Expected level of customer remediation costs (ouch)

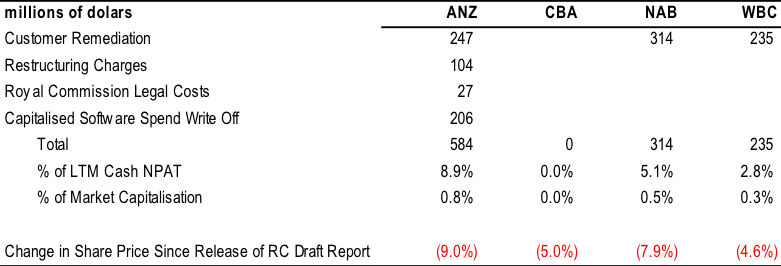

With the Financial Services Royal Commission having handed down its draft report at the end of September, three of the four major banks have recently released statements outlining the expected level of near term customer remediation costs.

Source: Bloomberg, Companies, UBS

Source: Bloomberg, Companies, UBS

Unfortunately, this does not cover the full extent of the damage to the banks from the Royal Commission, with additional charges likely to occur in future periods.

The problem has been compounded with the results of the Wentworth by-election on the weekend which is pointing to an all but certain change in the Federal Government at next year’s election. The timing of the election could have also been brought forward in the event that the now hung parliament proves to be unworkable.

Labor’s bashing of the banks increases the likelihood of further increases in the current 6 basis point bank levy that was introduced from 1 July 2017. An increase in the bank levy to 10 basis points would reduce major bank earnings by around 2.5-3 pre cent, assuming no offsetting adjustments are utilised by the banks to spread to cost to other stakeholders.

A change in Government is also likely to see an additional step up in regulatory compliance costs for the banks, while their financial services arms would probably be negatively impacted by Labor’s favouring of Industry Super Funds over retail funds and platforms.

Changes to negative gearing rules would impact the bid side of the property transaction market by reducing the attractiveness of incremental property investments. This creates the risk of adding to the current downside in residential property prices, thereby weakening the balance sheet of every Australian household.

As high dividend yield stocks, the elimination of cash tax refunds on excess franking credits will reduce the attractiveness of bank shares as an investment to Australian residents.

These issues add to the existing medium to long term issues regarding a normalisation of loan loss charges, a sustained period of slower credit growth as the cost of debt stabilises then increases, the heightened risk of a loan loss cycle and the competitive threat presented by technology and its ability to transform the cost base of the industry.

So, it’s not surprising that bank share prices have been weak. This places a lot of pressure on ANZ, NAB and Westpac management to demonstrate anything that can allay the fears of the market at the upcoming reporting season.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY