Should you invest more in resources?

Resource stocks have enjoyed a stellar year. Anyone who invested in the sector at the start of the year is enjoying bumper returns, while those who did not are lagging badly. It begs the question: should you invest more heavily in resources stocks? Our short answer is “no”. And here’s why.

If we sort the ASX300 by total return for YTD 2016, we see quite a number of companies have returned more than 100%.

| Company | Total Return (%) |

| WESTGOLD RESOURCES | 963 |

| RESOLUTE MINING | 402 |

| GALAXY RESOURCES | 339 |

| WHITEHAVEN COAL | 323 |

| FORTESCUE METALS | 271 |

| MINERAL RESOURCES | 215 |

| DACIAN GOLD LTD | 206 |

| SOUTH32 LTD | 177 |

| BEADELL RESOURCES | 146 |

| MACA LTD | 139 |

| BLUESCOPE STEEL | 120 |

| OZ MINERALS LTD | 116 |

| SERVICE STREAM LTD | 112 |

| MAGNIS RESOURCES | 110 |

| WORLEYPARSONS | 109 |

Notably, almost every name on this list is a resources-based business. It is the nature of resources that the returns from this part of the market can be feast or famine, and 2016 has been very much the former.

A natural question for investors to ask is whether this cycle may have much further to run. Being positioned in the strongest performing sectors can obviously make a big difference to returns.

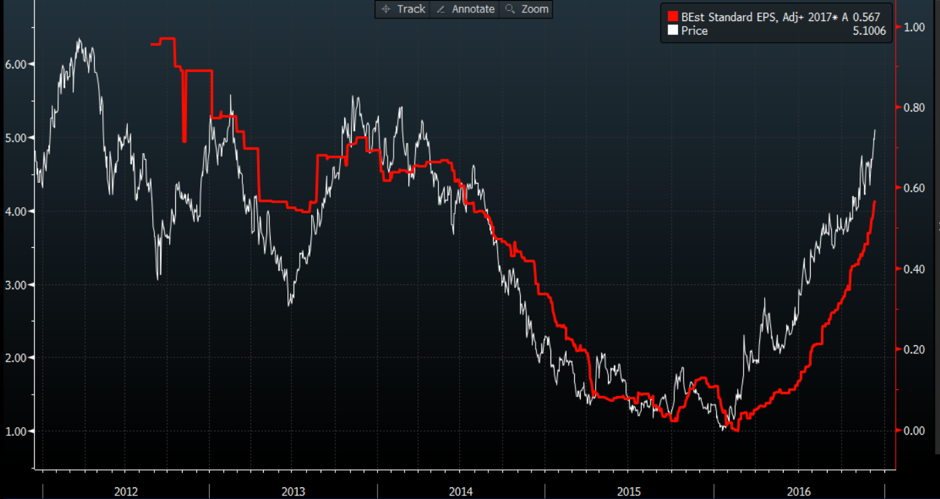

One useful perspective on this can be drawn from the following chart. It shows the 5-year history of broker consensus forecast FY17 earnings for one of the larger companies from the above list – Fortescue Metals.

What is interesting about this is how far consensus earnings estimates have moved during FY17: Having started the year at around zero, the consensus now sit close to 60 cents per share. You can see from the chart that in recent times these forecasts have been revised at what appear to be ten minute intervals.

The rate of change recently has been remarkable, and if there is one thing that is obvious from this dynamic, it is that the brokers have very limited ability to forecast very far in advance what FMG’s earnings might be. This is not a criticism of the brokers – commodity prices are inherently very difficult to forecast, and our own crystal ball is no better than those the brokers use.

To our way of thinking, this generally leads to only one investment conclusion: We just don’t know. This is an unsatisfying answer, but as an investor it’s important to recognise when “don’t know” is the only reasonable answer.

“Don’t know” for us means we stay out. Buying shares in something you can’t sensibly value is no different to gambling, and while gambling can provide some spectacular short-term wins, it has less appeal as a long-term strategy.

This long-term business can be tiresome, and it certainly doesn’t entertain an audience the way a dynamic sector rotation story might. However, as is often the case, it’s worth keeping Warren Buffet’s wisdom and observation in mind:

“The stock market is a device for transferring money from the impatient to the patient”

Hi Tim, on a completely separate note, what do you think of Mayne Pharma? Is the regulatory/ legal risk too big? Roger Corbett doesn’t seem to think so, with his disclosure of additional director’s interest. Although its only a small percentage of his existing holding.

Thanks.

Kelvin

We’re doing some work on it now Kelvin. Not sure we can make a case for it being a ‘quality’ business.

Thank you for providing the link, Tim. As you’d probably agree, if the data in the link was updated to the present, it would show that buying value based on book value had experienced another leg-up more recently.

That said, I didn’t mean to suggest that buying value based on book value or on some other balance sheet metric was the only way to buy value. I suppose that I feel that the Montgomery funds are less value investors and are more growth-at-a-reasonable-price investors inasmuch as you want growing companies and will buy them where you feel that you have identified a reasonable discount between their future growth prospects and their then current market price.

What I have never been able to get comfortable with in that approach is that the discount in most cases is only ever “reasonable”. I want a yawning discount.

Even then, however, based on the research that I have seen, a growth-at-a-reasonable-price approach underperforms a crude value approach (which I define as an approach that is only concerned with buying stocks that have the widest possible spread between value and price where value is defined as either assets or earnings and price is defined as enterprise value).

Very true. When we refer to ‘value’ we really mean valuation. Traditional terminology takes ‘value’ to mean high book-to-price or low price-to-earnings, which is a very different concept to valuation. Using that terminology we are definitely in the GARP bucket.

Hi Justin/Tim, is there any evidence that traditional deep value fund managers outperform GARP fund managers (using your terminology above) in the long run? I am aware of a very good deep value fund manager in Australia who in the last 5 years has performed similarly to the Montgomery Fund, but he’s been 50% in cash because he can’t find much to buy!

Thanks.

Kelvin

Hi Kelvin. I’m not aware of any good research that addresses your question. Would be interested to read it if any can be found. Tim

Tim, can I put this to you:

Might your (or my) assumption that we can accurately and reliably forecast earnings be a snare and delulsion except in the case of a number of steady-earning businesses?

In businesses that are small and fast-growing, like ISD, HSO and SRX (all of which, I understand, have negatively affected Montgomery’s performance to date), the slightest miss or hiccup tends to cause a violent re-pricing of the company’s stock – mainly because companies like ISD, HSO and SRX are usually priced as if nothing can go wrong. And when something does go wrong, watch out!

The significance of this is that, while you concede that you can’t forecast the earnings of FMG or WHC, you presumably would not make the same concession in respect of the future earnings of ISD, HSO, SRX or the other stocks held in the Montgomery funds. I find that interesting given the recent performance of these stocks (which cannot be attributed solely to sector rotation) and the disappointment that they must have caused you.

Now, consider this: in contrast to sophisticated projections of future earnings, cruder measures of value such as book value would have revealed stocks like BHP and WHC earlier this year to be trading at extremely low levels – in some cases as if they were going to go out of business tomorrow.

Book value is a crude valuation metric, I grant you. But studies invariably show that it is surprisingly effective in achieving superior investment outperformance. The fact that the resource sector along with the financial sector at the beginning of 2016 was so beaten-down and on-the-nose is precisely the place where value investors should have looked. And had they been guided by an assessment of value based on book value rather than on a projection of future earnings and business prospects, they would have bought miners and banks and have been rewarded.

There is nothing new about this. It is the constant refrain of value investing: invest where the outlook is most negative and don’t spend too much time trying to predict the future.

Now, it seems to me that if the performance of the Montgomery funds is currently suffering, it might be because it only invests in sexy areas of the market like tech, healthcare and biotech that promises high growth. But history has shown that over the long term value beats growth – comprehensively.

Hi Justin. Some good questions in there. My main thoughts in response would be:

The future is always highly uncertain, and “accurate” forecasting is a relative, not an absolute concept. We think the chances of forecasting accurately improve for businesses without commodity price risk, but of course uncertainty remains.

An earnings forecast is not the same as a share price forecast. In the short term the two can be disconnected, and this is important for the stocks you mention. This disconnect can make value-based investing painful short term, but also allows it to succeed long term.

In looking at metrics like book value, its important to look at all the data, not the most recent experience. Book value has had a good year, but a very ordinary decade, as set out in this analysis we did previously:

http://rogermontgomery.com/the-end-of-old-school-value-investing/

Similarly, while the Montgomery funds have had a very ordinary year, the performance over long periods of time has been good…better returns, lower risk. We accept short term pain from time to time in pursuit of good long-run outcomes.