Electric Cars, Autonomous Vehicles and the Oil Price

The recent announcement by Volvo that starting 2019, it will only make fully electric or hybrid cars has seen the team at Montgomery doing a lot of thinking about electric cars, autonomous vehicles and the potential threats to the combustion engine powered car and what this may mean for associated industries in the areas of manufacturing, wholesale, retail, distribution and service.

Combined with the US shale oil boom on the supply side of the equation, we wonder if the demand for oil will experience some headwinds. And while the Gulf States of Bahrain, Kuwait, Qatar, Oman, Saudi Arabia and the United Arab Emirates (UAE) have become incredibly wealthy over recent decades, they are highly dependent on the price of oil for their economic health.

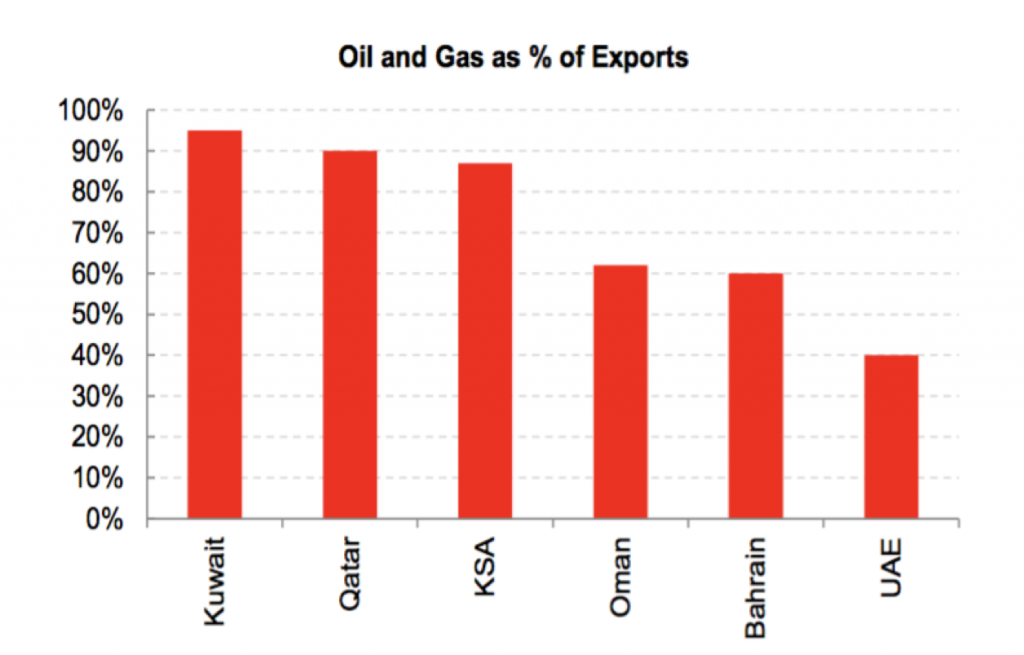

The chart below illustrates this dependency in terms of the degree oil and gas contributes to their exports. Only the UAE has made any serious inroads in reducing its dependency on oil, diversifying into finance and tourism.

All the Gulf States subsidise their populations’ fuel use to a large extent, and when the oil price is weak for long periods, there is a lot of pressure on finances with the combined Current Account Deficit and Budget Deficit for Bahrain and Oman both exceeding 20 per cent of their GDP (Venezuela is currently at 20 per cent).

Given most Gulf States peg their currencies to the US Dollar, oil price weakness leads to pressure on and potential depletion of their foreign currency reserves. And the longer this goes on, the more likely the authorities are to decide to stop propping up their currency, with the Bahraini dinar or Omani riyal most vulnerable. Generally, when a country drops its currency peg, there is short-term upheaval, but ultimately it allows the underlying economy to adjust more quickly.