The Revolution at Evolution Mining

Gold miners generally don’t meet our quality requirements at Montgomery. But there is one miner that has gone through a massive transformation over the past eighteen months – Evolution Mining (ASX: EVN).

Last September, I wrote about the massive transformation of Evolution Mining, which is led by gold entrepreneur Jake Klein.

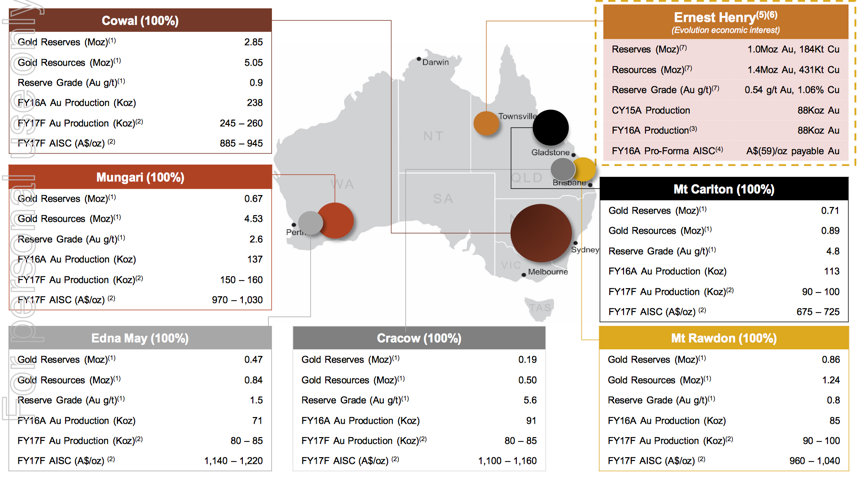

Evolution has continued to transform, completing a number of significant acquisitions over the past 18 months. These acquisitions are the La Mancha Australian assets (known as Mungari) from the Egyptian-based Sawiris family for 31 per cent of the Company’s issued capital, worth around $300m at the time; the tidying up of the neighbouring Phoenix Gold for $56m; the Cowal gold mine from Barrick Mining for $750m; and the economic interest in the Ernest Henry copper gold operation from Glencore for $880m.

Evolution has also divested the relatively mature Pajingo operation, which realised $42m.

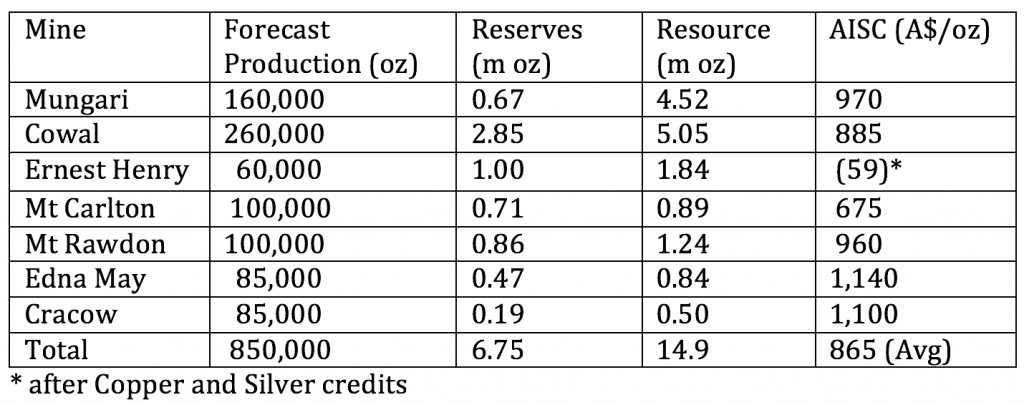

Over the three years to FY18, attributable gold production is forecast to double from 437,500 ounces to 850,000 ounces, the All-In-Sustaining Cost (AISC) is forecast to decline 16 per cent from A$1,036/ounce to A$865/ounce, and based on today’s gold price of A$1,760/ounce, EBITDA margins are forecast to jump from 41 per cent to 51 per cent.

Evolution’s gold reserves have increased from 2.6m ounces to 6.75m ounces (eight years of production), while the resource has increased from 5.7m ounces to 14.9m ounces. Crucially, management are optimistic all three new mines offer strong exploration potential and this is partially reflected in their resource profile.

I have detailed the company’s forecast production profile for FY18, the current reserves and resource, and note the three new mines – Mungari, Cowal and Ernest Henry – collectively account for 56 per cent of the forecast production, 67 per cent of reserves and 79 per cent of the resource.

Over the past 18 months, the management team at Evolution Mining have done a wonderful job transforming their business and the market has applauded with the share price tripling to $2.40, despite the issuance of 956m new shares. (Cost cutting, a stronger gold price and a weaker Australian dollar have certainly assisted). With 1,673m shares now on issue, Evolution Mining has a market capitalisation of $4.0b (up from $315m in late-2014). Net debt of $780m is expected to come down from strong forecast operating cash flow and more money will likely become available to prove up the Company’s stated resource.

Ernest Henry, that takes me back. Ernest Henry was once 51% owned by MIM (a different one) which was, briefly, the largest company on the ASX, and the first stock that I ever bought back in 2000. I made a few dollars on MIM in what were the pre-mining boom days when copper was 85 cents a pound. Of course, I had no idea what I was doing but it did get me interested.

Yes Greg, and I remember when Mick Davis from Xstrata successfully acquired MIM for $5b or $1.72 per share in 2003. MIM’s CEO at the time, Vince Gauci, was the only one on the Board saying it was a steal and the rest of the “defence” folded like a bad hand of cards. Xstrata enjoyed extraordinary timing and got their money back quickly as the resource super cycle kicked in. Glencore was less successful in their timing in acquiring Xstrata, and so Ernest Henry was back on the block 13 years later.

I think still plenty of upside in both EVN and NST over the next few years (have held both for the last 12 months+). Jake Klein has shown himself to be a great deal maker and the recent innovative Ernest Henry transaction (from a somewhat distressed seller) in particular looks likely to deliver good value for shareholders when it is hard to find at the top end of the market.

NST’s performance has been largely due to the perfect timing in acquiring Jundee, Kundana and Kanowna Belle at the bottom of the Australian dollar gold market.

Jake and his management team have done a superb job. Timing is everything. Enjoy the ride Michael.

Return on equity single digits the past several years.

Northern Star have done a far better job, with returns on equity 20 – 30% the past few years and better share price appreciation, zero debt and cash over 300 million.

Agree EVN worth a look, but NST even more so

Thanks Carlos for your Northern Star input. It looks like NSR’s ROE could jump towards 50% and hence its excellent share price performance. It will be interesting to see EVN’s ROE in say FY18, potentially its first full year without acquisitions/ divestments and capital raising. I believe relatively low indebtedness and a ROE approaching 20% is on the cards.