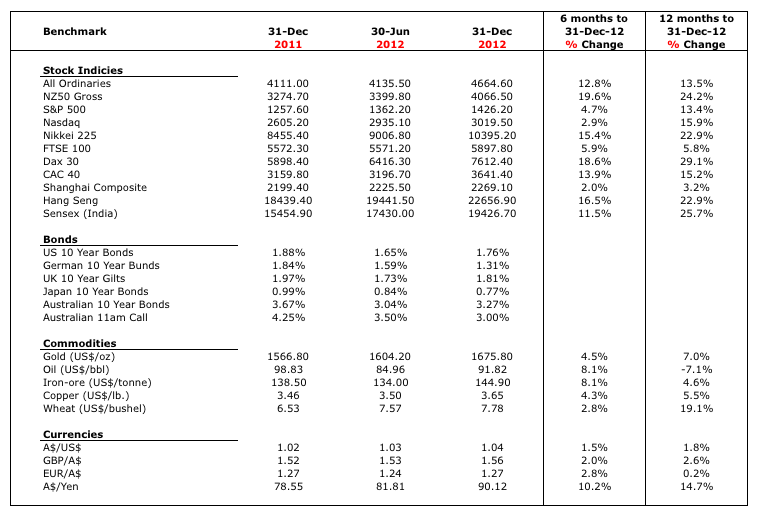

The Australian All Ordinaries Index, was in the middle of the pack, appreciating 13.5 percent from 4,111.0 to 4664.6. Virtually the entire gain was recorded in the six months to December 2012.

Of the major share markets, the German Dax 30 was the best performing over 2012, up 29.1 percent, while the Shanghai Composite Index was the worst performing, up 3.2 percent.

The 14.6 percent rally in the month of December 2012 to get the Shanghai Composite into positive territory for the year coincided with data revealing China’s manufacturing had in fact expanded for a third consecutive month.

With the exception of wheat (up 19.1%), most commodities were relatively flat over 2012. This hides the extreme volatility of the iron-ore price, which jumped by 65% from US$88/ tonne in October 2012 to finish the year at US$144.90/ tonne. The relief rally cannot be over-stated as most second line Australian iron-ore producers are profitless below US$90/tonne. Some deferred projects may now commence in 2013.

The yield of most countries’ ten year bonds are at multi-decade lows and it will be interesting to see if they start “backing up” in 2013. Will inflation return while the Western World remains focused on reducing leverage?

The Australian Dollar has been very steady over 2012, although the depreciating Japanese Yen is noted.

Don’t you count dividends David? The Accumulation Index was up 18.84%.

I wish you a great 2013!

High Charlie, Roger here. With deadlines for these posts, it was far simpler to compare all the indices on a price basis. As managers, let me assure you we are always comparing our post fee returns to the no-fee accumulation indices!