Drums of the island

On Lord Howe island, in January this year, I sat reading The Australian. The paper was two days old – a function of relying on the airlines to deliver the papers and the fact that ‘island life’ means islanders aren’t that interested in the content. What didn’t age however was the human tendency to overreact.

Throughout history, financial markets have measured and plotted the impact of this human trait and there it was again in the worn pages of a two-day old copy of The Oz. What I am talking about of course is the price of oil.

Sitting at US$46, oil struck me and my buddy as being the next very profitable venture, outside of equities, for a long-term investor. As I stared at the price, (I was interested because I had previously bought oil personally at $80/barrel and sold it at over $140/barrel) I recalled a round table discussion in California 2013, called the 21st Committee of 100 Annual Conference, at which Berkshire Hathaway’s curmudgeonly 2IC, Charlie Munger, had said;

“Oil is absolutely certain to become incredibly short in supply and very high priced. The imported oil is not your enemy, it’s your friend. Every barrel that you use up that comes from somebody else is a barrel of your precious oil which you’re going to need to feed your people and maintain your civilization. And what responsible people do with a Confucian ethos is suffer now to benefit themselves and their families and their countrymen later. The way to do that is to go very slow in producing domestic oil and not mind at all if we pay prices that look ruinous for foreign oil.

It’s going to get way worse later …

The oil in the ground that you’re not producing is a national treasure … It’s not at all clear that there’s any substitute [for hydrocarbons]. When the hydrocarbons are gone, I don’t think the chemists are going to be able to just mix up a vat and create more hydrocarbons. It’s conceivable that they could, I suppose, but it’s not the way to bet. We should spend no attention to these silly economists and these silly politicians that tell us to become energy independent.”

Those comments were made when oil was trading at $110/barrel and here it was at $46/barrel. See Figure 1.

Figure 1. Oil Price

Let’s fast forward to today and oil should still feature in your thinking about preserving and growing your wealth. This time however it is for a different reason.

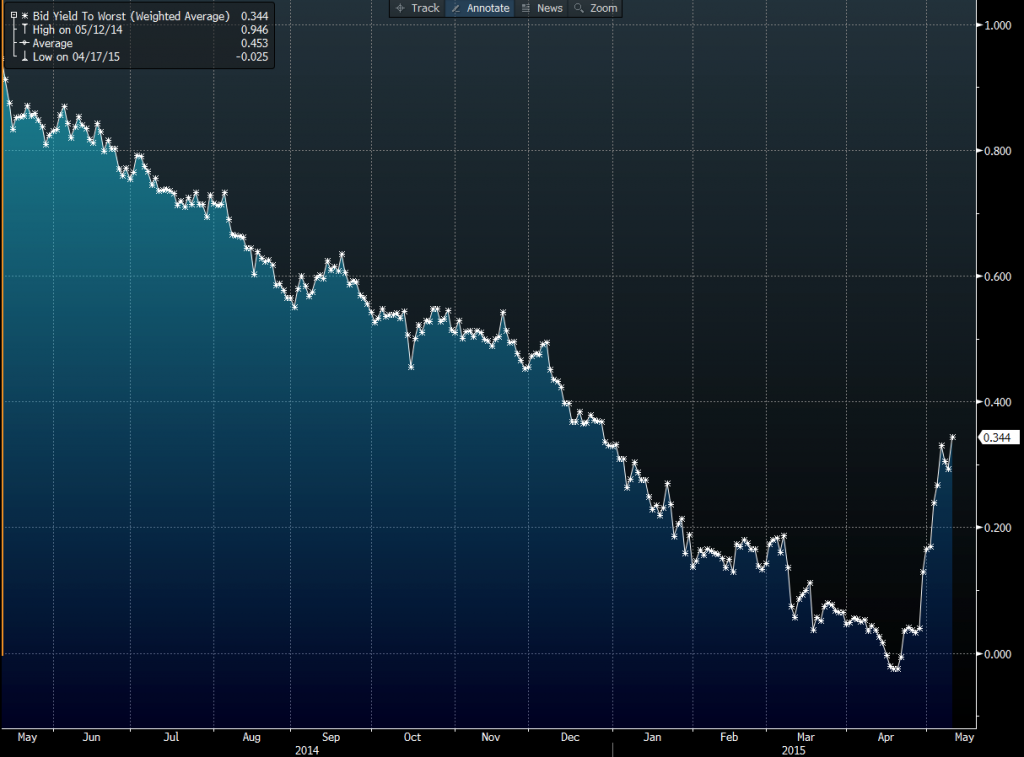

You see, oil – now at $66/barrel up nearly 50 per cent from its lows – isn’t the only thing going up. Inflation in Europe is picking up as are economists expectations for Euro-region economic growth (admittedly from 1.10 per cent per annum in January to 1.40 per cent per annum today). As a result of this – and an unwinding of the ridiculously compressed yields between the US and other global bonds, as US Treasury yields rise – German bond rates have quickly reversed. See Figure 2.

This dramatic change is going largely unnoticed in Australia where the lower-rates continue to dominate investing commentary. Investors need to consider what the rising oil price could be reflecting, that global nascent growth may be accelerating. That could mean a normalisation of rates in the US, and an increase in the importance of being invested with a fund manager who can hold plenty of cash, to take advantage as bargains emerge.

This dramatic change is going largely unnoticed in Australia where the lower-rates continue to dominate investing commentary. Investors need to consider what the rising oil price could be reflecting, that global nascent growth may be accelerating. That could mean a normalisation of rates in the US, and an increase in the importance of being invested with a fund manager who can hold plenty of cash, to take advantage as bargains emerge.

With thanks to our friends at Baillieu Holst and Elvis Presley.

Roger Montgomery is the founder and Chief Investment Officer of Montgomery Investment Management. To invest with Montgomery, find out more.

Michael Shapiro

:

I disagree with Charlie Munger on long term oil prospects. The supply picture of oil has changed since shale oil revolution especially in US. On demand side, lighter vehicles are going to be overwhelmingly electrical, within 10 years 80% of cars would be electrical. I believe oil is the commodity of the past not the future, the demand for it will disappear within the next 50 years all together. I would be investing in batteries technologies instead right now.

Roger Montgomery

:

Interestingly Berkshire has been investing in electric cars, environmentally-‘friendly’ recyclable cars and lithium battery plants since 2008.

Guy Davis

:

Hi Roger, if the yield on the 10 year bund has risen from .073% to .73% does this mean that investors have lost 90% of their capital, like it would on a share that maintained it’s DPS and saw it’s yield rise 10x?

Say for example investors were paying $100 for a $.073 return and that return is unchanged and now yielding .73%, this would imply the bond is now changing hands at $10 would it not?

I am a bond novice and I was having this debate the other day with my dad. The maths seems right to me, but it seems like more people would be talking about a 90% loss on a sovereign bond.

David Michie

:

“Sitting at US$46, oil struck me and my buddy as being the next very profitable venture, outside of equities, for a long-term investor”

So did The Montgomery Fund make any oil-related investments in January?

“Global nascent growth might be accelerating. That could mean a normalisation of rates in the US”

And yet the AUD seems determined to rally, despite the best efforts of the RBA. Does this mean dollar exposed industrials are being undervalued by the market?

Roger Montgomery

:

Hi David,

Oil is cyclical and one needs to be able to forecast its price to determine a sustainable ROE for a company, to then be able to value it. The bigger issue is that buying oil stocks is not the same as buying oil the commodity. You can get the direction of oil right but a particular company can suffer from execution risk, agency risk, terrorist related disruption etc. The UAD will rally if sentiments shifts towards a growing global economy. Eventually fears of inflation however will emerge.

David Michie

:

So why restrict TMF to equities and cash? If you see an opportunity in commodities, or bonds, or some other asset class, why prevent TMF from taking that opportunity, or creating a fund that can?

“The UAD will rally…”. Did you mean USD?

Roger Montgomery

:

Should be USD. In funds management we have to stick to our equity mandate. A go anywhere hedge fund is not on the horizon for us.

David Michie

:

Fair enough.