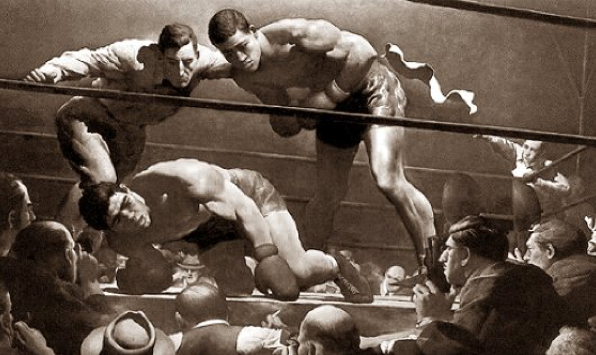

Don’t throw the towel in yet

Jeremy Grantham is the co-founder and chief investment strategist of Grantham, Mayo, & van Otterloo (GMO), a Boston-based asset management firm with more than US $118 billion under management. His letters are always worth reading. “I set myself a task this quarter to give my views on why suddenly so many strange things are going on in the US and in the UK and what they might mean.”

In his July letter he makes the following observations:

- Brexit “seems to have been undertaken almost casually, without the normal planning for consequences. It has been likened to a dog that to its amazement catches the car – now what? The consequences for the remarkable experiment of the European Union are unknowable but potentially profound.”

- “Our financial establishments are driving interest rates toward zero and beyond. How will this end? I think of these political, social, and financial experiments as Black Hole Experiments in which the further we push them, the more the laws of physics, finance, or politics begin to change in unknowable ways. We live in interesting times.”

- “Pushing stock prices higher are the twin forces of the Fed’s policy and corporate buybacks. Trying to push prices down is an impressive array of everything else: disappointing productivity, growth, and profit margins together with all our domestic and international political uncertainties. And now Brexit! It is a testimonial to the strength of those two bullish forces that they can steady the US market near its high, regardless, apparently, of what is thrown at it. I therefore remain, on the basis of those two remarkable pillars of support, for at least one more quarter where I have been for the last two years; despite brutal and widespread asset overpricing, there are still no signs of an equity bubble about to break, indeed cash reserves and other signs of bearishness are weirdly high. In my opinion, the economy still has some spare capacity to grow moderately for a while.”

Grantham’s reference to the cash piles remaining “weirdly” high is interesting in light of the fact that, at least in Denmark, negative rates are driving consumption down and savings up.

“All the great market declines of modern times – 1972, 2000, and 2007 – that went down at least 50 per cent were preceded by great optimism as well as high prices. We can have an ordinary bear market of 10 per cent or 20 per cent but a serious decline still seems unlikely in my opinion. Now if we could just have a breakout rally to over 2300 on the S&P 500 and a bit of towel throwing by the bears, things could change. (2300 is our statistical definition of a bubble threshold.) But for now I believe the best bet is still that the US market will hang in or better, at least through the election.”

You can read the entire letter here: GMO Commentary: Immigration and Brexit

Roger Montgomery is the founder and Chief Investment Officer of Montgomery Investment Management. To invest with Montgomery, find out more.