ETFs inevitably boost the value of fewer outperformers

Across the investment world, ETFs are on the rise. And for good reason – as Tim recently noted, ETFs outperform many actively managed funds. But the growing popularity of ETFs is having another consequence – it is making outperforming managed funds even more valuable, and pushing underperforming funds out faster.

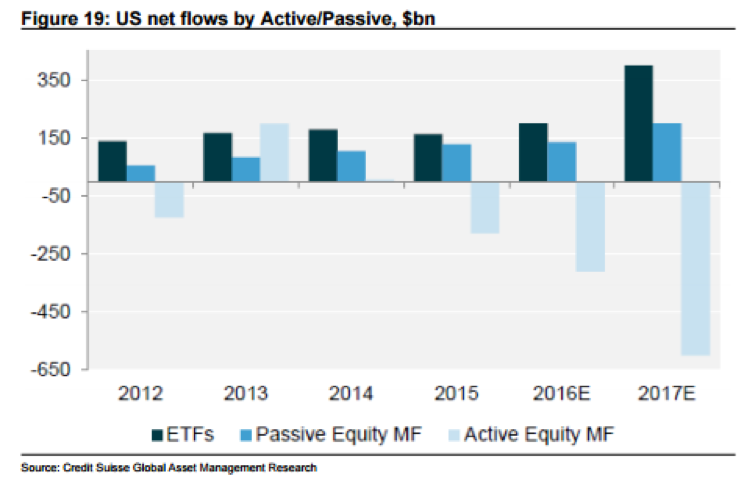

It’s very clear that passive money has gained a growing share of assets under management (AUM) over the past few years. This has been happening on a global scale and can be seen in both market share and the movement of flows. Take, for example, the continual inflows of ETFs in the US over the past 5 years, or the continual outflows of active money, as shown in the chart below.

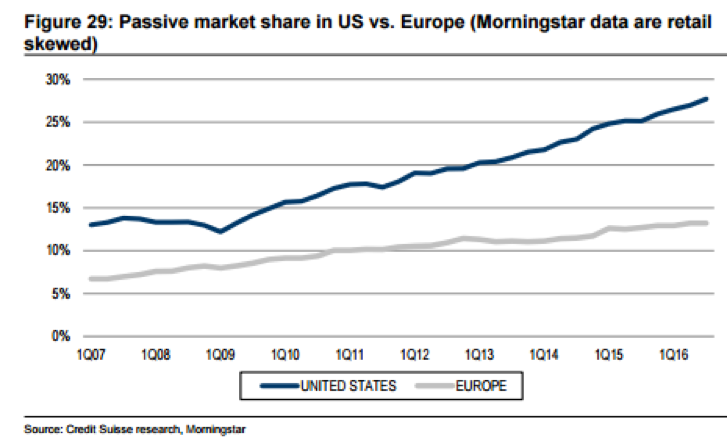

Or look more directly at the market share of passive money in the leading US market and also the European market in the next chart.

Let’s start with getting a better understanding of passive returns.

As Tim pointed out, it is difficult for active managers to compete with passive money. Let’s have a closer look at what’s going on at the return level. We can begin by making some rules to simplify our analysis.

The market is made up of x market players. Let y (<x) of them be active and the rest passive. This makes sense:

Active managers + Passive managers = Total managers

i.e. y + (x – y) = x

So we can continue…

- But as passive returns mimic the market we can also add:

- Active returns = passive returns = total market returns

But now we consider that it is cheaper to buy the index than to be active. To compensate for this, active managers charge higher fees than passive managers. So:

The sum of active returns – active fees < The sum of passive returns – passive fees

What is important to note here is that we are talking only about the aggregate. Within active managers some will outperform others. These active managers achieve superior returns to the market. So we can have:

- Outperforming active manager returns – active fee > passive manager returns – passive fee

- Underperforming/ average active manager returns – active fee < passive manager returns – passive fee

What this means is that investing in every active fund will be more expensive than investing in every passive fund. However, as some active funds will perform better than others, just as some stocks will outperform, investing in these funds will lead to superior returns.

So what does this mean when it comes to investing in fund managers?

Funds earn returns and grow value from a combination of:

- Market returns and outperformance on this – leading to more performance fees

- Flows – leading to more management fees

As you can imagine, 1 tends to lead to 2; i.e. flows go to funds that are outperforming. So, clearly, if a fund manager is outperforming, this is good for valuation. Investors would like to own more funds that have the ability to outperform the market in the long-term. But what does the growth of passive money mean for this?

For a start, it means that there is less total flow moving in at point 2. So point 1 becomes even more important. It also means active management is becoming more competitive for the flows that do exist, so net fees have come down.

In short, the growing share of passive management increases the importance of superior market returns in valuing a fund. Seth Klarman, the legendary founder of the Baupost Group, recently noted the growing dominance of ETFs is actually making markets less efficient, and this could end up causing investors harm, noting; “The inherent irony of the efficient market theory is that the more people believe in it and correspondingly shun active management, the more inefficient the market is likely to become.” In other words investor enthusiasm for passive ETF’s will peak, at the same time that stocks are generating returns unsustainably superior to what their fundamentals suggest. Bubbles will inflate unchecked, distortions will increase and the disruptive consequences will be greater. As Roger likes to say, ‘markets will always transfer wealth from the many to the few, from those with no patience to those with patience’.

The impact of growing ETFs makes outperforming active funds even more valuable, and underperforming funds get squeezed out of the market faster (because ETFs offer a cheaper, better performing alternative to an underperforming fund). Outperforming fund managers however will continue to provide a quality alternative and an increasingly valuable one.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Hi Lisa,

As a side note to above I found this great article on how to invest in active fund managers.

https://www.americanfunds.com/individual/insights/active-management/select-active-funds.html

The main points of the article were:

The active fund managers that perform the best over the long term had the following 2 characteristics:

(i) they were in the lowest expense ratio or cost quartile

(ii) they were in the highest manager ownership quartile

I therefore ask you & the team – how do the Montgomery funds compare in each of their

respective categories for the following 2 traits?

Regards,

Joe

The staff own almost 100% with Magellan Financial Group owning a few percent. Not sure that the Australian database would showest lowest quartile for fees in the highest quartile for performance.

Hi Lisa,

Great reading a logical treatise of why successful active funds managers are preferred over non-successful ones – its just that your assumptions have me baffled.

Let AR = 0.2, PR = 0.8, TR = 1 i.e. active return + passive return = total return.

If PR -> TR then AR ->0

=> AR PR=TR i.e. assumption 3 doesn’t make sense.

In reality see link below which shows <25% of AR beat MR = PR

http://www.lyxor.com/fileadmin/user_upload/pdf/Active_vs_passive_-_Septembre_2015.pdf

An important point in the article is:

(i) low costs of index funds – which you succinctly point out

(ii) fact that only ~ 20% of active funds beat the market

This 2nd point is vital for the average investor to appreciate – it means that 80% of financial

experts do worse than the index – shows how hard it is to succeed and why Buffett recommends

index funds to average investor & if you can find an active fund that manages to beat the

market consistently over the long term – they are worth their weight in gold.

I hope that the Montgomery funds reach that status in Australia.

Regards,

Joe

Our long only equity funds both globally and domestically have all beaten their benchmarks since inception. Keep in mind that can continue even though we will inevitably have weeks, months and years where we underperform.

Would Montgomery Fund be willing to put its “money where its mouth is” and guarantee at least the market index performance like an ETF?

I think this would be a great innovation in the investment landscape.. otherwise as investors we are taking a ‘punt’ that our chosen active manager will do a good job with our money, and if they don’t.. well they still get paid commisisons and go home happily, but as investors we lose our capital.

My suggestion is to offer the prospective investor a new type of deal/fund.. Montgomery should guarantee at least achieving index performance after costs (so no risk of market underperformance to the investor).. in return Montgomery should take a much large commission for outperforming the market. Eg if normal commissions are 1.5%, charge 3.0% instead (so long as at least market index performance is met).

This way, the active investor’s interests and hip pocket is truly aligned with their customer.

I would certainly go for an active fund manager that guarantees me at least ETF / index level returns. There is no loss to me, and even though I would be paying much higher fees, the active manager would have earned it and I still am better off than a ETF alone.

Given Montgomery’s record of beating the general ASX200 index, this is something I think you are in a position to try and establish a new market product… “Montgomery’s ETF Plus”! It could actually wipe out a lot of money flowing to ETFs, and redirect to your fund.

It is impossible for good fund managers to beat the index every month and every year as there are periods of time where the poor quality companies ( eg miners) sometimes outperform the best quality companies on the price charts due to market sentiments.