Dick Smith vs JB Hi-Fi

As Dick Smith prepares to re-enter the public domain, it may be worthwhile comparing the company with JB Hi-Fi to understand the sustainability of its transformation.

Let’s first discuss the business model of electronics retailers. Companies operate on slim margins. They handle a very large volume of products and this can translate into considerable profits. Two important metrics to consider when assessing retailers are: the gross profit margin (the direct mark-up that is received on the sale of the goods), and the Cost of Doing Business (CODB) margin (the percentage of operating costs to sales).

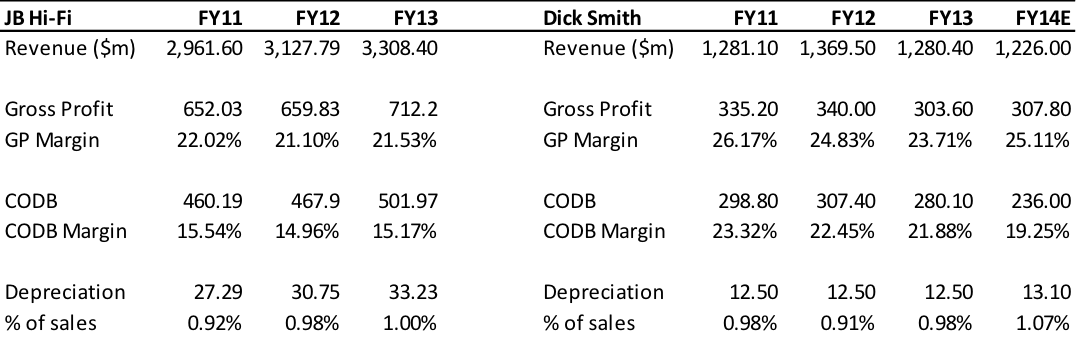

When comparing the margins of Dick Smith and JB Hi-Fi, you will note that JB Hi-Fi has a more favourable CODB margin, while Dick Smith has a more favourable gross profit margin.

At its core, JB Hi-Fi is a very good ‘box mover’, with a focus on moving large items such as televisions. The supply chain is very efficient because it does not handle the goods between the suppliers and the stores, which removes a lot of operating costs. But the company is unable to charge high premiums on these goods, which is reflected in its gross profit margin.

Dick Smith has a greater focus on selling accessories, which accounts for 20 to 30 per cent of total sales. This allows Dick Smith to generate a higher gross profit margin than JB Hi-Fi. Dick Smith is very unlikely to achieve a CODB margin that is comparable to JB Hi-Fi because it handles the goods that it sells through its own distribution centres. Management has done well to reduce this margin from 23.25 per cent in FY11 to a forecast 19.25 per cent in FY14, and it seems 17 per cent is achievable in the long term.

On these two measures, you may consider that Dick Smith has a comparable profitability to JB Hi-Fi. But the metric that we are most wary of is depreciation as a percentage of sales.

Dick Smith expects that depreciation will represent approximately 1.1 per cent of sales, which is comparable to JB Hi-Fi. But JB Hi-Fi has a very simple store presence that doesn’t rely on refurbishments to invigorate sales. A major driver in Dick Smith’s expansion is the rollout of a new concept store called “Move”, which is designed to appeal to young, affluent consumers in prime locations. It is likely that management must keep these stores fresh and exciting to appeal to this demographic. As such, a more aggressive depreciation schedule should be factored into Dick Smith.

After meeting with Dick Smith’s management, we were comfortable with the transformation and the growth prospects of the business. For example, the gross profit margin less the CODB margin less depreciation/sales is expected to jump from 0.85 per cent in FY13 to 4.79 per cent in FY14. Nevertheless, we declined to participate in the float because we felt it wasn’t priced with a sufficient margin of safety. Truth be told we believe the estimated intrinsic value is at best the IPO price. While the company is being floated on 13 times FY14 forecast earnings, and compares with JB Hi-Fi trading at a prospective multiple of 17 times, our assessment is that Dick Smith’s intrinsic value does not offer the margin of safety we require.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Hi Roger

My view is Dick Smith is OK but JBH is better because JBH’s operating cost is lower (includes depreciation) and runs more efficiently.

Besides. JBH’s pricing is more flexible (very happy to negotiate price with customer) resulting in higher sales volume and hence revenue and profits.

Personally if I want to buy something, JBH is the first choice before Dick Smith and they are jusitified for a higher P/E.

Basically I agree with Roger’s article. Not very interested in the IPO at that price.

Thanks for the insights into buyer behaviour Kent.

When i look at a company, one of my first thoughts is whether this company would be the first or automatic choice a customer will make when trying to buy a particular product. I am not convinced that Dick Smith falls into this category.

The Dick Smith prices are definitley competitive looking online at a few products particularly in the TV and computer area. So for me, it comes down to brand leverage which i believe is always a key factor in determining which is better between two companies that are similar in how competitive they are.

People tend to be creatures of habits and retail consumers tend to also form attachments to certain brands. This is where JB really got ahead of anyone else especially with the Gen Y market. People also know that JB will price match and mobile phones mean that competitive prices are a click away if they are better.

I wonder whether the supply chain you discuss allows for people to be more confident that a product will be in JB than others that have to wait for it tobe delivered from warehouses.

Overall, the model seems to be better for JB. Crowds are always larger from my experience in a JB store to a Dick Smith store and JB tends to have better quality locations (albeit this obviously comes with their own issues in relation to rents).

I have shopped at both, but if it wasn’t for an electrician emphasising how important it is to get one from Dick Smith, i probably would have just went to JB or got a cheap cable from Big W or Kmart.

Nothing overly scientific here and it is purely qualitative. The key for Dick Smith i think is to try and put a dent in the brand equity of JBH which they obviously know as they are rolling out “Move”. However if they go down the glossy route, i am not sure if they are going down the right track. At least for me the almost edgy minimalist and cardboard structured JBH stores are more appropiate.

Thanks Andrew.