CrossBorder Capital’s liquidity warning

CrossBorder Capital’s latest report by founder Michael Howell paints an ominous picture of a maturing global liquidity cycle, raising concerns that the U.S. Federal Reserve’s (the Fed) waning role in providing liquidity (the fuel for market and asset rises) has negative implications for markets and the U.S. economy.

Howell’s analysis concentrates on the September Federal Open Market Committee (FOMC) meeting, where a 25-basis-point rate cut was delivered alongside hints of further cuts, consistent with Trump’s demands. Yet, he labels this a “hawkish cut,” emphasising the Fed’s tough stance on liquidity. Fed Chair Jerome Powell, incoming appointee Stephen Miran, and Treasury Secretary Scott Bessent are reportedly aligned in their push to shrink the Fed’s balance sheet and minimise its market influence.

Indeed, former hedge fund manager and now Treasury Secretary, Scott Bessent, has recently provided ample evidence of this pivot.

Scott Bessent’s warnings

- “The Fed must re-establish its credibility as an independent institution focused solely on its statutory mandate of maximum employment, stable prices, and moderate long-term interest rates.” Reuters, Sep 5, 2025

- “The Federal Reserve’s heavy intervention in financial markets over recent decades has led to a series of unintended consequences. While these unconventional tools were introduced to address extraordinary circumstances, their efficacy in stimulating economic activity remains unclear. But they have clearly produced severe distributional outcomes across American society, undermined the Fed’s credibility, and threatened its independence.

“Looking ahead, it is essential the Fed commit to scaling back its distortionary impact on markets. At a minimum, this likely includes the Fed only using, and then halting, unconventional policies like QE [Quantitative Easing] in true emergencies and in coordination with the rest of the government.” The International Economy, Spring 2025

What’s important to know is that emergency interventions by the Fed aren’t off the table, but the interventions that have propped up the market almost constantly since the Global Financial Crisis (GFC) might be coming to an end.

The heavy lifting for future U.S. liquidity growth, Howell argues, will fall to private credit operators – think banks – and the U.S. Treasury. This shift could boost stablecoin issuance, but Howell argues that any new funds are likely to flow into the real economy rather than into financial markets.

A central theme in Howell’s latest note is what he describes as the “baton pass” in managing liquidity – from the Fed to the Treasury. Howell describes how the Treasury’s more recent strategy of ramping up short-term bill issuance acts as a form of “Treasury QE,” effectively capping yields and injecting liquidity. The only problem, however, is that it’s on a smaller scale than the Fed’s past quantitative easing programs. This creates a tighter overall liquidity environment, with lingering risks in money and repo markets. He warns that while stablecoin supply might surge, the redirection of funds could leave financial markets sidelined, starving them of the liquidity that is necessary to keep markets soaring and fuelling speculative excesses such as have been recently observed in meme coins, penny stocks, short-dated options and even the broader artificial intelligence (AI) thematic.

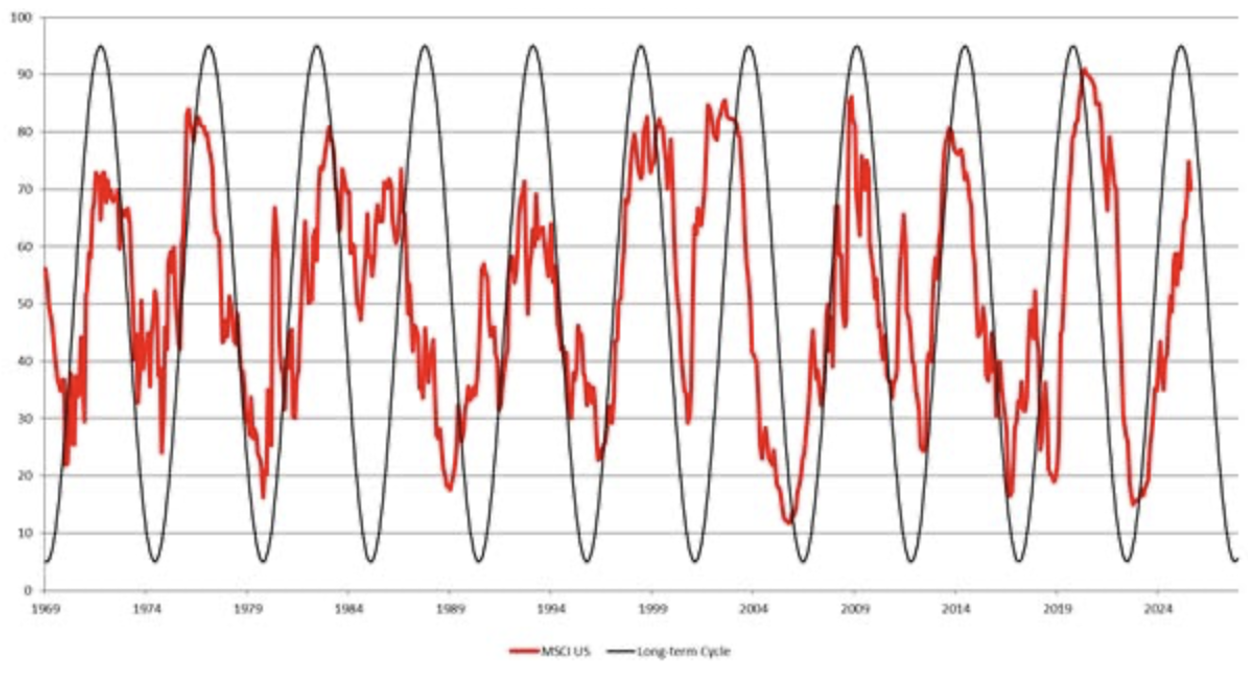

Howell highlights the fading momentum of Fed-driven QE (Figure 1). Global liquidity is touching record highs around US$185 trillion but struggling to push higher. Howell notes the slowing momentum in the Bitcoin and Gold prices is evidence of the deceleration in liquidity growth. Recent events, such as the US$150 billion withdrawal on America’s Tax Day (September 15th), spiked the Secured Overnight Financing Rate (SOFR) despite the anticipated rate cut, highlighting vulnerability. Meanwhile, quarter-end pressures loom, and the Fed’s “backdoor” stimulus mechanisms are already tapering. CrossBorder’s own U.S. Liquidity index (Figure 1.) reveals a dip, signalling a maturing cycle with potential further declines in September due to reduced Fed support.

Figure 1. U.S. liquidity cycle

On the flip side, Howell spotlights the rise of “Treasury QE” as a counterbalance. With the Fed committed to quantitative tightening (QT) – rolling off Treasury Securities – the burden shifts to the Treasury’s aggressive short-end security issuance, like August’s US$375 billion bill calendar. This echoes “Yellen-omics,” creating scarcity in longer-dated coupons and suppressing yields. Without this, Howell estimates 10-year Treasury notes should be yielding 75 basis points more than current rates.

However, this Treasury-led approach, while substantial, pales in comparison to prior Fed efforts.

The risks are unmistakeable, particularly in repo markets. Squeezed liquidity could drop bank reserves below US$3 trillion, heightening tensions and spiking the SOFR-Fed funds spread. This might compel dealers to offload inventory, disrupt arbitrage, and unwind massive Treasury basis trades. Bonds, as Howell stresses, are more crucial than ever, underpinning nearly 80 per cent of global lending through collateral. More volatility in bonds would mean bigger haircuts to prices, effectively meaning less collateral, escalating repo rates and creating a vicious cycle.

Intriguingly, Howell points to a revival of the Fed’s “third mandate”: ensuring modest and orderly long-term Treasury yields. Both Bessent and Miran echo this, prioritising Treasury market stability over dictating fiscal policy. Historical precedents, such as the swift responses to the 2019 Repo Crisis, the 2023 SVB fallout, and the UK’s 2022 gilt meltdown, reinforce that bonds are non-negotiable for policymakers.

Howell’s latest warning concludes that the new liquidity pivot supports the real economy more than financial markets. By leaning on short-term bills, the Treasury not only gains control but also paves the way for stablecoins, which “monetise” fiscal impulses to fund public spending, redirecting flows away from financial markets, and potentially leading to any bull market in bonds fizzling out.

His key takeaway is that the Fed’s era of QE is waning, liquidity is tightening, and repo stress lies ahead. Meanwhile, any further liquidity is ultimately channelled to Main Street, not Wall Street.