Did JobKeeper waste $40bn of public money?

Australia’s Department of the Treasury has just released a report into the JobKeeper Payment scheme. It shows that vast sums of money were transferred from taxpayers to companies that – in hindsight – should not have qualified for assistance. This includes almost $14 billion to businesses whose turnover increased during the lockdowns. This mis-use of taxpayer money leaves me with three big questions.

October 11 2021 was “Freedom Day” for people in NSW. With impeccable timing, this was also the day the Commonwealth Treasury released their report descriptively titled “Insights from the first six months of JobKeeper.”

The Jobkeeper scheme was put in place at the beginning of the pandemic to support companies to survive a lockdown-caused drop in revenues and retain their staff so that unemployment would not skyrocket. Businesses that saw or anticipated a 30 per cent drop in revenue, for businesses with turnover less than $1 billion, or a 50 per cent drop for larger businesses, were allowed to apply. At the time, it made sense to not wait until the actual drop in revenues came through as some businesses operate with little financial buffer and waiting could have led these businesses to fail before they could be supported. With hindsight, it is now clear that the scheme was effective at preventing business failures but also there was quite an extraordinary transfer of wealth from tax payers to shareholders and employees of companies that did not in fact need to receive support.

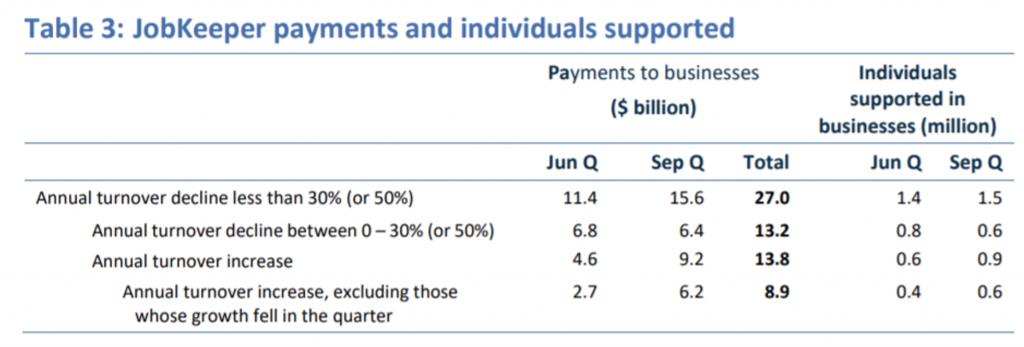

The total disbursement under the scheme during the first six months was $70.3 billion and Treasury’s report details that $27 billion was paid to companies that did not in fact experience falls of 30 per cent or 50 per cent respectively and that a staggering $13.8 billion was paid to businesses that saw turnover increase during the period, as we can see in this table which is published on page 42 of the report:

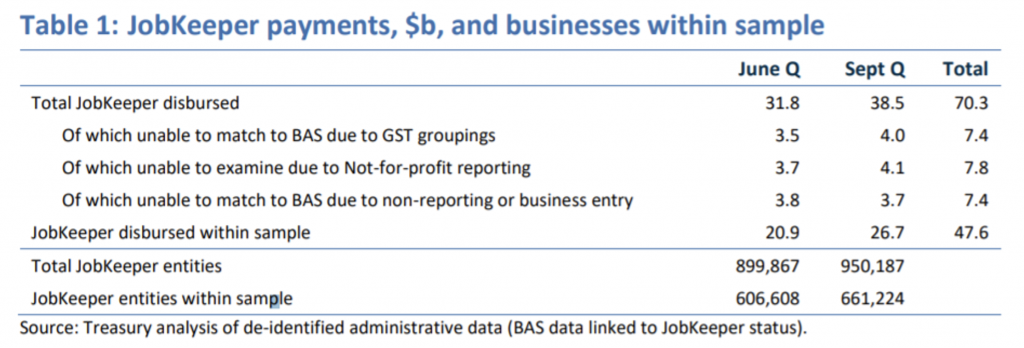

This is not the whole story as it is only based on a sample of $47.6 billion in payments as the table excludes a number of organisations for a number of reasons (not for profits, start-ups that did not file activity statements the year before and businesses which are part of a larger consolidated group and they could not directly identify the actual drop in turnover etc.) as per the next table:

If we scale the $27 billion up to the full $70.3 billion size of the program and assume that the ratio is the same as in the sample group, we get that about $40 billion was paid to organisations that (with the benefit of hindsight) were not eligible to qualify.

If we spread the $40 billion across the Australian population of approximately 25.7m people, we get about $1,600 per person that has been transferred into the hands of organisations that should not have received it! If we were to spread it across the people actually paying tax, the amount per tax payer would be substantially higher.

This raises three really big questions for me:

Firstly, why was the scheme not designed with a claw-back mechanism? It is understandable that businesses cannot correctly anticipate how much their turnover would fall but not having a claw-back mechanism seems completely inexcusable to me as it would virtually eliminate this waste as it would either discourage organisations from actually applying in the first place or at least provide an avenue to recoup excess payments!

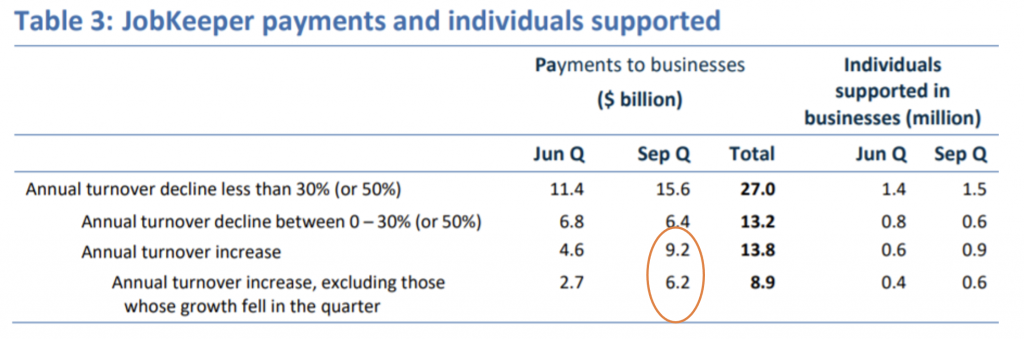

Secondly, the even more disturbing thing, as some of the eagle-eyed readers have probably spotted, is that this data was collected on a quarterly basis and the Australian Treasury was indeed aware of this wastage after 3 months as we can see from the table again and now circled in red to highlight the payments in the September 2020 quarter to organisations that actually grew their revenues:

Thirdly, why are the scheme recipients kept secret? Most other countries like New Zealand and USA that implemented similar schemes have made the recipient public. In Australia, it is only publicly listed companies that have reported what they received and generally buried in a footnote in their annual reports. A public list would have made the transparency significantly better and discouraged frivolous applications.

Why none of these issues were fixed at the three-month review of the scheme and why there are no efforts to retrospectively claw back this money is absolutely mindboggling to me…

As an investor, I am all for companies being able to produce a profit, but it should not be subsidised by tax payers when not needed! Several of the independent senators like Rex Patrick and the Green’s Nick McKim are pushing for this but both the Coalition and Labour are saying no to any claw-back, thus making this a permanent value transfer from tax payers to organisations that should not have been supported… What a shame…

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

My mother passed away a few months ago, we visited the Funeral services the next day who advised they would notify the relevant Government agencies.

A few weeks later a letter came from Centrelink to advise that an extra payment had gone into Mum’s account and would be deducted from her bank account.

The pensioner deduction on her council rates was also stopped as there was no record of her being on Centrelink, I spoke to council to advise she had passed away, I was then told “well she is no longer on Centrelink ”

So it seems the Government can be quick to reclaim overpayments , just not for businesses !

Of course it did ! Look at it this way (from the perspective of someone who, both myself and my partner are “essential workers”), and you can include the “COVID stimulus cheques” under that banner too.

When the pandemic struck, there were a lot of our friends in discretionary retail that were stood down (both here and in the UK, where it was called “furlough” at 70% full pay), but WE still had to work full time, whether it was coming into the office or working from home where possible (my partner was a bank worker, so had no option to work from home). To my mind, that is completely unfair because there was never any danger of essential workers being made redundant and Jobkeeper was, by definition, to retain those jobs (which it seemingly did).

The stories that I could tell you of friends who said “how great it was” (I’ll bet !), “playing tennis” and just sitting around binge-watching TV for three months. Meanwhile, some of us are actually working and actually keeping essential services going. No free “jobkeeper paid holiday” cheques for us ! Now (particularly in the UK), not many of those people want to go back to work or to the office, they like the idea of permanently “working from home”.

Meanwhile, the stimulus cheques – that was another waste of money because it was SO poorly targeted, just like Kevin Rudd’s $900 GFC stimulus (most of which probably ended up in the pokies). I can tell you stories – from the bank – of all sorts of people (even sadly, some homeless people who probably needed it more than some of the others) coming in with $1,500 cheques to cash and thinking how great it was, then wasting it on “essential” items (alcohol and cigarettes).

ALL of us will be paying this back for years to come, in the form of more taxes and reduced services.