Enter Corporate Travel Management

In a recent post here, we explored the Online Travel Agent (OTA) space and came away with a view that barriers to entry in the industry were arguably low, which went a fair way to explaining why there are so many agencies already in existence. It appears that this piece was unknowingly well-timed.

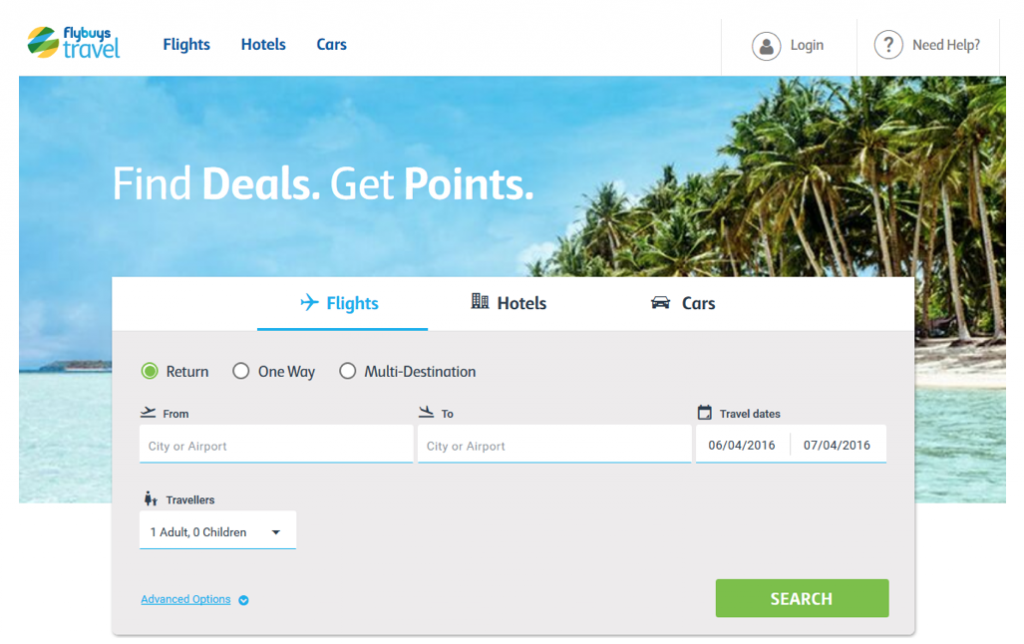

Announced this week, Corporate Travel Management (ASX: CTD) have somewhat confirmed our view by launching their own Flight / Hotel / Car travel booking website, called Flybuys Travel.

Up until now, CTD have largely been focused on being a corporate travel provider, and so, the launch of Flybuys Travel is their first foray into the Australian retail landscape post their recent acquisition of Montrose in the US.

In what looks to be simply an extension of their Corporate service, CTD will now deliver the same technology and buying power they have for their business customers, to their retail travellers.

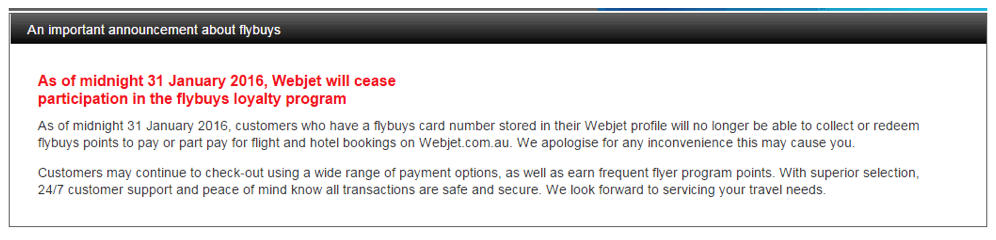

And because Flybuys Travel is a retail or B2C (Business to Consumer) service, it will compete with other listed companies such as Flight Centre and Webjet along with everything else in the space. And whilst increasing competition from a capable business is always a concern broadly, this is perhaps more of an immediate threat for the likes of WEB who recently made the following announcement;

Why is this a concern you ask? As we have also previously mentioned, even if a new competitor is able to get a website up and running, the question becomes how do you get traction? How long is that going to take and will it ever be successful?

The answer here is that CTD appear to have played the game well and arguably have an extremely large and active captive audience to market to from the get-go. This is true because CTD have partnered with Coles (owned by Wesfarmers) via their frequent flyer points program.

The above announcement relates directly to Coles’ frequent flyer points program, and to put the opportunity in perspective, the program currently has over 5.5m active cards which equates to about two thirds of all Australian households. It’s a program even larger than the Qantas frequent flyer program.

A simple view is that CTD may just be able to (based on management’s excellent track record) build brand awareness quickly and take some market share in what is already a highly competitive market. Also worth considering is that Wesfarmers, which owns Coles, is one of CTM’s major corporate travel clients and so this deal is clearly a sign that they are impressed with Corporate Travel Management’s system and its ability to be leveraged more broadly.

As we’ve pointed out before, a significant part of a Online Travel Agent’s revenues comes from rebates and incentive payments which can represent up to 25 per cent of revenue for a group (some have argued more). The benefit to CTD from such a deal is that they will no doubt expand their total transaction value (TTV) base. This will give them even more buying power which in turn no doubt sees them receive higher amounts of these revenues by placing yet more business with just a handful of suppliers, such as airlines.

At the end of the day, CTD operates like any other travel agency, it’s a volume game and they are attempting to leverage their buying power, attract purchases with no booking fees and deliver best-in-class content in an intuitive manner.

We’ve subsequently spent some time on the website and can attest to the fact that importantly, it’s very simple to use, is uncluttered and quick versus others! So it should get a good reception. We think it’s one to watch.

Russell Muldoon is the Portfolio Manager of The Montgomery [Private] Fund. To invest with Montgomery domestically and globally, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY