Could automation eat your job?

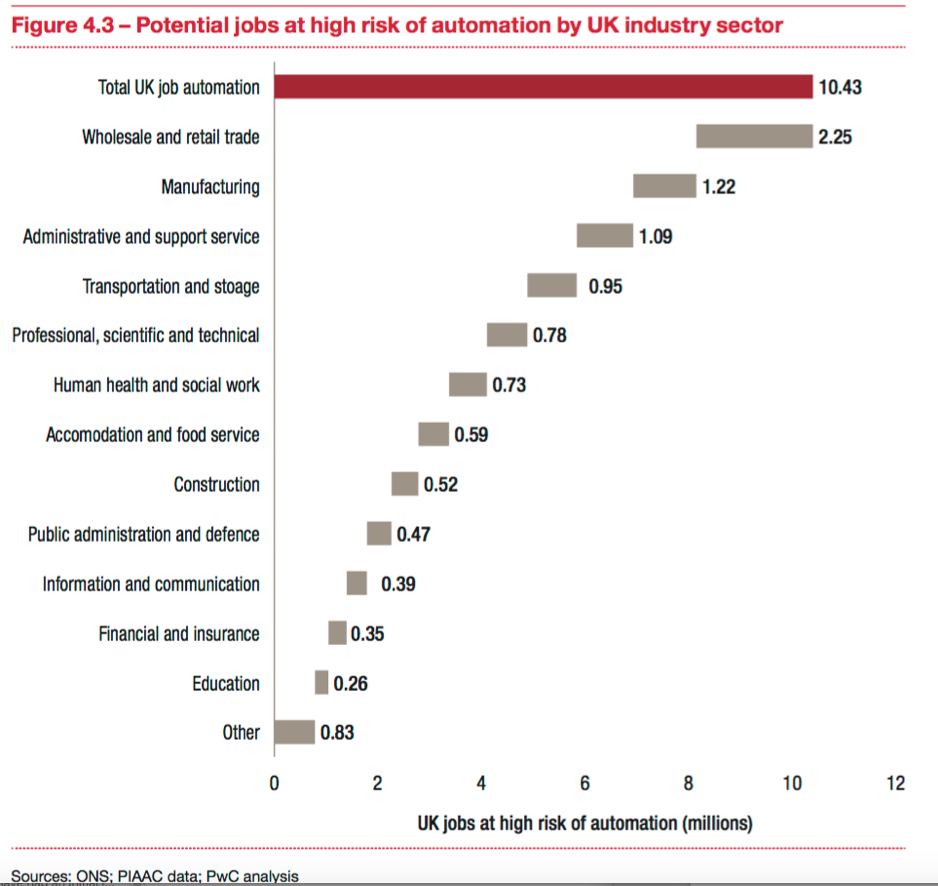

As if there’s not enough to worry about these days. Now, a report by PwC estimates that automation will put at risk a large percentage of jobs in developed countries within 20 years. Sure, new job opportunities will emerge. But, in all likelihood, we will see increased income inequality and less job security.

In its latest UK Economic Outlook report, PwC states: “around 30 per cent of existing UK jobs could be at potential risk of automation by the early 2030s, with the most exposed sectors including retail and wholesale, transport and storage, and manufacturing. Less educated workers face the highest risk of automation”.

The study also found that automation will put at risk 38 per cent of jobs in the US, 35 per cent of jobs in Germany, and 21 per cent of jobs in Japan.

This should generate jobs in service sectors that are less easy to automate, but could also increase income inequality. New automation in areas like Artificial Intelligence and robotics will both create some totally new jobs and, through productivity gains, generate additional wealth and spending. The net impact of automation is unclear, but we know from recent history the benefits will not be evenly spread.

Fears of technology-driven job losses have re-emerged with advances in smart automation, the combination of AI, robotics and other digital technologies, that is already producing innovations like driverless cars and trucks, intelligent virtual assistants like Siri, Alexa and Cortana, and Japanese healthcare robots.

Traditional machines have replaced our muscle in the rural and manufacturing worlds, too, and these smart new machines have the potential to replace our minds. Government needs to respond by reshaping education and vocational training to help workers adapt to this fast-evolving technological world.

Good point Roger but I beieve the biggest job losses will come from appluing blockchain technology. Watch this space. On the same topic do you watch any blockchain related company?

Thanks Erek, my colleague Lisa Fedorenko has written a number of articles on blockchain on this blog.