Earnings expectations

If you are a close observer of the share market and the subsequent release of material information such as half-year and full-year reports, you may be perplexed to see a stock price fall after the company increased or even delivered record earnings, or conversely, similarly confused as to why a stocks price would jump after the company announces earnings that decreased producing an ugly set of results?

It’s a well-known fact that the stock market is forward looking and while long-term earnings growth is the core driver of solid long-term investment performance, the market likewise has an obsession with shorter-term performance. What we over the years have referred to as ‘noise’, is a feature particularly noticeable around events such as the most recent reporting season.

It’s at these times that the market becomes much more short-term, focusing intensely on how recent results stack up against expectations for the quarter, half or even full-year. And as a result, changes in earnings expectations based on actual results delivered, no matter how slight, can have a significant impact on a stock’s price—the effects of which can be felt for as long as a year.

These adjustments typically take the form of earnings estimates which are often derived from a number of industry / institutional analysts all attempting to put forward their opinion of such factors as sales growth, product demand, competitive industry environment, profit margins, and cost controls (to name a few stock specific drivers).

And because most stock valuation models use earnings (or a derivative thereof), slight changes in future earnings per share or earnings growth can translate into a significant and lasting impact on stock prices as valuations for large parts of the market change.

There are three main types of adjustments that can be typically made;

- Where a result is delivered in-line with the market’s expectations and actual earnings reported are basically the same as what everyone expected. There’s little change.

- Where there is a positive earnings skew and actual reported earnings are above the mean forecasted earnings per share by the market. There’s likely to be an increase in estimates on the back of this.

- Where there is a negative earnings skew and actual reported earnings are below the mean forecasted earnings per share by the market. There’s likely to be a decrease in estimates on the back of this.

The impact of the last two can be immediate and most noticeable changes are often quickly reflected in an individual stock price. Indeed, there are numerous studies that have been conducted since the 1960’s that clearly show that the stock prices of firms with positive earnings surprises show above-average performance, while those with negative surprises have below-average performance.

So naturally, if one was focused more shorter-term, a simple strategy would be to hunt for those listed businesses delivering or expected to deliver positive earnings surprises and avoid those where expectations are either too high or just not conservative enough.

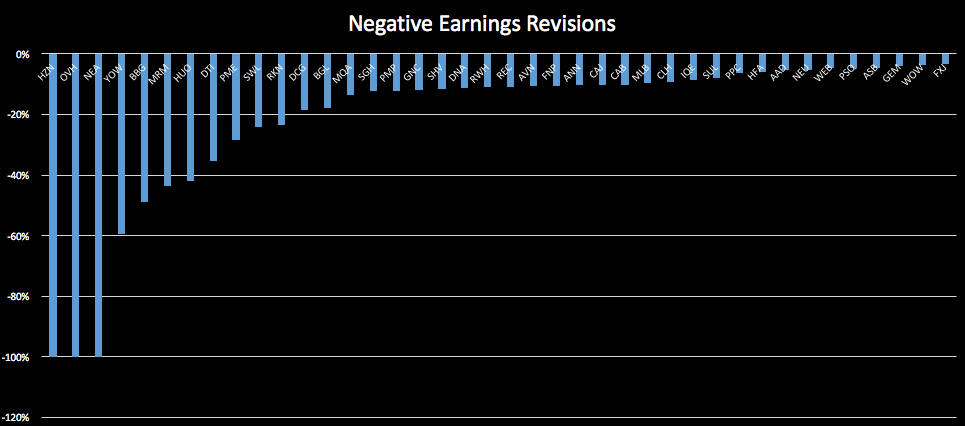

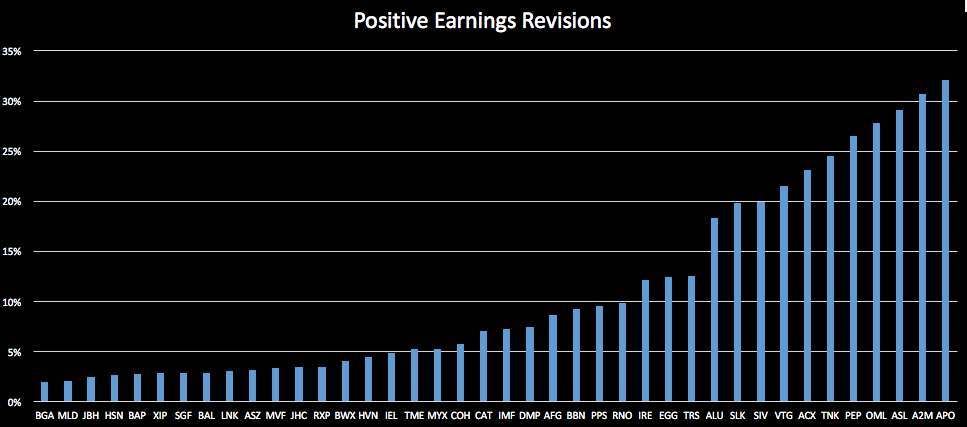

In that light, we have prepared two simple charts. One which shows the top40 companies in aggregate who have experienced the highest positive earnings revisions since they reported and another, showing the top40 companies who have significant negative revisions.

It should throw-out some useful names that warrant further research. Click on the charts for a closer look.

Russell Muldoon is the Portfolio Manager of The Montgomery [Private] Fund. To invest with Montgomery domestically and globally, find out more.

Russell Muldoon is the Portfolio Manager of The Montgomery [Private] Fund. To invest with Montgomery domestically and globally, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Hello Russell: SRX Sirtex seems to be one company reporting “”steady as she goes” good performance, yet is further sold off by market. Perhaps the market is getting a bit nervous with no new trial announcements for a while? This was once a company highly regarded by Montgomery team; is it still the case?

Hi David, we still own SRX however it is a much smaller weight in the portfolio these days. About 1.2% versus ~5-8% at various points in the past. That mostly comes down to our valuation of SRX vs. the market price which is based on our views about the businesses prospects which do change as and when new information comes to light.