Falling purchasing power could hit retail spending

In June, Australia took the record for the longest run of uninterrupted growth in the developed world. In the same week, it was reported that the share of Australian GDP going into workers’ pockets hit a record low. It’s therefore timely to look at the difference between total GDP and GDP per capita, and the outlook for retail spending and consumer-driven businesses.

As I’m sure you know, GDP gives a measure on how a country is doing in absolute terms and can be compared directly to the headline figures of other countries and is a useful measure to assess political clout etc.

GDP per capita is less commonly used but is at least as important as total GDP as it gives a measure of the living standards for individuals inside the country.

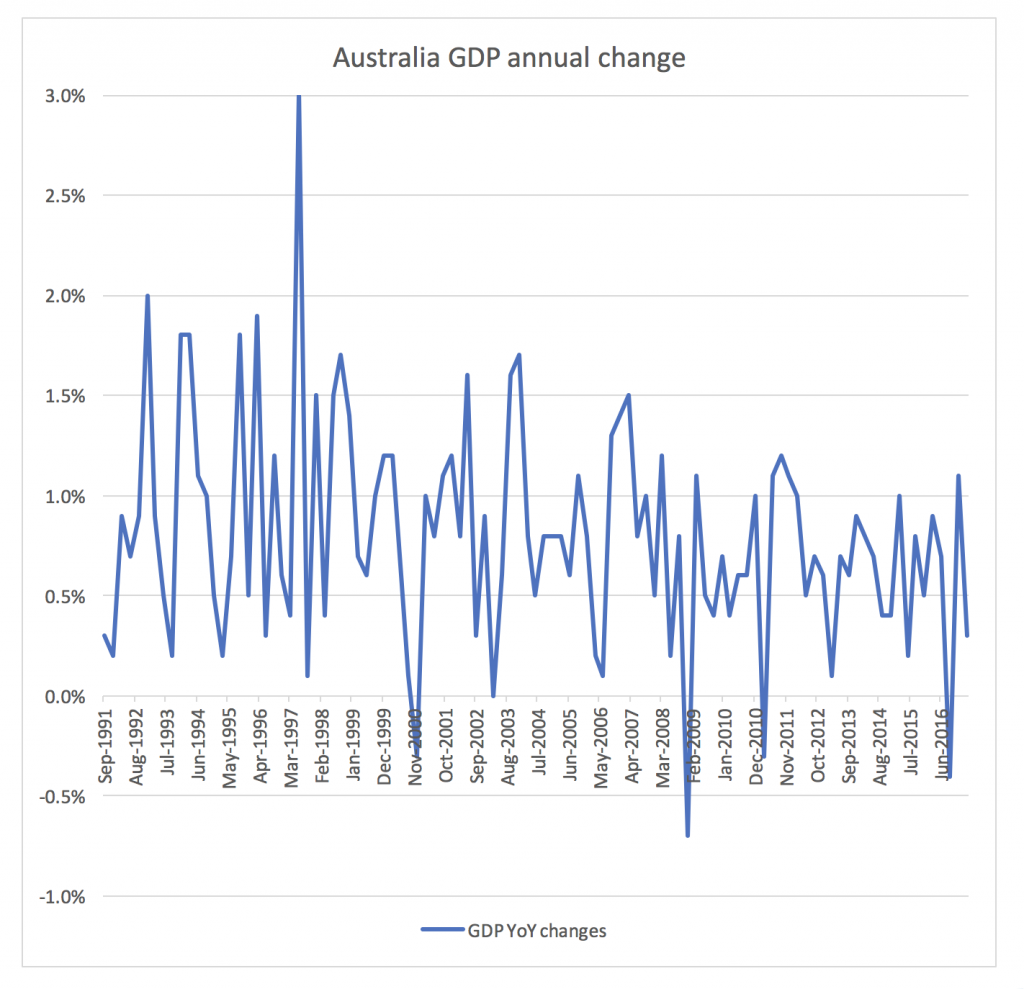

Politicians recently celebrated the fact that Australia overtook Holland in having the record with the longest period without a recession (recession defined as negative GDP growth for two consecutive quarters). The following chart shows the annual changes in GDP since the September 1991 quarter which is where the current streak of non-recession started.

As can be seen, there have been 4 instances where the GDP has gone backwards for one quarter but it has quickly recovered again and we have not had a single instance of 2 consecutive quarters with negative growth.

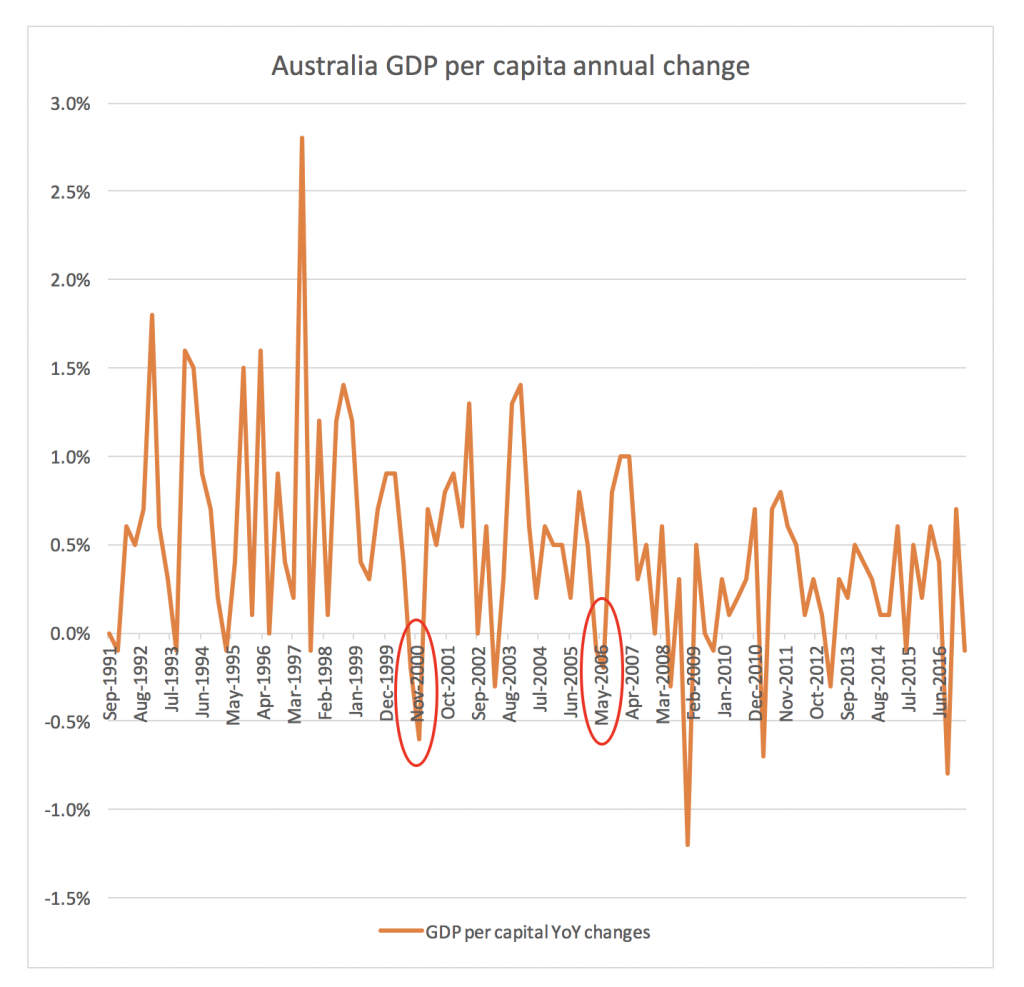

If we instead look at the GPD per capita trend, the picture is a little different:

We have had 17 instances of negative growth (over 4 years out of 26) and indeed two instances (2000 and 2006) of two consecutive negative growth quarters.

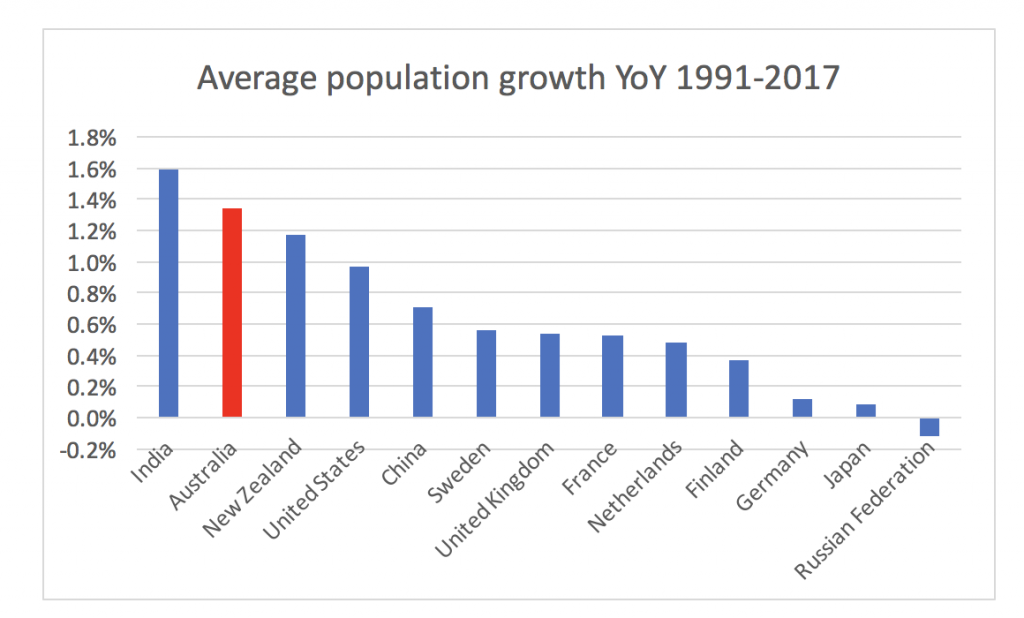

What has helped the overall GDP numbers is clearly the large population growth that Australia has had during the time. Indeed, if we look at the population growth in the same period, we can see that Australia has had by far the strongest population growth of any Western country and is just lagging India of the major economies of the world:

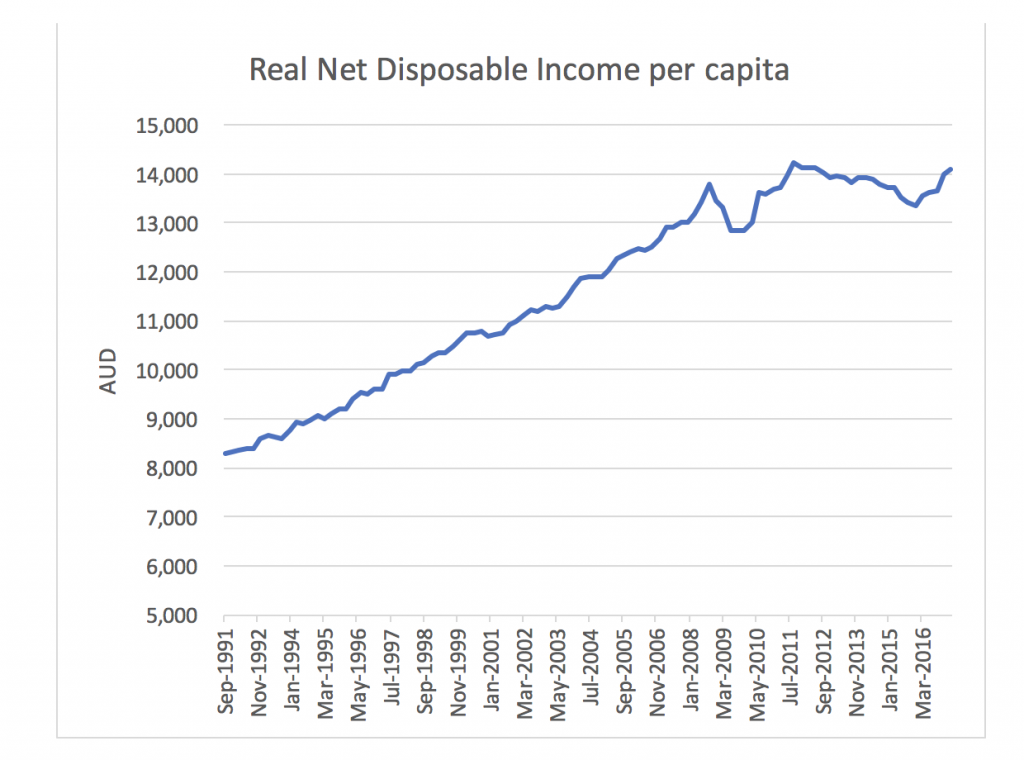

What is even more interesting is to look at the Real Net Disposable Income which is GDP adjusted for certain items (terms of trade, foreign trade and consumption of capital) to show a clearer picture of the real domestic income, i.e. the purchasing power domestically.

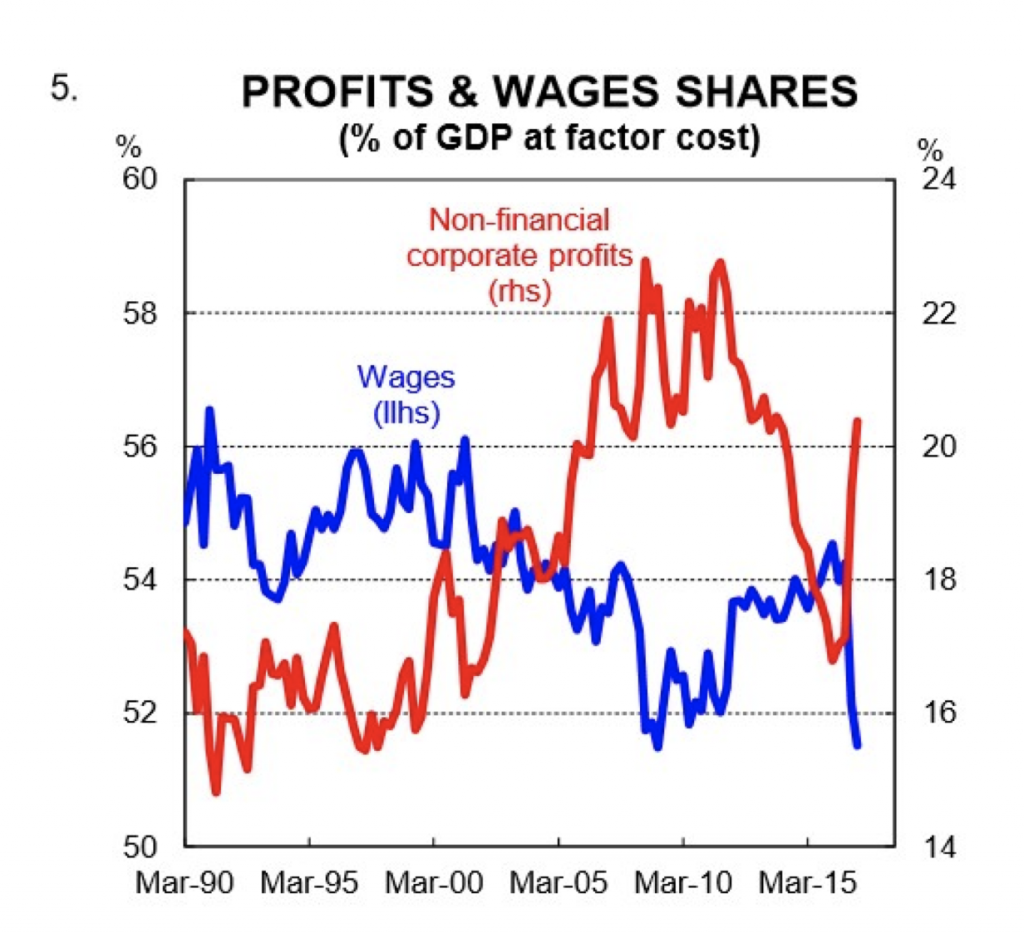

Here we can see that the we have been going backwards for about 6 years even though the last data points are encouraging. We should though remember that Real Net Disposable Income consists of purchasing power for both companies and people, and recently more and more of this pie has gone towards corporates as the chart below shows (borrowed from CBA).

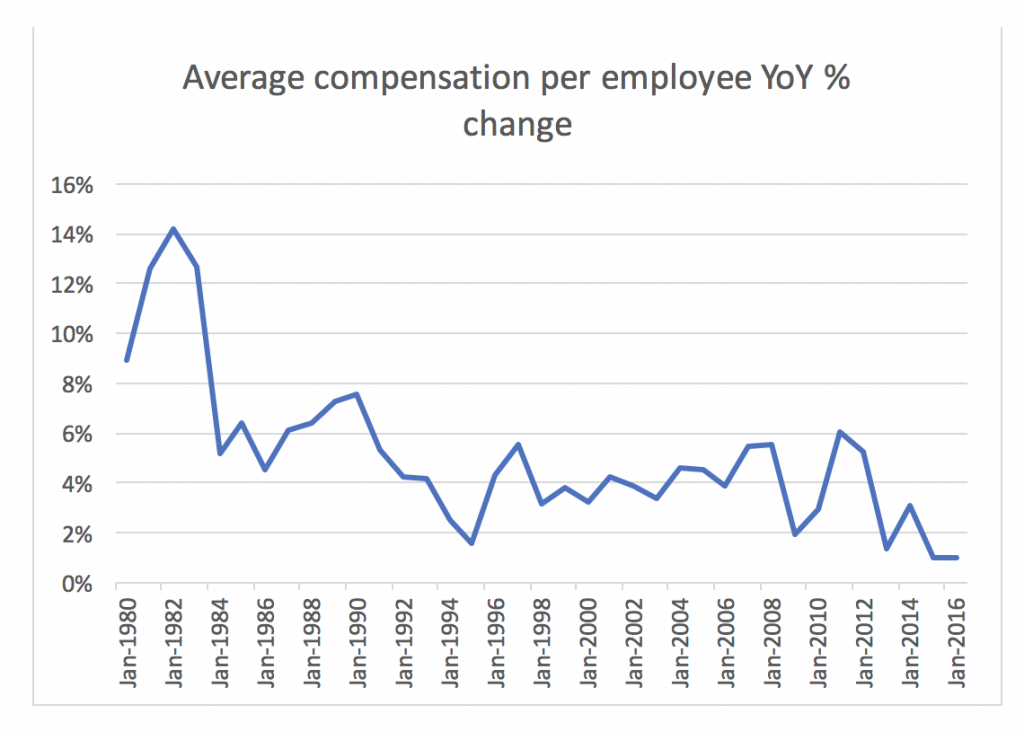

And what this has resulted in is a situation where average compensation per employee is growing very slowly as the population is not getting wage increases:

As we have described in a previous blog post, a significant portion of retail spending growth has come from the Consumer Wealth Effect and we believe this will stop having a positive effect on consumer spending with a slowdown in the property market.

If consumers are not:

- Earning more from working and

- Able to access equity from increasing asset prices

… then the only driver for retail spending growth left is population increases which we believe is a very fragile base for demand growth as it is also to a large extent depending on a good economic environment for workers (you are less likely to migrate if you cannot get a good paying job).

Please note that we do not intend to put a value judgement on this trend. Indeed, as a mostly long-only fund manager, we are generally trying to identify companies that can grow their profits faster than GDP overall and this trend certainly helps in this regard! This trend in the distribution between compensation to employees and capital is though one of the key reasons why we are staying away from retail consumption driven stocks as we believe they will see significant pressure from lack of demand (not to mention increased competition from new entrants like Amazon and Kaufland etc.).

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY