The Online Travel Agent space

One of the core tasks of an analytical role such as being an equity or business analyst, is really understanding what makes a business tick. Why does the business exist? Why do clients use their product or service? How do they monetise what they do? How sticky are their clients and how long will it last given the ever threat of competition and obsolescence? These are just some of the basic questions that always need to be asked when trying to understand a business and ultimately frame an investment decision.

You’ve no doubt seen a bombardment of offline / tv advertising recently, so we took a look at the Online Travel Agent (OTA) space. An industry that includes the likes of webjet.com.au, wotif.com, bookings.com (bookings.yeah!), expedia.com and trivago.com.au to name a few.

If we can readily answer the first question we posed, “Why does the business exist?” in a satisfactory manner, it helps us frame what ‘barriers to entry’ are present. In theories of competition in economics, these are obstacles that make it difficult to enter a given market. If an industry or business has high barriers to entry, like significant IP or network / scale advantages, then current businesses are likely to be more protected, have some form of pricing power and longevity. On the other, if there are few barriers to entry and the product is readily replicable, then the future for such businesses is arguably less attractive.

To give a laymen’s view on how the Online Travel Industry has been born and local businesses like Webjet and Wotif have come into existence, it was interesting to discover that as part of our research, many simply rely on the existence of Global Distribution Systems or GDS’ for short.

Basically, in the world of travel you have a few key elements: these include Airlines, hotels and car fleet owners. This makes sense as 1) You need to get to where you want to go and flying is often the most preferred / quickest form of travel 2) You need somewhere to stay when you get there and 3) You’ll need some transport to get around.

When you (the traveller) therefore go looking to make a holiday booking, in a time-starved world, you will want to go to a place that offers a good range of these services to choose from given globally, there are literally thousands of travel product and service manufacturers. So if they are not delivered from a centralised platform, you’re more likely to get confused and or frustrated with the amount of time consumed on what is supposed to be fun holiday! This is where a GDS comes in.

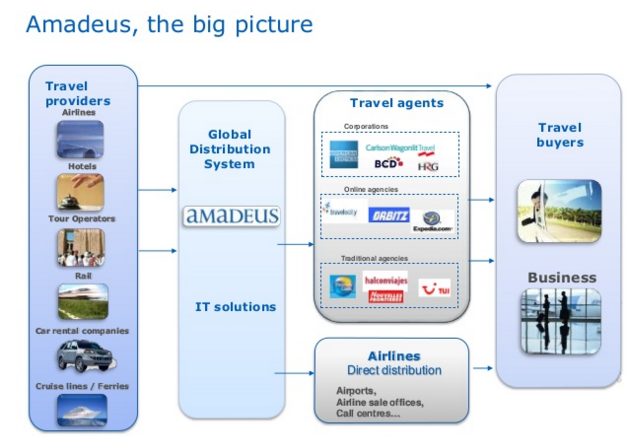

A good GDS such as Travelport and Amadeus will link all services, rates and bookings and act as the consolidator of information, content, products and services across the main travel industries. As shown below; By way of example, in addition to Qantas’ main website, Qantas will also provide travel content (flight schedules) to a number of GDS’. And because a GDS will consolidate this information globally, for many other operators also, Online Travel Agents can then pay to access this data / content and then all they then need to do is build their own front-end infrastructure (website – like webjet.com.au) to link into the GDS (backend). Once they have access to the ‘live’ content, and have a website or business up and running, they then effectively become a distributor of such products (Qantas flights).

By way of example, in addition to Qantas’ main website, Qantas will also provide travel content (flight schedules) to a number of GDS’. And because a GDS will consolidate this information globally, for many other operators also, Online Travel Agents can then pay to access this data / content and then all they then need to do is build their own front-end infrastructure (website – like webjet.com.au) to link into the GDS (backend). Once they have access to the ‘live’ content, and have a website or business up and running, they then effectively become a distributor of such products (Qantas flights).

From the product manufacturers perspective (like Qantas), a GDS is effectively an ‘external’ booking channel enabling automated transactions between them (the travel service provider) and travel agencies who can then resell their ‘inventory’.

And it’s because of this GDS aggregated data platform / database, derived directly from the product manufactures that websites such as webjet.com.au, wotif.com, bookings.com, trivago.com.au etc… are able to be born and simply act as third-party distributors / marketers for the businesses supplying the services or content into the GDS.

Depending on the success of their efforts in delivering a good customer experience and building a brand (ease of use / range of product / availability / pricing), determines if they will be successful or not as a re-seller. It really appears to be that simple.

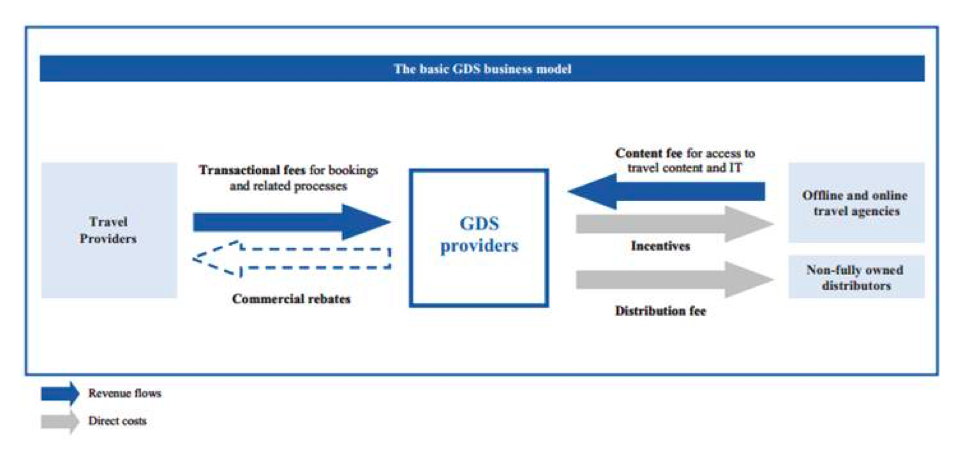

OTA’s simply pay these GDS’ a ‘content’ fee to access this data and the GDS then charge a fee-per-transaction basis from the relevant product manufacturer for travel bookings processed through their GDS platform. Once connected to a GDS and with their website ‘live’, travel agents such as OTA’s then make their money by ‘marking-up’ a product manufacturers base prices by a margin, which is ultimately dependent on the level of price competition by other industry participants. This mark-up is known within the industry as a TTV (Total Transaction Value) margin or a revenue margin and can range from 5 to 15 per cent.

Once connected to a GDS and with their website ‘live’, travel agents such as OTA’s then make their money by ‘marking-up’ a product manufacturers base prices by a margin, which is ultimately dependent on the level of price competition by other industry participants. This mark-up is known within the industry as a TTV (Total Transaction Value) margin or a revenue margin and can range from 5 to 15 per cent.

OTA’s and travel agents also have the potential to earn substantial ‘incentives and distribution fees’, also known as volume based rebates. In this regard, third party distributors are likely to ‘partner’ with just a handful of core travel suppliers / operators and push the majority of their customers (volumes) through a limited number of channels. And because volume rebates can represent upwards of 25 per cent of the revenue generated across the entire business, these incentives fees are the reason some websites often don’t offer all competing airlines on a specific route.

One attractive feature of this model is that OTA’s such as Webjet.com.au do not need to invest in hotels or own its own airlines, it simply pays a fee to access and search ‘content’ and then simply becomes a reseller of inventory such as hotel rooms and airplane tickets. On which it generates a margin.

Inventory is ultimately held by the product manufacturers and recorded as such on their own in-house desktop reservation systems. The GDS has a ‘real-time’ link into these systems / databases (their competitive advantage), and when a OTA / travel agency requests a reservation / search, the GDS system routes the request to the appropriate reservation system / product manufacturer(s) and then aggregates that data.

So, in answering the first question we posed, why does this business exist, as we can see from the above, it really only takes capital and a captive audience to market to in order to build and operate an OTA.

That to us demonstrates that barriers to entry in the OTA industry are small and easily surmountable in time. If one has a budget to pay the GDS platform to access content, another budget to build a website that consumers can access to search and book their travel requirements, and another budget to continuously market and continue building the businesses brand, then anyone can theoretically operate an OTA. Which is why, when you do a search for Online Travel Agents, there are many, many businesses in existence.

The core reason why you’d want to be an investor in ASX listed Webjet for example – is if you believed they will be more successful than others that also operate in this space. But if the industry is already dominated by just two players, Priceline and Expedia, whom are expanding quickly globally given they have marketing and IT budgets that dwarf smaller players, on this basis and thinking longer-term, one finds it difficult to build a case for investment in our local listed players.

Russell Muldoon is the Portfolio Manager of The Montgomery [Private] Fund. To invest with Montgomery domestically and globally, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

CHRISTEL AULD

:

My colleagues were looking for OH OUF-1 yesterday and were informed about an online service that has lots of sample forms . If people have been needing OH OUF-1 too , here’s https://goo.gl/wpsVFB.

Matt

:

Hi Russell,

Thanks for article, very insightful and some great learnings!

Two quick comments for your thoughts:

1. Are barriers to actually low? Although access to a GDS is technically open to anyone with a website and a budget to pay the fee is the real barrier to entry the size of the marketing budget required to get customers. It seems this budget is a real barrier based on the spend size of Expedia.

2. Is access to a GDS truly open to any player? what I mean by this is I assume the market users don’t negotiate restrictive use clauses so that their competitors can’t use the same GDS (eg webjet doesn’t or can’t negotiate that flight centre can’t use the same GDS).

Look forward to your thoughts

Matt

Russell Muldoon

:

Some really good thoughts here. Its my view that yes, barriers to entry are low. To give a feel for the level of competition that a business like Webjet potentially faces, both now and in the future, whilst they don’t all operate within similar markets, they could eventually. We have identified the following;

• Other online travel reservation services such as Expedia, Hotels.com, Hotwire, Travelocity, Elong, Wotif (acquired by Priceline), CarRentals.com and Venere, which are owned by Expedia; Orbitz.com, Cheaptickets, ebookers, HotelClub and RatesToGo, which are owned by Orbitz Worldwide (also acquired by Expedia); laterooms and asiarooms, which are owned by Tui Travel;

• Hotel Reservation and Car Services such as hotel.de, which are owned by Hotel Reservation Service; and AutoEurope, Car Trawler, Ctrip, MakeMyTrip, Rakuten, Jalan, Hotel Urbano, ViajaNet, Submarino Viagens, Despegar /Decolar, 17u.com, Bookit.com, CheapOair, Mr. and Mrs. Smith and eDreams ODIGEO. Webjet also sits in this category;

• Online accommodation search and/or reservation services, such as HomeAway and Airbnb, focused on vacation rental properties, including individually owned properties;

• Large online companies, including search, social networking and marketplace companies such as Google, Facebook, Alibaba, Amazon – those with large captive audiences with whom they can market products should they wish and steal market share;

• Traditional travel agencies, wholesalers and tour operators, many of which combine physical locations, telephone services and online services, such as FlightCentre, HelloWorld, Carlson Wagonlit, American Express, Thomas Cook and Tui Travel, as well as thousands of other ‘personal-touch’ travel agencies around the world;

• Actual travel service providers, such as accommodation / hotel owners, rental car companies and airlines, many of which have their own branded websites to which they drive business, including joint efforts by travel service providers such as Room Key, an online hotel reservation service owned by several major hotel companies. And;

• Online travel search services and price comparison services (generally referred to as “meta-search” or ‘google-like’ services), such as TripAdvisor, trivago (acquired by Expedia), Qunar, Skyscanner and HotelsCombined.

Given all one needs is effectively a budget to build IT/Infrastructure to link into a GDS system and then another budget to market and a build a brand highlighting their services, those groups who already have large captive audiences and are already very profitable, can launch new services at a relatively low cost and quickly – think Google, Apple, Alibaba, Amazon and Facebook. All of whom have access to significantly greater and more diversified resources. All of which may be able to leverage other aspects of their businesses.

Google for example has entered various aspects of the online travel market through its acquisition of ITA Software, Inc., a major flight information software company. According to Google when they acquired ITA: “Google’s acquisition of ITA Software will create a new, easier way for users to find better flight information online, which should encourage more users to make their flight purchases online.” Google also stated that the deal would not change existing market shares. Since that time however, its clearly interested in changing that dynamic as it has been developing QPX, their own retail service solution, which is apparently coming soon. Google’s Android operating system is now the leading smart phone operating system in the world. As a result, Google could leverage its Android operating system to give its travel services a competitive advantage, either technically or with prominence on its Google Play app store or within its mobile search results.

Apple, Inc., one of the most innovative and successful companies in the world and producer of, among other things, the iPhone and iPad, obtained a patent for “iTravel,” a mobile app that would allow a traveler to check in for a travel reservation. In addition, Apple’s iPhone operating system includes “Passbook,” a virtual wallet app that holds tickets, boarding passes, coupons and gift cards, and along with iTravel, may be indicative of Apple’s intent to enter the travel reservations business in some capacity. Apple has substantial market share in the smart phone category and controls integration of offerings, including travel services, into its mobile operating system.

Ive quite literally written 10 pages on competitive threats spanning from low barriers to entry and other businesses, like meta-search, that are well positioned and could pop-up at any time. In terms of your final question, the only real issue we see to accessing a GDS is cashflow to do so. Which is why Webjet have their B2B segment – it helps under-scale competitors in markets they dont compete (such as Europe – LOH and SunHotels), get access to a GDS. Dont get me started on the potential conflicts of reselling GDS’.

Also, my understanding is that both FLT and WEB largely use Travelport – its not exclusive.

leon payne

:

Excellent breakdown of the mechanics and thank you for sharing

Ghazi

:

Hi Russell,

Great article and being a novice value investor I have learnt quite a bit from this.

The one main thing I got from this article was that basically the OTA industry is pretty competitive and many firms are entering. Obviously firms such as Expedia being the dominant firms in the market, smaller entrants will have a tough time surviving/profiting in the long run. As you mentioned, a simple Google search can show you how many firm there are proving this service.

My question for you is would it be sensible for an investor to look away from these companies (even Expedia) and focus more on the companies providing the GDS service? As I read this article the following quote came to mind, “when everyone is looking for gold, it’s a good time to be in the pick and shovel business”.

It seems like these GDS service providers are simply companies providing the “picks and shovels”.

I look forward to your reply on whether a company like Amadeus would be a better investment as it just providing a service to the many firms now entering the OTA market but it is not directly affected by the OTA competitiveness, but benefits from the competivness.

Russell Muldoon

:

I agree with that. Id look first at the larger, more established and scaled GDS’ in Amadeus and Travelport as my first picks and then move onto the 3rd and 4th positioned businesses to see how they are fairing and or if they are have shown an ability to take market share over time.

Don McLennan

:

It seems not all OTA’s have all Airlines on their site

Over time customers will find out what OTA’s list all airlines

& use the ones which do.

The two largest OTA’s are the ones best able to have the biggest range

They then may be able to negotiate larger volume discounts than the smaller players

Sounds muck like where the supermarkets are now?

Russell Muldoon

:

Thats a very good pickup Don. Indeed Webjet paint a very different picture of market shares for local OTA’s in their own presentations given they ONLY include in their own market-share presentations, other OTA’s which also include flight booking services. Booking.com for example do not offer flights at present (they most likely will eventually), so they [Webjet] simply exclude it from their market-share analysis. This is despite the fact that it’s the clear no.1 Australian OTA and also despite a much lower importance of flight bookings done through OTA’s.

The reason for this last comment is that during a survey conducted by Statista, 68% of survey respondents indicated that when they shop on an OTA website, they will avoid the booking fees and book their flights direct with the airline. Given the transparency is lower and choices more varied when booking hotel rooms, more people however will book their room nights via the OTA. This is the bigger market which Priceline via booking.com and Expedia, are currently dominating. And once you have the eyeballs… adding additional product into your customer base becomes much easier.

Heres the link if you are interested: http://www.statista.com/statistics/455895/ota-us-shopper-booking-completion/

Joe

:

Thanks for the great article Russel! Further to the above article re; Flight Center, do you see this business (or traditional bricks and mortar operators) having a better competitive ‘moat’ than online operators, due to the fact that a physical presence is harder to replicate?

Will customer ‘stickyness’ look better due to tech-averse baby-boomers preferring personal contact with a human travel agent?

Russell Muldoon

:

There will no doubt always be a certain proportion of the market that likes to speak to a travel consultant and or deal with them face-to-face. But if we look at the experience in other markets, we can see that this has become a smaller part of the market as technology, ease of use, information / travel content and reviews and most of all convenience, have all improved to the benefit of online travel agencies.

Russell Muldoon

:

On other thing we noted when researching OTA’s:

(Feb 22, 2016) ACCC ‘crackdown’ on credit card surcharges.

http://www.abc.net.au/news/2016-02-22/credit-card-surcharge-legislation-touted-as-a-win-for-consumers/7189672

Australian companies were given permission to impose a surcharge to consumers for paying on credit cards in 2003. Initially companies tended to pass on the cost that credit card companies charge retailers, usually between 1-2% of the transaction value. However, as surcharges became more prevalent and larger retailers were able to negotiate lower costs with the credit card companies, surcharges became a profit centre with a margin being applied to costs.

The Turnbull Government has vowed to act on recommendations made by the Murray Financial Inquiry to reduce profiteering on credit card surcharges. Recommendation 17 of the inquiry was to ‘improve surcharging regulation by expanding its application and ensuring customers using lower-cost payment methods cannot be over-surcharged by allowing more prescriptive limits on surcharging’.

The government agreed with this recommendation and has committed to phasing in legislated ban on surcharges that exceed reasonable costs faced by merchants accepting credit cards. The ACCC will be responsible for enforcing the ban on excessive surcharging. In practice, this means that merchants will only be able to pass on the cost of processing credit cards to consumers – the implementation is scheduled for mid 2016.

The reason we flag this is because its estimated by some analysts that FLT (Flight Centre) generates ~$75m profit or 20% of group, from such fees. The prevailing view from the above is that these fees are ‘excessive’ / are ‘profiteering’ and bear no resemblance to the low-cost of processing credit card payments. And therefore, could be stripped.

Luke Joseph

:

A someone who books travel online frequently, Priceline’s and Expedia’s websites are both significantly easier to use and far less clunky than Webjet and Flight Centre.

To me it seems like it will eventually become a global duopoly.

Russell Muldoon

:

Seems you are not alone here. Although this is from January 2014, the table in this article gives a good indication of whose winning and who continues to lead;

https://skift.com/2014/02/24/the-top-online-travel-booking-sites-for-january-2014/

Luke Joseph

:

This is one of the reasons I’m invested in Priceline and Expedia. I think they have a network effect similar to REA Group which is hard to replicate. Do you see any stark differences between a network effect of an OTA and a company like REA Group?

Russell Muldoon

:

I think that’s right. Consider this as an example in building a brand and what that does in terms of driving eyeballs and the associated network effects:

In 2005 Expedia’s, capital spending was $130m per annum on reinvestment into its technology platforms and marketing. In 2010 that had grown to $362m and in 2015, $750m. Brand Expedia alone has increased its coding workforce since 2010 from 200 software engineers to 2000, all in the name of getting ahead of the competition, building a brand and a seamless user experience. In the same year, 2015, our leading listed OTA, spent less than $50m on IT development and marketing.

Keith Love

:

Great article thanks Russell.

Where does Flight Centre fit into this? I guess their physical stores are the difference but on the other hand they have to use GDS ?

Russell Muldoon

:

Thank you Keith. Pleasure publishing it for you. In terms of Flight Centre, I believe they are no different and would similarly use a GDS to access aggregated global travel content. I also believe that they, like Webjet, use Travelport. One of the larger and more established GDS operators.

Here is a recent link for you. Apparently FLT have been using them (Travelport) for more than 2 decades:

http://www.travelport.com/company/media-center/press-releases/2015-07-02/travelport-announces-new-agreement-flight-centre