China’s softening demand becomes a reality

In Tuesday’s Video Insight I discussed the fact that Australia’s Terms of Trade had nearly doubled from its 55 year average of 67 to 118.5 Index Points by mid-2011. However, with the slowdown in the Chinese economy, I suggested Australia’s Terms of Trade, which had declined 26 per cent to 87.9 Index Points by late 2014, could get somewhat worse over the foreseeable future.

From the recent trip to China the team at Macquarie Commodities concluded that “the tone (of the trip) was certainly bearish with many participants highlighting a slowing of economic activity and greater focus on a structural slowing of demand from major end use sectors such as property.”

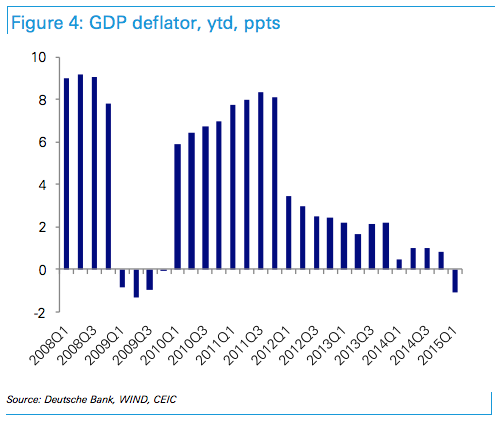

On Wednesday, China released its headline Gross Domestic Product (GDP) figure which saw year on year growth of 7.0 per cent for the March 2015 Quarter. Yet with the GDP deflator at negative 1.2 per cent – the first time it has been negative since 2009 – China’s nominal growth at 5.8 per cent is running at the lowest level registered since the Global Financial Crisis (year on year growth of 5.7 per cent in the March 2009 Quarter).

With the risk of deflation, we wonder if the government insists on loosening policies in an attempt to stabilise (nominal) growth, and unsurprisingly some commentators are calling for three cuts to the RRR (Reserve Requirement Ratio) over the next six months.

Importantly, from Australia’s viewpoint, year on year growth of China’s Industrial Production at 5.6 per cent in March 2015 was at the lowest level since November 2008. Electricity production went negative and with the weak property sector, cement output recorded a year on year decline of 20.5 per cent.

To learn more about our funds, please click here, or contact me, David Buckland, on 02 8046 5000 or at dbuckland@montinvest.com.

David,

further to my previous email, I note some are claiming to be money market dealers at Tyndall assisting to manage $5 billion dollars. The returns were not spectacular at all.

Kind regards,

AT.

Thanks Adrian for sharing your insights

Dear David,

good article.

Saw your appearance with Todd and Wang on the Business Channel 17th April 2015 last night, regarding flogging Fixed Interest products to pensioners. It is known that in the accumulation stage of the superannuation benefit, those that go long on equities will outperform those with fixed interest in their portfolios. Those with gearing on domestic share will outperform those with domestic fixed interest by cash rate plus 20 ( at least). Going overseas to buy Chinese bonds is a very risky adventure and not a prudent investment that a Trustee would take for a Complying Australian Superannuation Fund.

Flogging F/I to the investors in todays market is like flogging a dead horse.

Kind regards,

Adrian Totolos.

Business Analyst.