China’s power consumption growth – indicative of slower GDP growth?

It has always amused us that China, with 1.34 billion people (19 per cent of the world’s population of 7 billion) and with an economy of US$8.5 trillion (12 per cent of the world’s GDP of US$70 trillion), can produce their GDP growth rate within days of the quarter end.

In the March 2013 quarter, the annual rate of GDP growth eased back to 7.7 per cent from the 7.9 per cent set in the December 2012 quarter.

Contributions came from domestic consumption (+4.3%), capital formation (+2.3%) and exports (+1.1%).

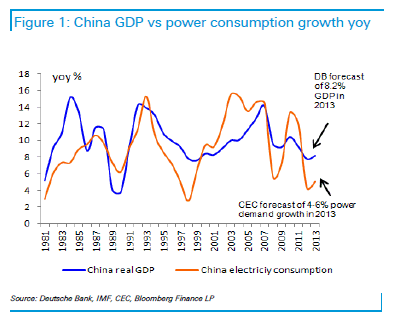

We like the correlation between Chinese GDP growth and power consumption growth.

Recently, the China Electricity Council lowered its forecast for power consumption growth for 2013 to 4-6 percent.

The Australian resources sector has felt the brunt of the lower expected growth. Caterpillar Inc., a bellwether stock in terms of demand from the mining sector, announced its March 2013 quarterly net income had declined by 45 per cent year on year to $0.88b on a 17.5 per cent reduction in revenue to $13.2b. Comments from the company included:

“We remain very positive on the mining industry for the long term, but it’s clear 2013 is going to be a challenge for our mining business . . . We’re close to the floor in mining”.

Caterpillar’s revenue forecast for 2013 has been cut by around 8 per cent to $59b.