Watch this space: Emerging Markets, External Debt and Currency Decline

In recent weeks, there has been a lot of commentary on the decline of certain emerging market currencies. Not unlike the Swiss bank loans that were heavily promoted to Australian farmers in the mid-1980s, a declining currency can have a devastating effect on the value of the outstanding external principal borrowed.

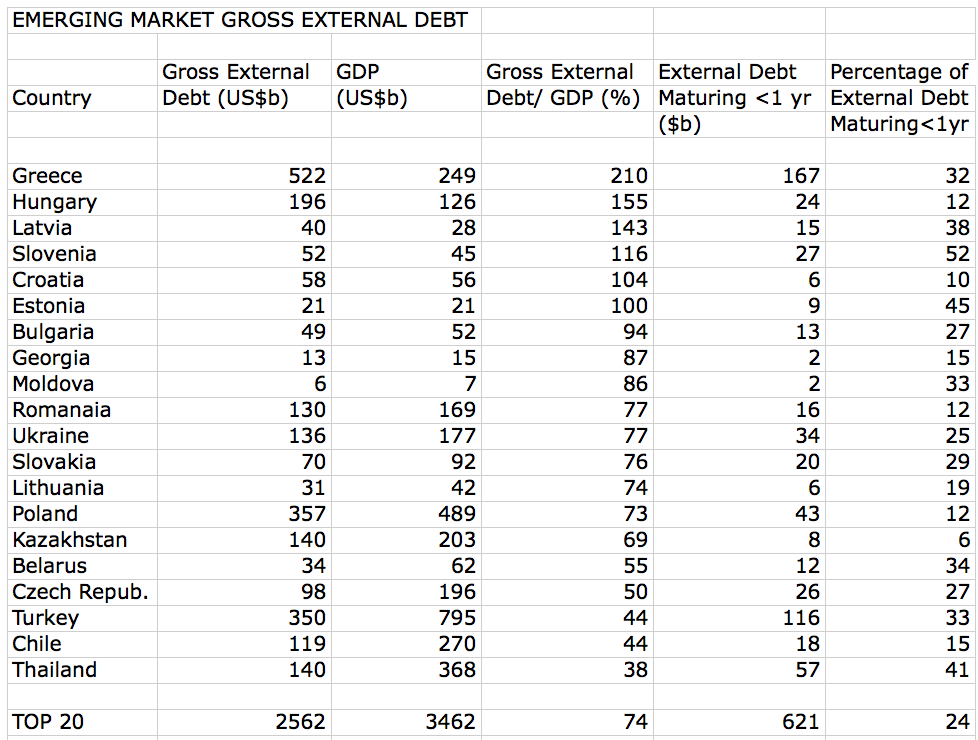

The table below shows twenty emerging economies, from Greece to Thailand, with a combined external debt to GDP ratio of 74 per cent, where approximately one quarter of that external debt matures within twelve months. And this data was collated prior to the severe decline in many of these countries’ currencies.

The problem is that several of these countries have recorded a dramatic fall in the value of their currency. Take Turkey, for example, which had US$350 billion of external debt, or 44 per cent of its GDP of US$795 billion. The relatively fast decline in the Turkish lira against the US dollar – to a record low – will have two main implications.

Firstly, we estimate the value of the external debt to GDP ratio has likely jumped by over ten percentage points to 55 per cent over recent quarters. Secondly, the external lenders will be less likely to rollover the short-term component of the loan unless they are rewarded with much higher interest rates.

Meanwhile, Turkey’s US$60 billion current account deficit, which is approaching 8 per cent of GDP, and is largely financed by short-term funds, will also negatively affect investor confidence. Meaning that investors may want to keep an eye on the emerging market space!

I doubt they can switch to Euro even if they wanted to, because they are not member, yet. Plus many political issues the current government is facing internally as well as externally, particularly with their neighbours in the middle east.

David,

No mention of South Africa ? Have you studied their numbers ? Things are starting to look rather wobbly at R9.70 + to the AUD, R18.00 + to the GBP and R11:00 + to the USD.

Dave

Hi Dave,

The Joint External Debt Hub (www.jedh.org) reveals South Africa had gross external debt (US$136b) at 35 per cent of GDP (US$390b) at March 2013.

With the South African rand declining by 24 per cent against the US dollar in the past year (from under 9 to 11.2), I would suggest this figure is now over 40 per cent of GDP.

Together with the current account deficit (nearly 7 per cent of GDP), it appears about one quarter of their gross external debt is due for repayment within 12 months.

According to Reinhart and Rogoff, if a country’s external debt exceeds 30 per cent of GDP, there is a material risk of a credit event – and there are at least 25 countries in that category!

David

If there is any danger of the Turkish defaulting, do you think that they would consider switching currency to the Euro to minimise debt repayments?

Hi Adam,

Thanks for your comment. I’m sure many peripheral eastern European economies would be delighted to join the euro, if it could reduce the likely upcoming pain on their external debt.

David