Data Centre Apocalypse

Another week, another artificial intelligence (AI) powered disruption. This time, two big announcements from China that may threaten the valuations of the big U.S. hardware-centric tech giants.

The news

First, the release of AI-produced hyper-realistic movie-quality video from the Chinese company ByteDance-owned AI Seedance 2.0 has gone viral and simultaneously rocked Hollywood by completely reframing what the movie industry thought was possible.

Here’s one of the shorter viral clips; it’s Brad Pitt fighting Tom Cruise which was made with a two-line prompt in SeeDance 2.0.

Variations of the video include an AI-generated Pitt and Cruise each fighting a zombie ninja, and the pair teaming up to fight a robot.

And here’s another short 2-minute movie made with SeeDance 2.0 by an individual with pre-release access to the tools.

Watching these early productions, it’s already difficult to remind yourself, these are 100 per cent AI-generated. There are no people, no cars, no sets, no water, no rain, no lighting.

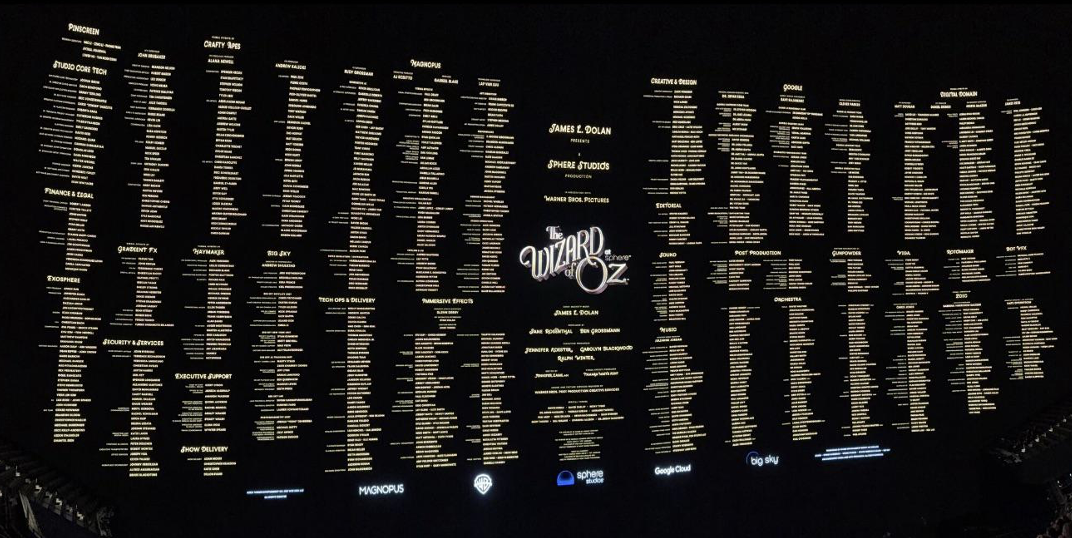

If you’ve ever watched a movie that incorporated VFX or CGI, and stayed behind to watch the credits, you will know that an army of people have been required.

Figure 1. This is the credit screen for all the post/vfx work on Wizard of Oz

Will those jobs exist in ten years? Will they exist in five years? Gustav Söderström, the co-CEO of Spotify, stated last week that some of the company’s most senior developers have not written a single line of code since December 2025, implying the work is being done by AI agents.

While SeeDance 2.0 has arrived hot on the heels of other AI-produced videos from Grok, Kling and others, China claims its tools use far less energy and resources. Whether that’s true or not, what’s most impressive is the rapid speed of advancement from China.

The second viral sensation from China came from footage of the Chinese New Year 2026 Spring Festival Gala as Unitree Robotics, Noetix, MagicLab, and Galbot – all Chinese robotics companies, showcased the rapid advancement of their technologies.

The questions

The questions on my mind include whether these developments signal a change in AI leadership and, if so, whether booming AI stock prices in the West are justified. I am also interested in whether there are other advancements – below the surface of the viral movie and robot releases – that matter more.

The global AI arms race has long been measured by the number of Graphic Processing Units (GPUs) humming in massive data centres. But another release from the Chinese lab, DeepSeek, is threatening to flip that script, suggesting the next era of artificial intelligence may be defined not by who has the most hardware, but by who can do the most with less.

As an aside, ByteDance has integrated DeepSeek models into its products.

As rumours swirl regarding the launch of DeepSeek V4, industry insiders are bracing for what some are calling a “data centre apocalypse.”

DeepSeek V4 is described as a “coding-first” model that represents a fundamental leap in AI capability, specifically targeting software engineering. The model utilises two core innovations: Engram Architecture (conditional memory) and Manifold-Constrained Hyper-Connections (mHC). It has been explained to me that these allow the AI to separate static memory (knowledge) from dynamic reasoning (computation), drastically reducing the “compute” required and lowering inference costs.

Meanwhile, internal tests reportedly suggest DeepSeekV4 outperforms Claude and Chat GPT in multi-file reasoning and complex repository-level bug fixing.

The “Data Center Apocalypse”

The Big Short’s Michael Burry – who, it should be noted, is short Nvidia – has warned of a “data centre buildout apocalypse.” His reasoning is that if software becomes exponentially more efficient (as demonstrated by DeepSeek), the multi-billion-dollar rush to build massive, power-hungry data centres may become redundant.

Consequently, the era of “brute-forcing” AI by simply adding more GPUs could end, especially if the focus shifts toward architectural efficiency, where smarter algorithms do more work with less physical hardware.

A seismic shift in leadership

The rise of DeepSeek is the culmination of a decade-long pivot in scientific dominance. Jensen Huang, CEO of Nvidia, noted last year the ecosystem in China has reached a “vibrant and incredibly innovative” state that the West can no longer afford to ignore.

Huang’s numbers tell a stark story of a leadership flip:

- Talent Pool: 50 per cent of the world’s top-tier AI researchers are now Chinese.

- Intellectual Property: Roughly 70 per cent of last year’s AI patents originated in China.

- Academic Pipeline: 9 out of the 10 top science and technology schools in the world are now located in China.

The population of highly qualified, incredibly hardworking Chinese students has reached a critical mass that is now manifesting as disruptive software.

For the last two years, the “bigger is better” philosophy has dominated Silicon Valley. The logic is that to obtain more ‘intelligence’, you need more power and more chips.

However, the “breaking information” surrounding DeepSeek V4 suggests a focus on architectural breakthroughs that could make current hardware-heavy approaches look like relics of the past.

If a model can achieve state-of-the-art performance with a fraction of the computational “compute” usually required, the valuation of the companies currently building massive data centres could be fractions of what they are today.

The new reality

As we wait for the official launch of DeepSeek4, one thing is clear: the AI landscape has completely flipped. China appears to have gained an edge in the quality of some outputs. Meanwhile, the focus is no longer just on who can manufacture the most silicon, but on the “incredibly innovative” ecosystem that is now producing the world’s most efficient code.

For investors in major Western stock market indices, and for the tech giants that dominate those indices, the message coming out of China is that efficiency might be the new ‘scale’. Hardware moats are shrinking, and the U.S. lead in high-end semiconductors is being challenged by Chinese innovations in software that require less powerful hardware to achieve similar results.

The valuations of hardware-centric tech giants may be at risk.