Consumer broadband – brief market overview

As many readers are aware, the Montgomery funds monitor the telecommunications industry on a consistent basis. With the development of the National Broadband Network over the next decade there appears to be an immense number of opportunities for valuation creation as the spend of each broadband consumer rises and the number of broadband users across Australia continues to grow.

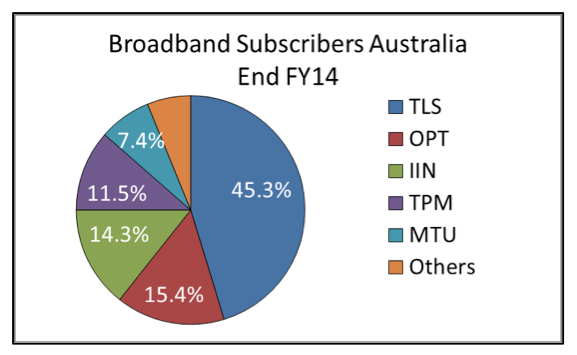

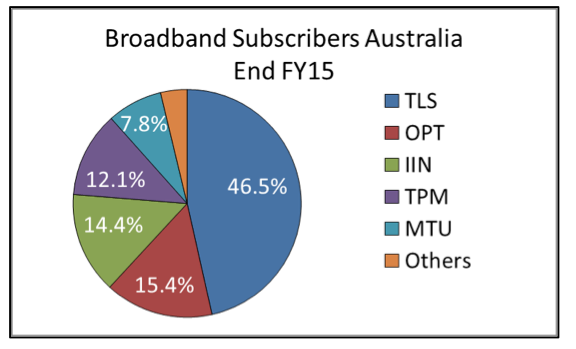

With the 2015 financial year result of TPG (ASX: TPM) announced yesterday we were able to compile an overview of the respective market shares of major consumer broadband brands across Australia.

Some of our findings include:

- Across the board, the 5 majors (now 4 majors) have all gained/held their market shares. Largely, this has been at the expense of the ‘other’ segment of the broadband market which includes smaller, lesser known operators.

- Telstra Corporation Limited (ASX: TLS) has managed to grow its market share by approximately 1.2 per cent – a solid result from the incumbent. This appears to have been driven by NBN subscriber adds despite relatively higher prices than those charged by its rivals.

- M2 Group Limited (ASX: MTU), a current holding in the Montgomery portfolios, has also grown share despite competition having heated up in the second half of 2015. M2’s Dodo brand has one of the lowest cost NBN plans in the market and we expect it likely to be a growing part of the market over time.

Scott Shuttleworth is an analyst at Montgomery Investment Management. To invest with Montgomery domestically and globally, find out more.

Scott Shuttleworth is an analyst at Montgomery Investment Management. To invest with Montgomery domestically and globally, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY