Did you ask a question?

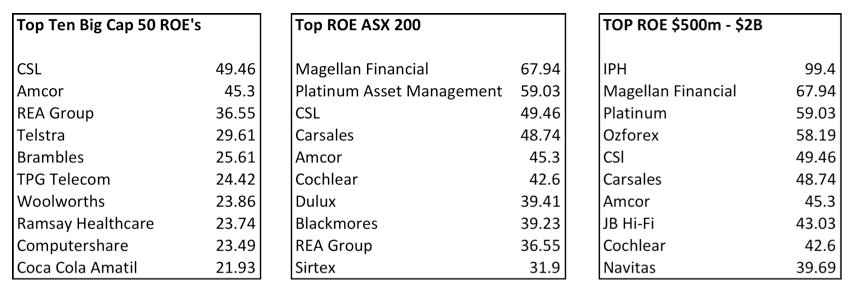

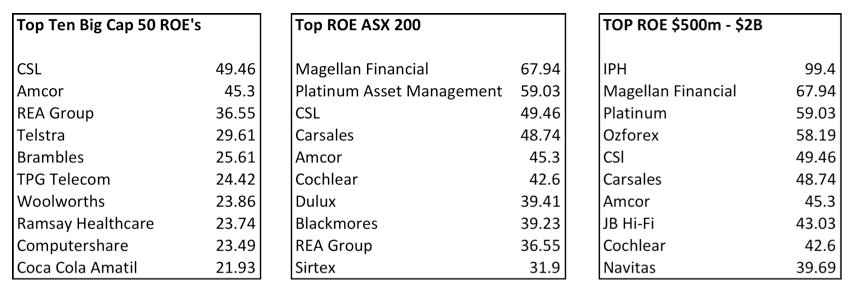

Each quarter we provide a Boardroom Breakfast video to all Montgomery clients. For those still considering investing with us we presented a webinar that more than a thousand people registered for, so there was simply no way we were going to be able to answer every question asked. And there was a bunch! One that was asked that we promised to publish the answer to immediately was a request for the top ten stocks by Return on Equity (ROE).

With that in mind here they are: Keep in mind this is not a recommendation to acquire any stock listed. ROE is just one measure of the economics of a business but investors need to also consider valuation, balance sheet, cash flow and prospects. None of that information is presented here.

Keep in mind this is not a recommendation to acquire any stock listed. ROE is just one measure of the economics of a business but investors need to also consider valuation, balance sheet, cash flow and prospects. None of that information is presented here.

Be sure to join as a subscriber to the blog to receive an invitation to future webinars – we’ll be running a few next year.

We look forward to presenting our next crop of insights and ideas and stay tuned here at the blog for further answers to questions posed at the webinar.

Roger Montgomery is the founder and Chief Investment Officer of Montgomery Investment Management. To invest with Montgomery domestically and globally, find out more.

MORE BY RogerINVEST WITH MONTGOMERY

Roger Montgomery is the Founder and Chairman of Montgomery Investment Management. Roger has over three decades of experience in funds management and related activities, including equities analysis, equity and derivatives strategy, trading and stockbroking. Prior to establishing Montgomery, Roger held positions at Ord Minnett Jardine Fleming, BT (Australia) Limited and Merrill Lynch.

He is also author of best-selling investment guide-book for the stock market, Value.able – how to value the best stocks and buy them for less than they are worth.

Roger appears regularly on television and radio, and in the press, including ABC radio and TV, The Australian and Ausbiz. View upcoming media appearances.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

Keep in mind this is not a recommendation to acquire any stock listed. ROE is just one measure of the economics of a business but investors need to also consider valuation, balance sheet, cash flow and prospects. None of that information is presented here.

Keep in mind this is not a recommendation to acquire any stock listed. ROE is just one measure of the economics of a business but investors need to also consider valuation, balance sheet, cash flow and prospects. None of that information is presented here.

Hi Roger

Do you use compounding returns when working out the returns for the fund ?

And what is the industry standard if there is one ?

Thanks

Tony

Hi Tony,

Yes we display compounded average annual returns as well as cumulative total returns. All returns are after fees.

Hi Roger

Thanks

The performance in a volatile market speaks for itself really but always interested in anything to do with the fund

Can I also get to view this webinar?

Thanks,

Yavuz

we are distributing links. Stay tuned.

As a subscriber to the fund I read everything from the Monty blog. Unfortunately I missed the webinar but would love to get a recording also.

We’ll get it out to you Peter.

Hi Roger,

I get the breakfast videos but am interested to check out the webinars too. Hope you can forward me a copy. Thank you.

Im the same as Tony Roger Are fund members able to view a recording ?

Also after comments by the governor of the reserve bank about recessions do you have a view on this ??

Thanks

We are already experiencing an income recession in Australia. If the apartment oversupply over the next two years (which will cause a correction in apartment prices first and all property shortly after) hits Australia while the income recession is still in place – a recession may be difficult to avoid.

Likewise Roger,

I am a fund member and wild like to view the webOmar

Cheers

Sent to you Dan!

Whilst ROE is an important measure, it concerns me that this can be easily ratcheted up with the leveraging effect of debt on balance sheets.

The trick John is to eschew companies with high levels of debt. Little or no debt is best.

Hi Roger

If a link could be emailed to our registered address it would be appreciated as well

Regards Daniel

Hi Daniel, this has been emailed to you.

HI Roger,

Could you also please organise it for me too ?

Hi Alex, this has been sent.

Hi Roger

Are fund members able to view a recording ?

I am sure we can arrange it Tony. I will have someone contact you in the next day or so.