Ensure your tray tables are stowed!

Qantas’ half-yearly ‘loss’ announcement today revealed a business in crisis. Fuel costs surged to a record level for any half-year period (there goes the hoped-for benefits of new, more efficient aircraft), intense competition, unfavourable currency movements and falling demand, have all been offered as reasons for the poor showing. In reality, however, the real reason for the poor result is that this is an airline.

For more than a decade I have warned investors against investing in airlines, for the long term, the short term, indeed for any term.

Some years ago, my article on the problems with airlines and their accounting was published in various university accounting texts as a case study.

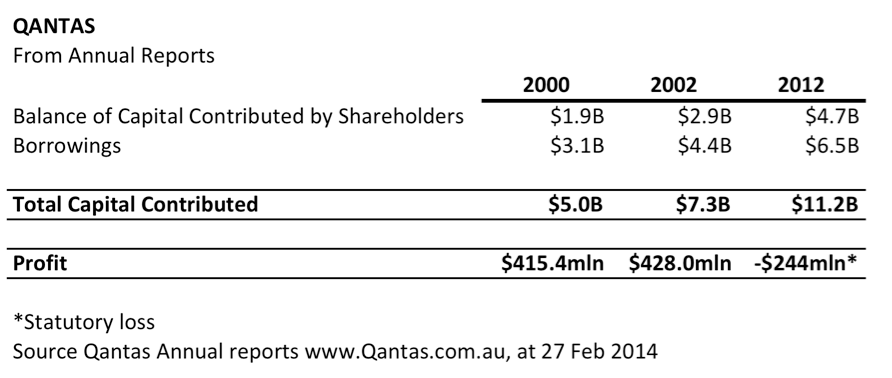

And as table 1 below shows, a great deal of additional capital has been contributed by shareholders and a roughly equal amount of additional debt loaned to the company, but these funds have failed to produce any meaningful financial benefit. Indeed the company is earning less despite having more to do it with!

Table 1

It beggars belief that there are still people who buy shares in airlines. Perhaps everyone gets excited about the $7.9 billion in revenue Qantas generated for the half-year and perhaps they hope there might be a way to keep some of that for shareholders. But revenue is vanity and profit is sanity. For millennia it seems airlines have, in aggregate, been destroying wealth.

It beggars belief that there are still people who buy shares in airlines. Perhaps everyone gets excited about the $7.9 billion in revenue Qantas generated for the half-year and perhaps they hope there might be a way to keep some of that for shareholders. But revenue is vanity and profit is sanity. For millennia it seems airlines have, in aggregate, been destroying wealth.

Speaking on the subject of socially transforming inventions that failed to reward investors, Warren Buffett was prompted, at Allen & Co.’s Sun Valley, Idaho, 1999 bash for business leaders, to observe:

“Here’s a list of 129 airlines that in the past 20 years filed for bankruptcy. Continental was smart enough to make that list twice. As of 1992, in fact – though the picture would have improved since then –the money that had been made since the dawn of aviation by all of this country’s airline companies was zero. Absolutely zero.

Sizing all this up, I like to think that if I’d been at Kitty Hawk in 1903 when Orville Wright took off, I would have been farsighted enough, and public-spirited enough –I owed this to future capitalists – to shoot him down. I mean, Karl Marx couldn’t have done as much damage to capitalists as Orville did.”

One wonders why the Qantas Group has waited until 2013 to “transform” the business. The company noted today the transformation strategy will involve renewing the fleet and simplifying it, right-sizing both the fleet and network, working the existing assets harder (we like that one best) and deferring the delivery of the eight remaining A380s. While these seem sensible, one needs to ask why they haven’t done this before? Did they just have a light bulb moment this year? Perhaps it’s because you have to order the A380s before you can defer them! Perhaps it’s political. Perhaps it’s strategic. We can only guess.

Somewhat remarkably, in our view, Qantas domestic made an EBIT (Earnings before interest and tax) profit of $57 million for the half year. We think this is remarkable because both Jetstar and Virgin domestic have both reported losses at the EBIT level in their most recent reports. Even the company’s own report stated that “Australian domestic market capacity has continued to grow ahead of demand, driven by competitor capacity growth ahead of the Qantas Group since July 2011” and “demand has been impacted by the resource sector slowdown, cautious business environment and low consumer confidence.” Given this admission, we believe it’s more than a little curious that only Qantas domestic was able to extract a profit, don’t you agree?

The company also noted “the impact of inflation; the more than $500 million increase in fuel price and foreign exchange movement and the reduction in Group yields of 11 per cent…”

Today, on air, one expert claimed Qantas’ problems coincided with Virgin becoming a low-cost carrier with a premium product. The expert claimed that Qantas should become more like Virgin.

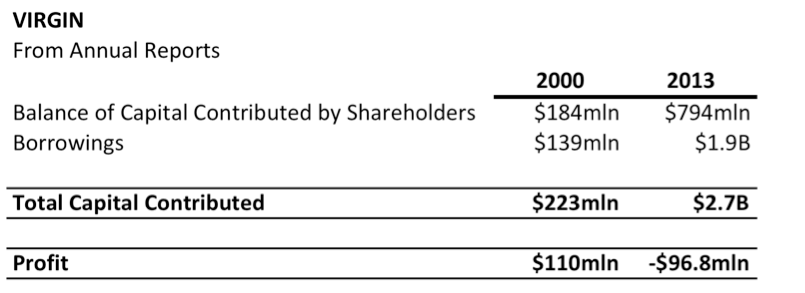

Someone forgot to tell the airline expert, that Virgin hasn’t made any money either over the last decade as table 2. demonstrates.

Table 2

And I am not sure Qantas should be more like Virgin, when VAH’s share price has fallen from $2.35 in 2004, to less than 40 cents today – reflecting the poor economics highlighted in our table above.

And I am not sure Qantas should be more like Virgin, when VAH’s share price has fallen from $2.35 in 2004, to less than 40 cents today – reflecting the poor economics highlighted in our table above.

We cannot see the economics of running an airline becoming any more favourable in the next decade, and so all of the items that impact profits – such as irrational competition (and those that are supported by sovereigns and free fuel), higher fuel prices, and both capital and labour intensity – will still be there in ten years’ time.

With that in mind, it might be worth passing on Buffett’s advice to the execs running the airlines: “When a management with a reputation for brilliance tackles a business with a reputation for bad economics, it is the reputation of the business that remains intact.”

Don’t disagree with your basic theses, but it also depends on the quality of the airline service to customers and the quality of its management.

“Air NZ has this morning unveiled a record interim financial result for the first half of the 2014 financial year.

The airline says its net profit after tax was $140m – a 40 per cent jump on the same period the year before.”

Regarding Air NZ’s profits, try or check remove depreciation which is based on historical cost of aircraft and replace with a provision for replacing the old planes with new ones. Would there still be a profit reported?

Hi Roger, if you ever recommend an airline, I know where you keep those special pills…

Very Funny mate. Thanks Phil.

Hi Roger, Just quick question as to why Canadian airline WestJet was promoted by Skaffold in Feb Money edition when fundamentals in Airlines is flawed.

SOme airlines do make money but in aggregate they do not. Regional airlines with monopoly routes can sometimes go many years making good profits…until they need to replace their fleet usually.

Hi Roger,

I have said the exact same thing elsewhere. All that has been written about Qantas and its problems can be summed up by “its an airline”. Whilst in no way meaining to tivialise the loss of jobs and the effect it will have on those people, it is unfortunatley true.

I see the benefit to QAN in regards to some form of government assistance or guarantee to reduce their credit rating and there for source cheaper debt.

However, i question the effectiveness of a loosening on the Qantas Sales Act. Whilst it would work in theory as it would allow a greater source of equity capital to be invested in Qantas, it would first need to be an attractive enough investment for that money to be put in place. I don’t think there is much arguement at present that currently it is not an attractive investment.

All of what i said however is ignoring that less restirciton on ownership may allow Etihad to to increase significant funds via a placement. This would of course add additional funding, but i do question how far the government will seriously allow a foreign airline to creep up the register towards outright control.

I anticipate the eventual sell off of the frequent flyer program (i think it has already been mentioned). Although the most profitable arm of the company it is the easiest one to divest of.

Sad but probably correct.