Costly Dividends

One thematic that stood out in the latest reporting season was the increase in dividend payout ratios across listed companies. Whilst this no doubt pleases income hungry investors right now, many would be unaware that an insatiable hunger for dividends today could actually cost you a tonne of money longer-term.

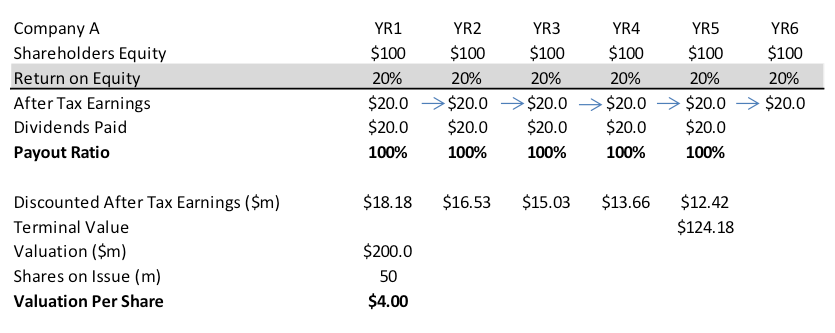

Let me explain. Consider two identical companies – Company A and Company B – which have $100 million in shareholders’ equity and 50 million shares on issue. Both companies generate a return on equity of 20 per cent, and both companies have been paying out all of their earnings as dividends.

If management at Company A maintain their dividend policy and pay out everything, there will be no capital available for reinvestment, which means no funding for future growth and hence little or no chance of earnings growth in the outer years. The after tax earnings will remain at $20 million, which values Company A at $4.00 on a 10 per cent discount rate.

Source: MIM analysis; company filings

Source: MIM analysis; company filings

Shareholders might be happy to receive annual dividends of 40 cents per year – a dividend yield of 10 per cent is certainly attractive in this market! But whilst a bird in the hand is sometimes worth more than two in the bush, they are in fact sacrificing far greater returns.

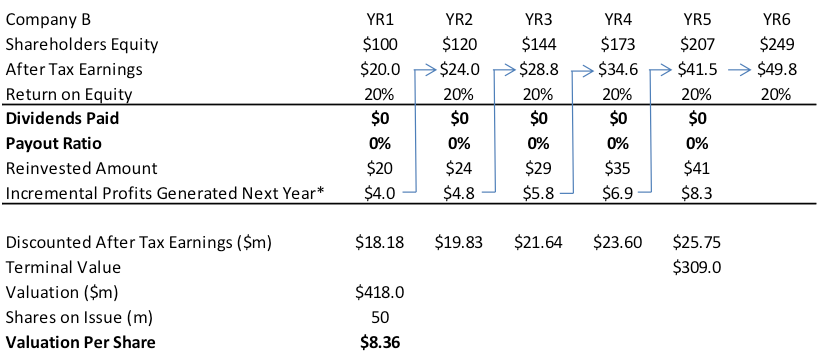

Let’s say that management of Company B pushes back against Australia’s SMSF income army, deciding to suspend dividends completely and reinvest every last penny back into the business.

Whilst it is highly likely that the shares would selloff on such an announcement, the irony is if the installed management team can reinvest capital at the historical returns noted before, then the value of Company B could be double that of Company A who doggedly sticks to its income-paying mantra.

Why is it worth so much more? Simply because Company B can reinvest an ever-growing pool of after-tax profits back into the business on which it generates a stable after-tax return of 20 per cent per annum. Over the next five years, if management adopted a policy of retaining and compounding all earnings back into the business to drive growth, then earnings under this scenario would grow from $20 million to $41.5 million over a five year period, and the company would be worth $8.36.

Source: MIM analysis; company filings

Source: MIM analysis; company filings

So despite the initial outrage over losing 40 cents per share each year in dividends, an investor in Company B is actually much better off than an investor in Company A, assuming that both investors purchased shares at $4.00 before the dividend / capital allocation change.

Consider their respective return profiles:

- For Company A, the total return over the 5 year period is 50 per cent, which solely comprises dividend income.

- For Company B, the total return over the 5 year period is 109 per cent, which solely comprises capital growth from $4.00 to $8.36.

It’s also worth noting that the investor in Company A has been required to pay taxes on its dividends every year (depending of course on the structure the asset is held within), while the investor in Company B has allowed the pre-tax returns (from an investors perspective) to be reinvested – this makes the after-tax return even better!

Food for thought for those who think that buying a stock for its ‘yield’ is the way to approach the share market.

Russell Muldoon is the Portfolio Manager of The Montgomery [Private] Fund. To invest with Montgomery, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

James

:

Apologies for my late question, Is there any chance you could clue me in on the model you used to calculate the terminal values above, prior to discounting back to Year 0? Or is it proprietary?

Andrew Legget

:

Very good post Russell. The focus on dividend payouts in Australia is a bit of a irritant to me. As a relatively young investor, growth is a major focus for me and i just can’t help but think a lot of Australian companies would be better off reinvesting for growth a bit more and there for make more valuable long term investments for me. For investors who focus on high sustainable ROE type companies, reinvestment makes sense.

I am happy for companies who earn ROE’s below the cost of equity to pay out all the money. These companies aren’t generating any value so better to pay it out, i also wouldn’t be investing in them.

Berkshire has shown the benefits of reinvestment, the blueprint is there. Lets not forget that for the most part Apple also didn’t pay dividends and a whole host of other businesses that are doing very well.

If there are profitable value generating opportunities, then a business should take them. However in Australia i just believe that increasing dividends is much higher on the list of importance for many.

Russell Muldoon

:

Nice wrap-up Andy. Thanks as always for your constructive comments.

Paul Audcent

:

Tell me Russell, I invest in companies that have divident re-investment, so is that the same as investing in Company B?

Russell Muldoon

:

Hi Paul, its one way a business can pay a dividend, payout franking credits and yet retain funds for growth via those dividends being reinvested back into the business. It comes at a cost though, both in the form of the dividend (taxable in your hands) plus the additional shares issued due to the DRP.

So its not the same as the pure example I gave whereby the company does not pay a dividend at all and reinvests everything. Saying that, the fact they have a DRP means they need the capital – you need to know question if they can deploy it at attractive incremental rates of return.