Evidence of our predicted retail slowdown is mounting

Over the course of the last twelve months, we have warned investors off consumer discretionary stocks, consistent with the positioning of our domestic equity funds and the posture of Brett Craig’s private credit funds, which have also been eschewing extending credit to the sector.

You might recall we noted while there was doubt about the magnitude of impact on house prices from mortgagees rolling from low fixed rates to much higher variable rates, there was a lot less doubt on the migration’s impact on consumer spending.

That downturn is now accelerating and therefore beginning to make investors take notice.

Rob Scott, CEO of Wesfarmers, which owns Bunnings, Kmart, Target, Officeworks and Catch Group, recently said, “The honeymoon is very much over”, noting a consumer switch to value as the tailwinds of handouts, government spending, and low-interest rates came to an end.

Meanwhile, the ANZ-Roy Morgan Consumer Confidence Index has now spent 13 consecutive weeks below 80, which is considered a warning of trouble ahead. Such a poor showing last occurred prior to the 1991 “recession we had to have”.

Suggesting the soaring cost of living and mortgage stress is forcing people into the gig or flex economy, Airtasker CEO, Tim Fung, said in an interview the company’s real-time data revealed a counter-seasonal increase in the number of suppliers looking for work from September last year. Fung also noted an “enormous surge in supply” of weekly active workers in January – up 40-50 per cent on the prior year – and that this strength has been maintained in recent months. Cynically, some of those workers might be his own staff, having announced the layoff of 20 per cent of Airtasker’s workforce.

Adjusted for inflation, wages in Australia have declined 3.2 per cent over the last year and 7.2 per cent since their peak. Even in the absence of an officially defined recession, such declines make consumers ‘feel’ like they’re in a recession.

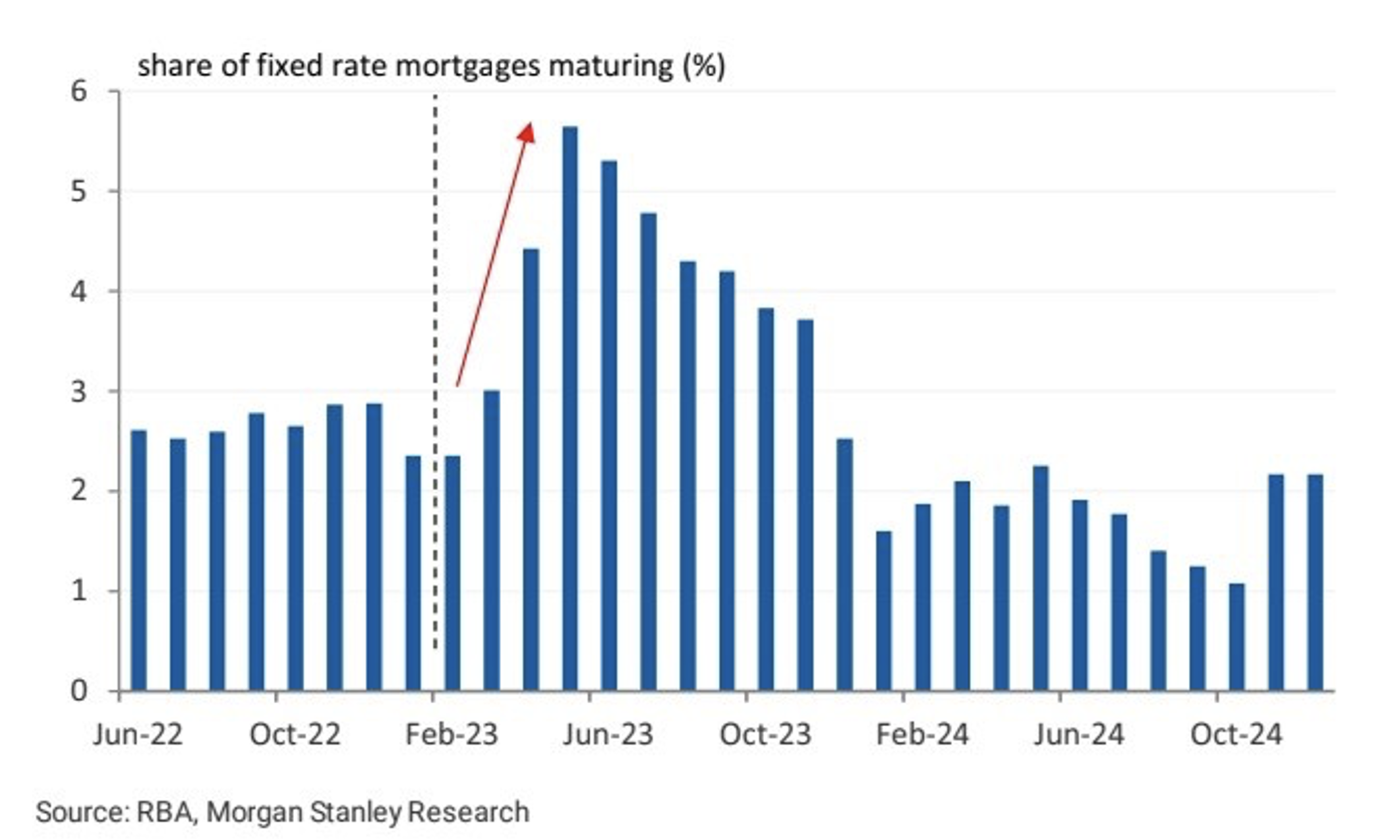

Meanwhile, according to Figure 1., a larger cohort of fixed mortgage borrowers are now rolling from ultra-low rates to much higher variable rate loans.

Importantly, Figure 1., reveals the percentage of all fixed-rate mortgages that are maturing. Approximately 18 per cent will be maturing by the end of December 2023. Importantly, it’s worth keeping in mind that the number of fixed-rate mortgages written during the 16 month period ultra-low fixed rates were being offered was about 100,500 loans. Even considering the sharp jump in the proportion that is rolling off variable rates, we are still talking about a tiny proportion of the roughly six million mortgages currently outstanding.

Former RBA Governor, Ian Macfarlane, recently noted in an interview with financial planner Vincent O’Neill, “…quite possibly APRA is going to have to relax the rule that says when you work out how much you can borrow, you’ve got to assume that interest rates could rise by 300 basis points.”

This would mean a relaxation of the rules that might prevent mortgagees from refinancing. Such flexibility is in keeping with the repayment holidays the big banks offered everyone during the pandemic, remembering it’s not in the banks’, the RBA’s, or the Australian Financial System’s interest to see home values plunge on the back of a wave of bank mortgagee-in-possession sales.

Figure 1. Mortgage stress? (Numbers of mortgagees rolling onto variable)

Nevertheless, many of these mortgagees are now described as mortgage ‘prisoners’ because they are currently unable to switch to alternative lenders. The combination of falling property values, and because at high interest rates they do not qualify even for their own mortgage, they cannot obtain refinancing. According to non-bank lender Lendi, 11.4 per cent of first-home buyers hold an LVR of 90 per cent or above.

According to Lendi data, a quarter of all first-home buyers currently enjoy a fixed-rate mortgage of three per cent or less. Fully 21 per cent are on a fixed rate of 2.5 per cent and below. The figures are more alarming for young Australians who took advantage of the government’s First Home Buyers scheme, with more than half of them with an LVR above 95 per cent still on a fixed rate below 3 per cent, leaving them exposed once their fixed term expires. According to Lendi CEO Dave Hyman, these first-home buyers will be some of the hardest hit over the next few months.

Elsewhere, unemployment has ticked up, with jobs down 4,300 versus economist expectations for an increase of 25,000. While the unemployment rate increased from 3.5 per cent to 3.7 per cent, the 400,000 immigrants arriving in the next twelve months will see the rate rise further. This will occur amid potentially persistent inflation (energy costs are expected to rise by 25 per cent next month), weakening consumer spending amid the rise in mortgages moving from low fixed rates to much higher variable rates, and the 25 per cent fall in building approvals which will crimp the incomes of tradies who are part of an industry that is the third largest employer in the country.

Australia’s underlying or core inflation is somewhere between five and six per cent, which is much higher than the RBA would like. It is also expected the Fair Work Commission’s wage increase of 8.6 per cent for minimum wage earners and 5.75 per cent for award wage earners, without productivity growth, will foster an entrenching of inflation. And because interest rate cuts will not happen unless there is a pronounced fall in inflation – which is unlikely – the market’s current expectations for rate cuts may be too optimistic. This will have a detrimental impact on retailers’ share prices.

And that is especially true for retailers who are only now starting to confess conditions are worsening.

Earlier this month Adairs announced that trading conditions have markedly deteriorated since the first half’s end.

After group sales at Adairs grew 34.1 per cent in the first half of the fiscal year, its group sales growth for the financial year to date is now just 1.9 per cent. This reflects a second-half sales decline (over the prior corresponding period) of 3.4 per cent for Adairs, a 10.9 per cent decline for Focus on Furniture, and a 24 per cent decline for Mocka.

At the end of May, jeweller Michael Hill explained economic headwinds in both Australia and New Zealand had triggered a double-digit sales decline for the jewellery category, although the company’s second half sales decline of 3.5 per cent means it is taking market share from competitors.

Meanwhile, food business, Maggie Beer, said rising interest rates and inflation were adversely impacting consumer spending while higher energy, freight and labour costs were pressuring the business and would result in 2023 earnings before interest, taxes, depreciation and amortisation halving from $11.3 million in 2022 to between $3.5 million and $4.5 million this year.

Candle and homewares retailer Dusk issued profit and sales warnings after a disappointing Mother’s Day sale, warning 2023 earnings could be as much as 40 per cent below 2022.

And finally, while Universal Stores predicted record sales and earnings, it warned a serious downturn in consumer activity since April, along with symptomatic aggressive promotional activity from competitors, would mean a revision of expectations by investors is reasonable. The company observed, “a deteriorating macro environment, and increasingly clear signs that the youth customer is seeing pressures on their discretionary spending levels”.

Investors are understandably cautious about the downturn in consumer behaviour and the possibility this will feed into a recession. Typically, investors zip up their wallets and don’t invest in any stocks when a recession is possible. The sharp rises in some sectors of the stock market however, including AI-related stocks, suggests investors should be more nuanced in their thinking, to avoid missing out on important opportunities. Notwithstanding the elevated multiples for AI-related stocks, we maintain the greatest concerns about business performance should be directed towards the retail sector.