Disinflation’s bumpy road

Last year, the stars were aligned for gains in equities. In 2023, we alerted investors to three key ingredients pointing in the right direction for 2024. Disinflation, positive economic growth and a massive injection of liquidity all helped investors feel confident about piling into the AI thematic, which drove equity indices to new all-time records.

More recently, investors have been banking on a continuation of one of those fundamental tailwinds for equities – disinflation – paving the way for the Federal Reserve (Fed) to ease monetary policy and fuel a prolonged bull market.

However, with the latest inflation data showing inflation has not only persisted but reaccelerated, one of the key pillars supporting a sustained bull run is now in question, and the unwelcome surge will challenge the belief that inflation is under control.

Central bankers in the U.S. have long described the path to price stability as “bumpy,” as have I, but the last six months look more like an uphill climb. After appearing to stabilise in mid-2024, inflation has roared back, with consumer prices rising at a new annualised pace of 4.5 per cent over the last quarter.

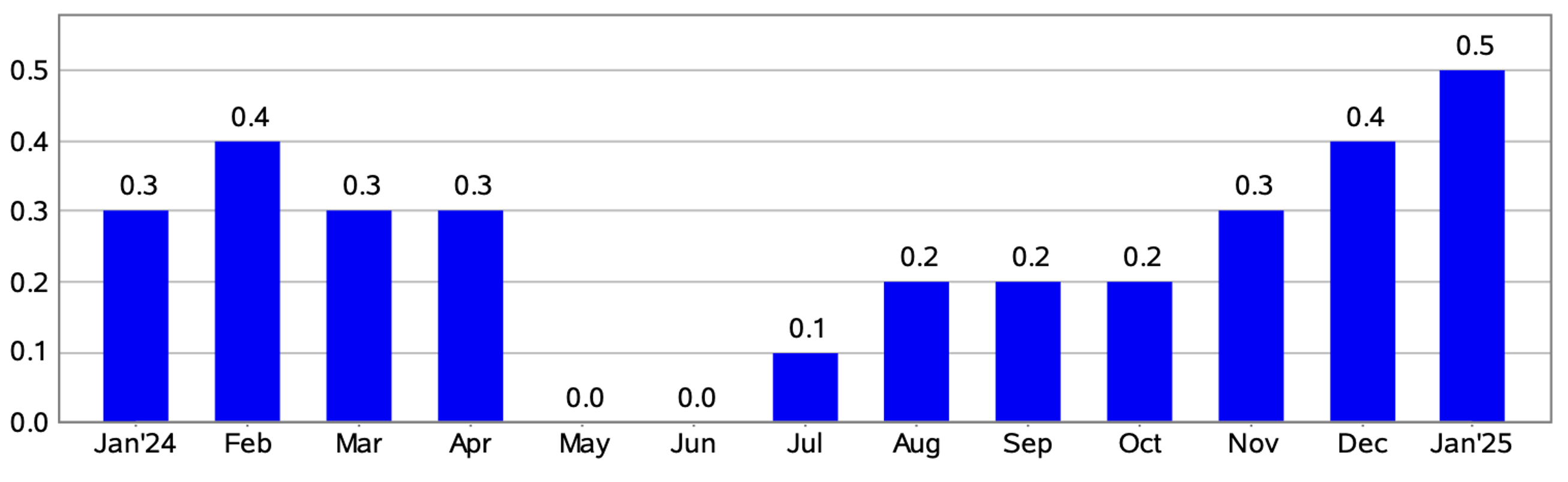

Figure 1. One-month percent change in consumer price index (CPI) for all urban consumers (CPI-U)

Source: U.S. Bureau of Labor Statistics

Source: U.S. Bureau of Labor Statistics

Not only is the inflation rate above the Fed’s target, but it’s also at its highest pace since late 2022.

Groceries saw their biggest price spike in nearly three years, used car prices jumped 2.2 per cent, and prescription drug costs surged 2.5 per cent. Even core CPI, which strips out volatile food and energy prices, climbed at an annualised rate of 3.8 per cent, further eroding confidence in a smooth disinflationary path.

The report highlighted again what has become a recurring January CPI overshoot, which some economists attributed to seasonal adjustment factors failing to fully account for year-end price hikes. However, they noted that residual seasonality alone didn’t explain the broader price increases, cautioning against President Trump’s tariff push, which is widely criticised as inflationary.

Coming into 2025, markets were betting on multiple Fed rate cuts, a necessary fuel for an extended bull market, particularly in tech and growth sectors. But the latest inflation data, combined with a strong labour market and rising wages, is forcing a reassessment. The bond market has responded swiftly: Treasury yields spiked, and futures now assign nearly a 30 per cent probability that the Fed won’t cut rates at all this year – up from just 10 per cent a week ago.

Before anyone panics and bails out of stocks altogether, it’s worth recalling 2024 also began with hot inflation readings that derailed expectations for aggressive Fed easing. In a case of déjà vu, history may be repeating itself. However, if inflation continues to run above the target, the U.S. central bank could be forced to hold rates steady and potentially keep them elevated for longer than markets had priced in.

Note the U.S. bond market has already responded: Treasury yields have spiked, and futures now assign nearly a 30 per cent probability the Fed won’t cut rates at all this year – up from just 10 per cent a week ago.

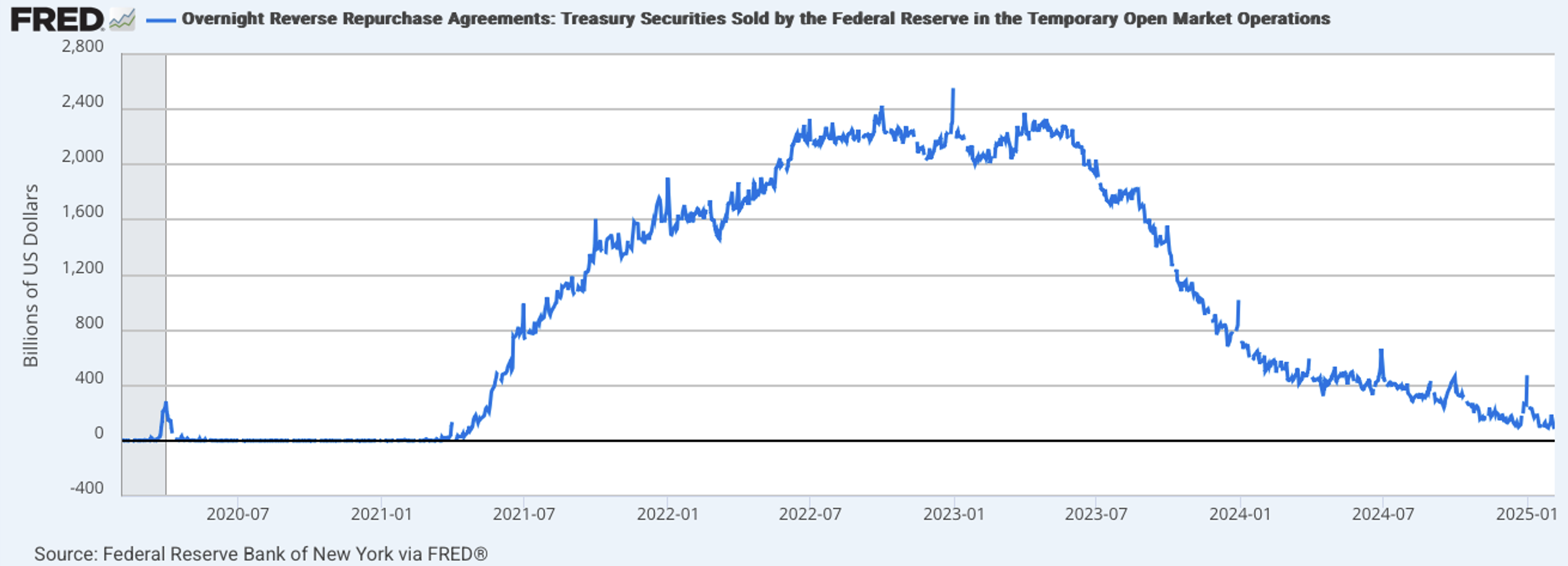

A bull market typically requires at least one of three conditions and preferably all of them: improving earnings – sometimes implied from positive economic growth – multiple expansion (driven by lower rates fuelled by disinflation), and/or abundant liquidity, which we had last year as the U.S. Treasury ran down its Reverse Repurchase agreement account by almost US$2 trillion (see figure 2.).

Figure 2. Fuel for a fire, 2024’s massive liquidity bump as RRA account drawn down

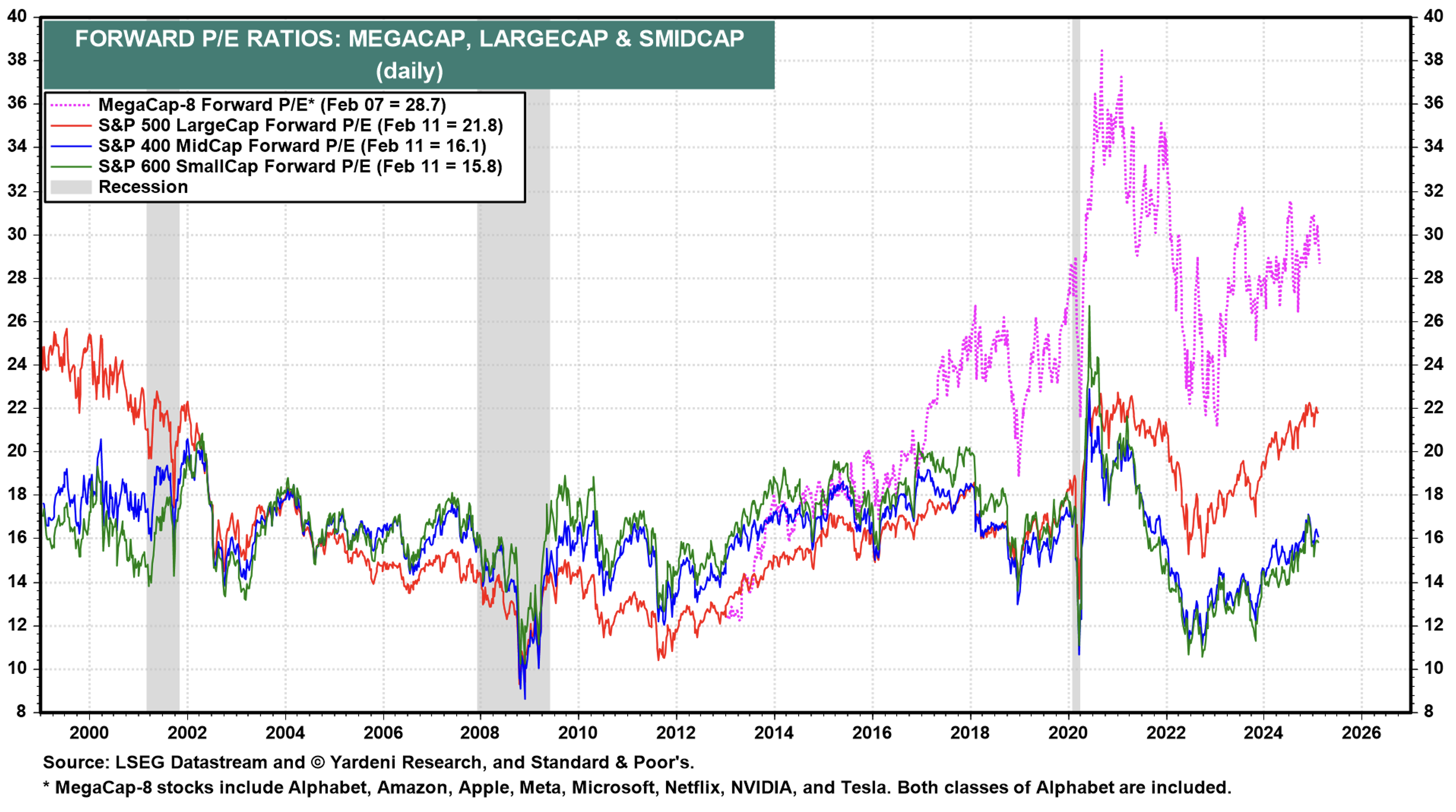

With valuations now appreciably higher than at the beginning of 2023 and 2024 (Figure 3.), and now arguably stretched in parts of the market – particularly in high-growth tech – investors had been counting on rate cuts to justify further gains. But if the Fed remains on hold, or worse, if markets begin to price in a “higher for longer” scenario, equity risk premiums might have to adjust.

Figure 3. U.S. market price-to-earnings (P/E) ratios

That means more liquidity will be needed from treasury and the central banks, but with inflation potentially accelerating, one could reasonably conclude they’ll be reluctant to commence another round of quantiitative easing (QE).

For investors, this could mean revisiting the shape of your equity portfolios and reconsidering heavy weightings to the highest growth holdings.

Defensive sectors, small cap companies with pricing power and those on lower multiples, and alternative assets like private credit could become more attractive if rate cuts get pushed further out. The recent bout of inflation volatility is also a stark reminder that macro risks remain front and center, and positioning accordingly will be critical in the months ahead. By that, I also mean to point out that any drop in the inflation rate will have the reverse impact, potentially triggering a strong re-emergence of animal spirits and the bull market.

The latest inflation resurgence is a challenge to the bullish narrative that had been driving markets higher. While the economy remains resilient, higher prices and a hawkish Fed could prove to be a bit of a headwind for risk assets.

Investors betting on imminent rate cuts might need to adjust their expectations and portfolios accordingly. The key word, however, is ‘might’. We could be ‘off to the races’ again if the latest inflation data is merely another January blip and disinflation resumes.

At a minimum, however, the Fed’s stance will be especially critical for high multiple stocks and former favourite but capital-intensive sectors. Investors should consider focusing, as we do, on companies whose P/E ratios are justified by demonstrable growth and pricing power or other high-quality and highly demanded quality characteristics, such as network effects or geographical monopolies. And those with handsome profits but now finding it all too nerve-wracking may consider future additional allocations being directed to private credit.