Day traders betting on Hertz could be in for a world of pain

COVID-19 stay-at-home orders have led to a surge in share trading, due to the lure of seemingly quick riches. The trouble is, many people are being drawn to extremely risky trades, particularly in the US. And, like moths to a flame, these traders could get badly burnt.

The uptick in share trading is most evident in the US, where commission-free platforms such as Robinhood have seen the total number of positions more than double over the past 3 months to over 30 million.

Associated with this spike in day-trading enthusiasm has been one of the most interesting (or bemusing / concerning depending on your view) “bull-market-within-a-bull-market” phenomena that I have seen – namely, the bankruptcy boom. These businesses have already entered bankruptcy (Chapter 11) proceedings but have seen a spike in their share prices as a result of surging popularity by these Robinhood traders speculating on share prices, probably best described as “greater-fool chicken”.

The posterchild for this activity has been Hertz, which entered into Chapter 11 on 24 May as the COVID-19 shutdowns forced a day of reckoning on its already stretched balance sheet. On 26 May as Hertz resumed trading, the share price closed down 80 per cent to 56 cents, as existing equity holders, including billionaire Carl Icahn, headed for the exit.

What should have been a decline towards zero instead saw a remarkable reversal the following day, with the shares more than doubling to $1.31 / share as over 345 million shares (or 2.5x the company’s total issued capital) exchanged hands. The craziness didn’t stop there, as 2 weeks later the share price spiked to over $6 /share intra-day on June 8, caught up in the broader enthusiasm of “re-opening the economy”. For anyone brave to buy at the bottom (56 cents) and able to sell at the top ($6), this would have represented a 10 bagger.

The chart below depicts the share price (pink) vs the total Robinhood users (green) holding Hertz stock. As can be clearly seen, total Robinhood holders have spiked up from 40,000 to 160,000.

Hertz share price versus RobinHood holders

Source: Robin Track

One key difference with the US and Australian listing rules is that once a company enters into Chapter 11 proceedings in the US, the stock is allowed to continue trading on the exchange, whereas in Australia the stock enters voluntary suspension whilst it goes through bankruptcy proceedings.

However, this doesn’t mean there is any equity value remaining in the business. Hertz has a line of secured and unsecured creditors totalling over US$18 billion that need to be repaid before equity holders are entitled to any ownership of what remains of the company.

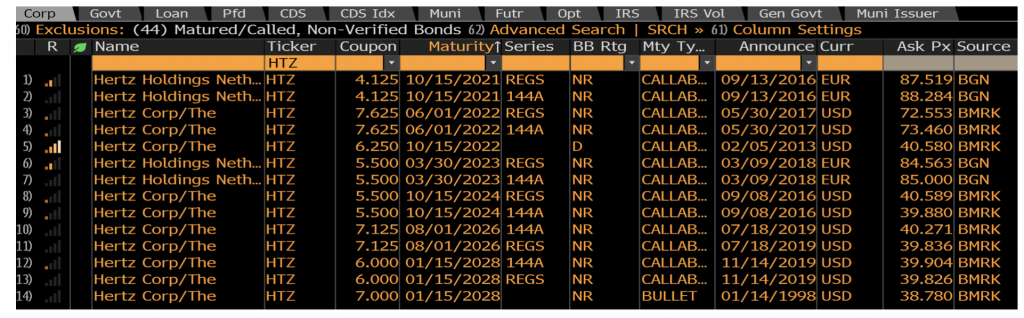

And what is notable is that even more senior lenders of Hertz are not too optimistic about their chances of receiving 100 cents on the dollar as the debt trades at 87 cents, while lower tranches are sitting below 40 cents on the dollar.

Hertz Global Debt on issue

Source: Bloomberg

Other notable examples of the “bankruptcy boom” include Chesapeake Energy (preparing for Chapter 11 filing) and JC Penney (20 cents to 63 cents, +200 per cent in 3 days).

JC Penney Share price

Source: Bloomberg

Sometimes it is worth paying attention to fundamentals.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY